- United States

- /

- Metals and Mining

- /

- NasdaqCM:HYMC

Hycroft Mining Holding Corporation's (NASDAQ:HYMC) Popularity With Investors Is Under Threat From Overpricing

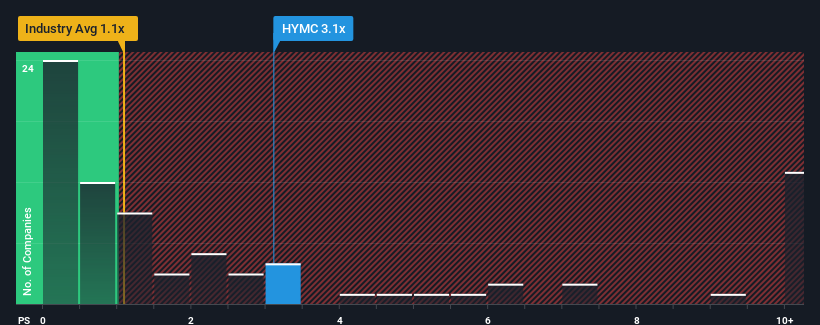

When you see that almost half of the companies in the Metals and Mining industry in the United States have price-to-sales ratios (or "P/S") below 1.1x, Hycroft Mining Holding Corporation (NASDAQ:HYMC) looks to be giving off strong sell signals with its 3.1x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Hycroft Mining Holding

What Does Hycroft Mining Holding's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Hycroft Mining Holding's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Hycroft Mining Holding.How Is Hycroft Mining Holding's Revenue Growth Trending?

Hycroft Mining Holding's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 70%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 142% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to plummet, contracting by 79% during the coming year according to the one analyst following the company. The industry is also set to see revenue decline 1.1% but the stock is shaping up to perform materially worse.

With this information, it's strange that Hycroft Mining Holding is trading at a higher P/S in comparison. When revenue shrink rapidly often the P/S premium shrinks too, which could set up shareholders for future disappointment. Maintaining these prices will be extremely difficult to achieve as the weak outlook is likely to weigh down the shares eventually.

What We Can Learn From Hycroft Mining Holding's P/S?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Hycroft Mining Holding currently trades on a much higher than expected P/S since its revenue forecast is even worse than the struggling industry. Revenue outlooks like this don't typically support a company trading at such an elevated P/S, and if it did, it doesn't usually do it for long. In addition, we would be concerned whether the company's revenue prospects could slide further under these tough industry conditions. Unless there's a material improvement in the forecast revenue growth for the company, it's hard to justify the share price at current levels.

Before you take the next step, you should know about the 2 warning signs for Hycroft Mining Holding (1 is concerning!) that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Hycroft Mining Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:HYMC

Hycroft Mining Holding

Operates as a gold and silver exploration and development company in the United States.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives