- United States

- /

- Metals and Mining

- /

- NasdaqGS:AUGO

Aura Minerals (NasdaqGS:AUGO): Assessing Valuation After Standout Dividend Declaration

Reviewed by Simply Wall St

Aura Minerals (NasdaqGS:AUGO) caught investor attention after its Board of Directors approved a dividend of $0.48 per common share. This totals about $40.1 million to be paid out later this month.

See our latest analysis for Aura Minerals.

This dividend announcement comes on the heels of an impressive run for Aura Minerals, with momentum clearly building. The company’s 1-day share price return of 3.44% and 7-day return of 6.06% reflect renewed optimism, while the stock’s 184.56% share price return year-to-date and stunning 199.73% total shareholder return over the past year highlight its rapid ascent. Over three and five years, long-term total shareholder returns above 400% reinforce that performance has been sustained and Aura has delivered for patient investors.

If Aura’s breakout performance has you wondering what else could be taking off, now is the perfect moment to broaden your investing horizons and discover fast growing stocks with high insider ownership

With shares trading below analyst price targets but after such a remarkable run, investors have to weigh whether Aura Minerals is still undervalued, or if the market is already factoring in future growth prospects. Could there still be a buying opportunity?

Price-to-Sales of 4.2x: Is it justified?

With Aura Minerals trading at a Price-to-Sales ratio of 4.2x compared to the US Metals and Mining industry average of 2.8x, the stock commands a significant premium to peers. At the last close price of $34.29, investors should consider whether current momentum justifies this higher valuation or if the market is getting carried away.

The price-to-sales ratio compares a company’s market value to its revenue and offers a useful yardstick for sectors where profits can be volatile or negative. For metals and mining companies, this multiple highlights how much investors are willing to pay for each dollar of top-line sales, regardless of profitability.

Aura’s rich sales multiple signals anticipation of future growth or operational improvements. However, this stands in sharp contrast to current unprofitability and a negative return on equity. Notably, Aura’s price-to-sales is also well above its own fair ratio estimate of 2.4x, a level the market could theoretically revert to if expectations cool or execution falters.

Explore the SWS fair ratio for Aura Minerals

Result: Price-to-Sales of 4.2x (OVERVALUED)

However, Aura's unprofitability and premium valuation mean that any slowdown in revenue or execution missteps could prompt a sharp reassessment from investors.

Find out about the key risks to this Aura Minerals narrative.

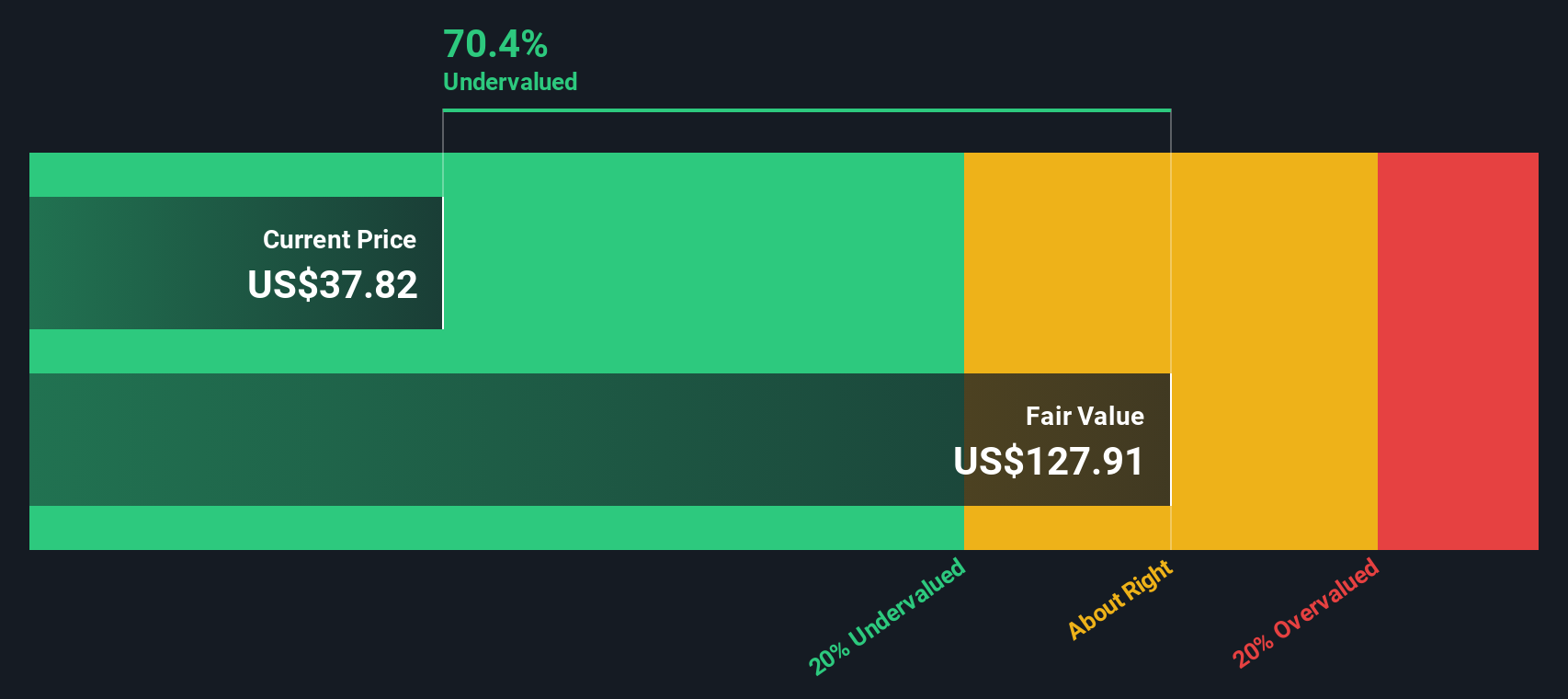

Another View: Discounted Cash Flow Signals Undervaluation

While Aura Minerals looks expensive versus sales, our DCF model offers a totally different perspective. By projecting future cash flows rather than focusing on sales multiples, the SWS DCF model values Aura at $117.06, which is over three times the current share price. Is the market missing something or rightly skeptical?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Aura Minerals for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 875 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Aura Minerals Narrative

If you prefer a hands-on approach or see these numbers through a different lens, you can quickly build your own view and contribute in just a few minutes. Do it your way.

A great starting point for your Aura Minerals research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Unlock fresh opportunities beyond Aura Minerals and get ahead of the market by taking action now with these handpicked stock ideas tailored for different strategies:

- Tap into growth by reviewing these 24 AI penny stocks, which are harnessing artificial intelligence to reshape industries and deliver strong returns.

- Capitalize on income potential and stability by evaluating these 16 dividend stocks with yields > 3%, featuring companies committed to rewarding shareholders with robust yields.

- Broaden your exposure to technological breakthroughs by checking out these 28 quantum computing stocks, which are driving the frontier of quantum computing innovation and future value creation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AUGO

Aura Minerals

A gold and copper production company, focuses on the development and operation of gold and base metal projects in the Americas.

Reasonable growth potential and fair value.

Market Insights

Community Narratives