- United States

- /

- Metals and Mining

- /

- NasdaqGM:ACNT

Ascent Industries (ACNT) Losses Worsen; Deep Discount Reinforces Bearish Profitability Narrative

Reviewed by Simply Wall St

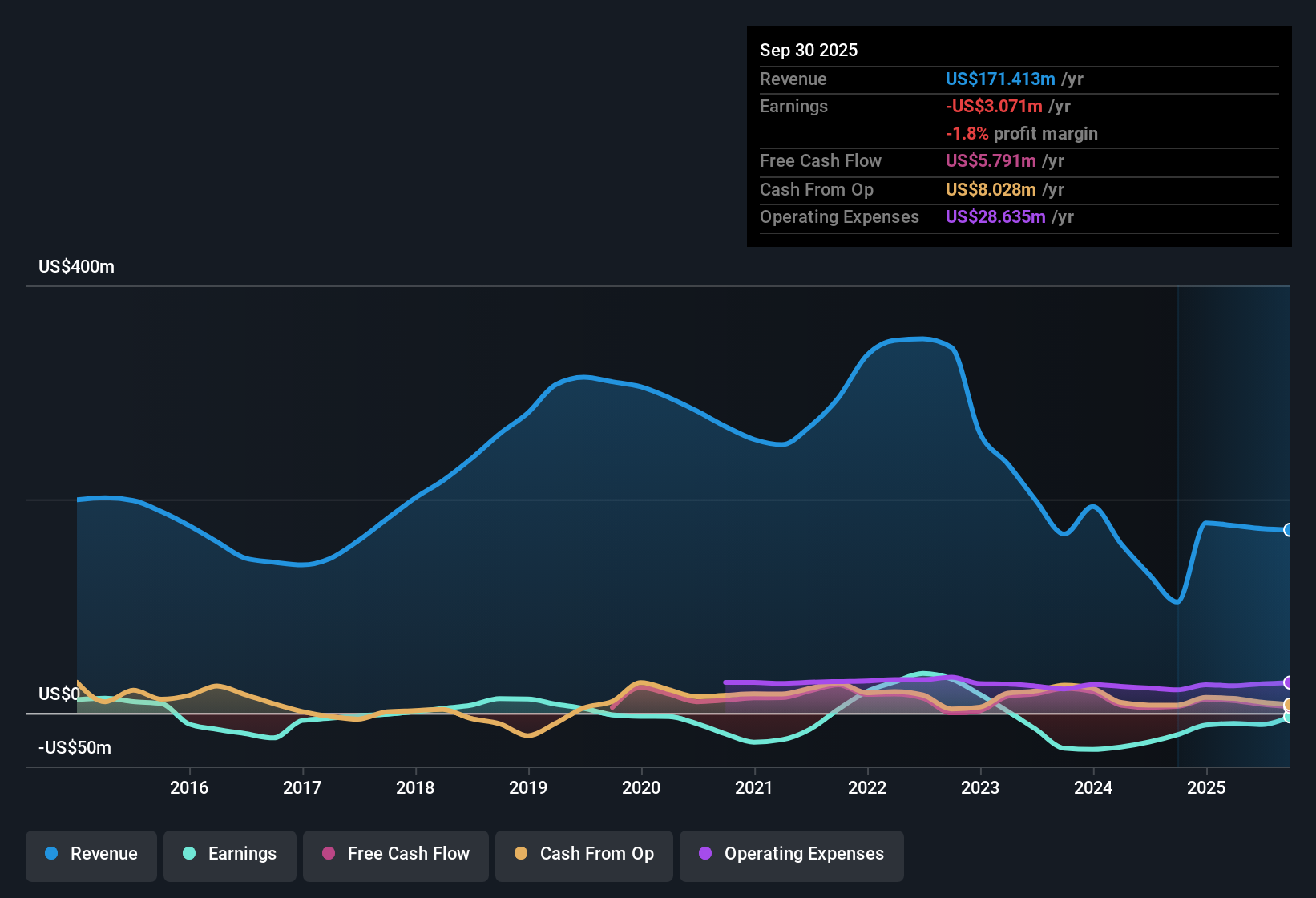

Ascent Industries (ACNT) has posted continued losses, with net income declining at an average rate of 16.3% per year over the past five years. Despite this persistent unprofitability and low earnings quality, the stock stands out for its value credentials: the current price-to-sales ratio is just 0.7x, notably below the US Metals and Mining industry average of 2.7x, and shares trade at $12.54, beneath the estimated fair value of $17.90. While ongoing losses and lack of visibility on future earnings remain key concerns for investors, the deep valuation discount may provide a reason for some optimism.

See our full analysis for Ascent Industries.The next section looks at how these latest numbers line up with the dominant narratives that shape investor sentiment around Ascent Industries, setting the stage for where views might converge or diverge.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Profit Margin Fails to Recover

- Ascent Industries' net profit margin has not improved and remains negative due to continued unprofitability over the past five years.

- Bulls argue that margin weakness could be offset if operational efficiencies or sector recovery take hold. However, with no explicit signs of margin rebound,

- Persistently low net margins support a lack of near-term operating leverage.

- Statements from the filing emphasize that positive momentum is missing, which limits the bullish case until tangible improvements emerge.

No Profit Growth in Sight

- Losses have consistently deepened at an average annual rate of 16.3% for five years, with no guidance or forecast for a turnaround.

- Bears highlight the increasing loss rate as a major red flag for growth and cash generation,

- Management’s absence of profit targets underscores uncertainty around future earnings sustainability and supports skeptical views.

- The continued escalation of losses makes it challenging for value-focused investors to make a near-term case for upside.

Valuation Discount vs Industry

- The stock trades at a 0.7x price-to-sales ratio, well below the US Metals and Mining industry average of 2.7x. The share price of $12.54 is also below the DCF fair value of $17.90.

- The market’s notable discount to both peers and fair value opens up debate:

- Such a low multiple suggests investors have already factored in ongoing unprofitability or sector risk.

- The wide gap to DCF fair value raises the question of whether the market may be overlooking potential for re-rating if fundamentals begin to improve.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Ascent Industries's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Ascent Industries continues to report deepening losses and persistent unprofitability, with no clear earnings recovery or sustainable profit growth in sight.

If you’d prefer companies showing consistent and reliable financial progress, focus on stable growth stocks screener (2074 results) to find stocks with steady revenue and earnings regardless of the cycle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ACNT

Ascent Industries

An industrials company, produces and sells stainless steel pipe and tube, and specialty chemicals in the United States and internationally.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives