- United States

- /

- Insurance

- /

- NYSE:WTM

Exploring White Mountains Insurance Group (WTM) Valuation After Q3 Results, Distinguished Acquisition, and Bamboo Divestiture

Reviewed by Simply Wall St

White Mountains Insurance Group (WTM) drew attention after its third quarter earnings release, which showed rising revenues and stronger underwriting performance. The company also highlighted its acquisition of the Distinguished segment and an upcoming sale of its Bamboo stake.

See our latest analysis for White Mountains Insurance Group.

Following the upbeat Q3 results and recent moves such as the upcoming Bamboo sale, White Mountains Insurance Group’s shares have shown renewed momentum, with an 8.95% share price gain over the past 90 days. While its one-year total shareholder return is a modest 2.35%, longer-term investors have seen impressive growth, as the three- and five-year total returns stand at 44.42% and 108.56% respectively.

If these developments have you curious about what else is gaining traction, now is a good moment to broaden your search and discover fast growing stocks with high insider ownership

But with earnings recovering, major transactions underway, and book value per share on the rise, is White Mountains Insurance Group an undervalued opportunity? Or have recent gains already captured the company’s future growth potential?

Price-to-Earnings of 35.1x: Is it justified?

White Mountains Insurance Group trades at a price-to-earnings (P/E) ratio of 35.1x, which is substantially higher than both the US Insurance industry average of 13.1x and the peer average of 15.3x. With a last close price of $1,908.46, investors are paying a significant premium to own shares at current levels.

The price-to-earnings ratio compares a company's share price to its earnings per share. It is a key measure of how much investors are willing to pay for a dollar of current earnings and often reflects expectations about future profit growth. For insurance companies, where earnings can be volatile, a higher multiple may indicate anticipated improvement or market confidence in management's ability to deliver consistent results.

In this case, White Mountains’ elevated P/E multiple could signal high expectations for future performance. However, recent financials show declining earnings and margin compression. The company’s P/E stands far above its industry and peer benchmarks. This suggests the market may be overpricing its current earnings outlook unless a sharp turnaround materializes.

With no “fair ratio” estimate available for further context, the strong premium appears difficult to justify given the recent profit decline and mixed near-term outlook.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 35.1x (OVERVALUED)

However, deteriorating profitability or unexpected market volatility could quickly challenge the optimistic outlook that is reflected in White Mountains Insurance Group’s current valuation.

Find out about the key risks to this White Mountains Insurance Group narrative.

Another View: Our DCF Model Suggests Overvaluation

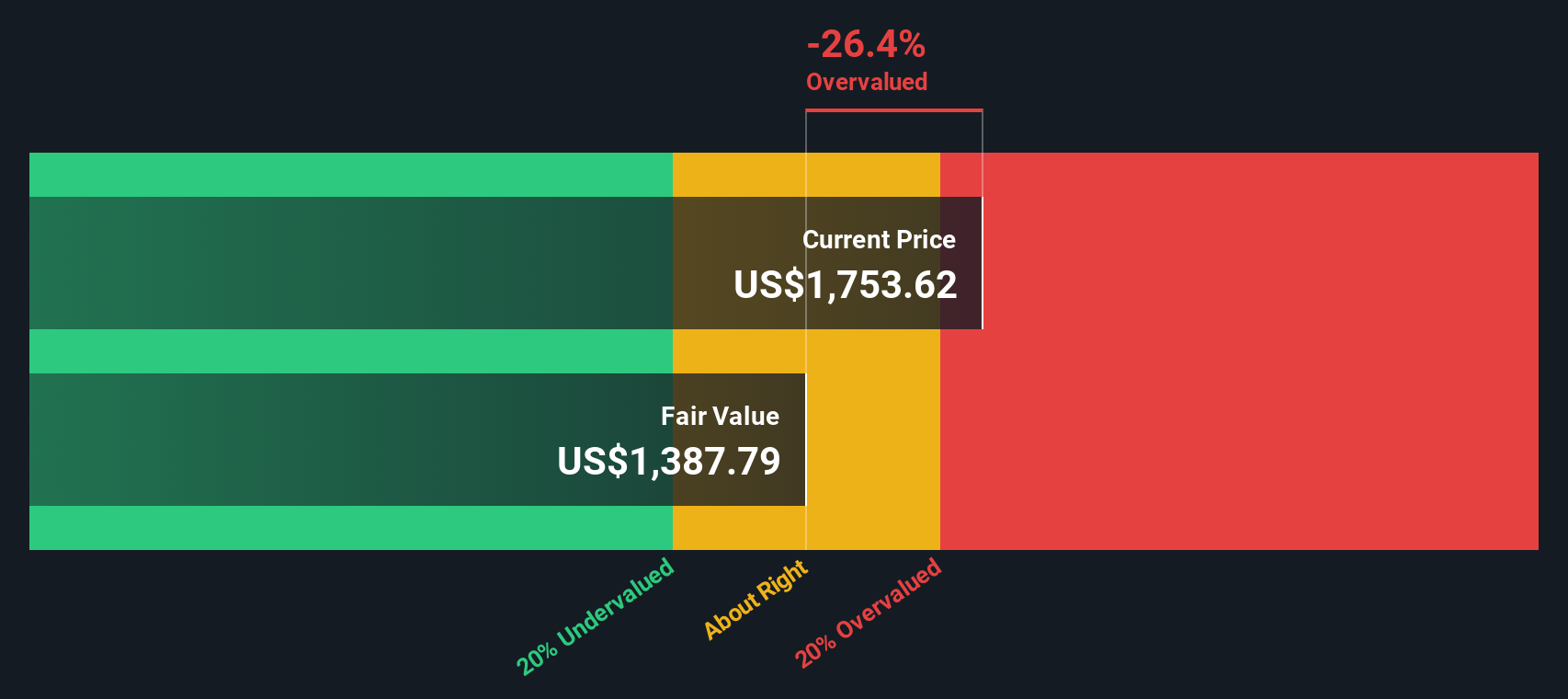

Looking at White Mountains Insurance Group through the lens of our SWS DCF model provides a different perspective. Based on this approach, the current share price of $1,908.46 sits well above our estimate of fair value at $1,172.01. This indicates that the stock appears overvalued. Does this gap reflect unrealistic future expectations, or is the market pricing in something that the DCF model cannot capture?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out White Mountains Insurance Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own White Mountains Insurance Group Narrative

If you see the numbers differently or want to dig deeper into your own research process, it is easy to build your own narrative in just a few minutes with Do it your way.

A great starting point for your White Mountains Insurance Group research is our analysis highlighting 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Want to make the most of today’s market opportunities? Spark your next winning move with these hand-picked stock themes every savvy investor should have on their radar:

- Boost your portfolio’s potential by reviewing these 16 dividend stocks with yields > 3% for consistent income and attractive yields in a changing rate environment.

- Jump ahead of the curve by examining these 24 AI penny stocks as companies power innovation across industries with machine learning and advanced analytics.

- Catch early-stage, high-upside opportunities by researching these 3590 penny stocks with strong financials where emerging businesses could become tomorrow’s breakout stars.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if White Mountains Insurance Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WTM

White Mountains Insurance Group

Through its subsidiaries, engages in the provision of insurance and other financial services in the United States.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives