- United States

- /

- Insurance

- /

- NYSE:WRB

W. R. Berkley (WRB): Evaluating Valuation After Recent Stock Stability and Long-Term Returns

Reviewed by Simply Wall St

See our latest analysis for W. R. Berkley.

This mild bounce comes after a choppy few weeks for W. R. Berkley. When you look past the short-term noise, the bigger story is a steady build in the company’s total shareholder returns, up an impressive 27.7% over the past year and 184% over five years. This hints that momentum is quietly building beneath the surface.

If evolving market trends have your attention, it could be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With shares trailing just behind analyst price targets despite strong long-term returns, investors now face a key question: is W. R. Berkley trading at an attractive price, or is the market already factoring in future growth?

Most Popular Narrative: 4.4% Undervalued

The most widely followed narrative sets W. R. Berkley’s fair value just above the current share price, signalling that the stock could have a slight upside. Let’s take a closer look at what’s driving this view.

The expanding complexity of global business and assets is driving strong demand for specialty insurance solutions. Record net written premiums and broad-based growth across all lines position W. R. Berkley to continue increasing revenue. Corporations' heightened focus on risk management, due to rising threats from climate change, supply chain disruptions, and cyber risks, is supporting disciplined underwriting and pricing power. This is evident in healthy combined ratios and a robust rate environment that should support further net margin expansion.

Curious about what’s fueling this robust fair value? The real story is hidden in dramatic expectations for profit margins, shifting revenue assumptions, and a bold future valuation multiple baked into the outlook. The numbers behind this narrative may surprise you. Crack open the full narrative and discover the catalysts moving Wall Street’s fair value calculation.

Result: Fair Value of $74.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, increasing competition and rising claims costs could present challenges for W. R. Berkley’s current trajectory. These factors may test the strength of the bullish outlook.

Find out about the key risks to this W. R. Berkley narrative.

Another View: How Do the Earnings Ratios Stack Up?

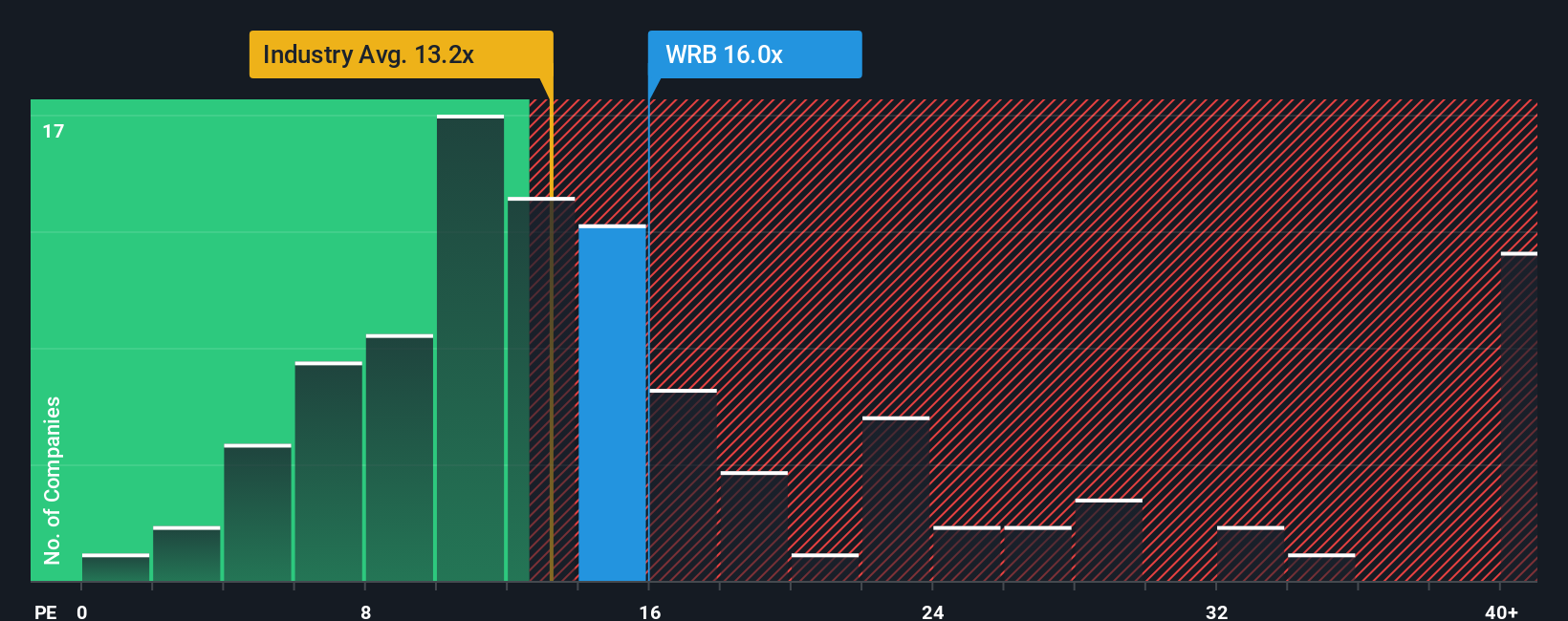

Looking beyond fair value estimates, the company's current price-to-earnings ratio sits at 14.3x. That is above the industry average of 13.2x and higher than the fair ratio of 12.6x our models suggest the market could move toward. This signals a premium price, raising the question: where will investor expectations go next?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own W. R. Berkley Narrative

If the current narrative does not align with your perspective, or you want to dive deeper into the numbers yourself, you can craft a custom view in just a few minutes. Do it your way

A great starting point for your W. R. Berkley research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for More Investment Ideas?

Why stop with just one opportunity? Give yourself an edge by using the Simply Wall Street Screener to spot standout stocks before the crowd catches on.

- Capture long-term growth by targeting consistent cash generators with strong upside potential among these 834 undervalued stocks based on cash flows.

- Boost your portfolio’s income streams by considering reliable payers in these 24 dividend stocks with yields > 3%, which offer attractive yields over 3%.

- Jump on tomorrow’s digital leaders by evaluating blockchain innovators and future giants within these 81 cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if W. R. Berkley might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WRB

W. R. Berkley

An insurance holding company, operates as a commercial line writer worldwide.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives