Stock Analysis

- United States

- /

- Construction

- /

- NYSE:AMRC

Exploring Three US Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

As the U.S. stock market navigates through a period of cautious trading and heightened attention to upcoming inflation data, investors are closely monitoring how these economic indicators could influence Federal Reserve policies. In this context, exploring growth companies with high insider ownership might offer valuable insights, as these firms often exhibit strong alignment between management’s interests and shareholder returns, potentially providing some resilience amidst market volatility.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| GigaCloud Technology (NasdaqGM:GCT) | 27.5% | 20.9% |

| PDD Holdings (NasdaqGS:PDD) | 32.1% | 23% |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 28.2% |

| Li Auto (NasdaqGS:LI) | 29.3% | 21.8% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.2% |

| Bridge Investment Group Holdings (NYSE:BRDG) | 11.8% | 90% |

| EHang Holdings (NasdaqGM:EH) | 33% | 98% |

| Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

| ZKH Group (NYSE:ZKH) | 17.7% | 91.8% |

| BBB Foods (NYSE:TBBB) | 23.6% | 76.5% |

Let's explore several standout options from the results in the screener.

Oddity Tech (NasdaqGM:ODD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Oddity Tech Ltd. is a consumer technology company that develops digital-first brands in the beauty and wellness sectors, with operations both in the United States and internationally, boasting a market capitalization of approximately $2.11 billion.

Operations: The company generates its revenue through the development of digital-first brands in the beauty and wellness sectors across various international markets.

Insider Ownership: 31.5%

Oddity Tech Ltd., a growth company with high insider ownership, has shown robust financial performance with significant year-over-year revenue and net income increases as of Q1 2024. Despite trading below our fair value estimate, the firm's earnings are expected to outpace the US market average, though its revenue growth projections slightly lag behind high-growth benchmarks. Recent successful equity offerings suggest strong market confidence, supporting its expansion strategies and potentially enhancing shareholder value through increased insider stakes.

- Delve into the full analysis future growth report here for a deeper understanding of Oddity Tech.

- Upon reviewing our latest valuation report, Oddity Tech's share price might be too pessimistic.

Ameresco (NYSE:AMRC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ameresco, Inc. is a clean technology integrator offering energy efficiency and renewable energy solutions across the United States, Canada, Europe, and internationally, with a market capitalization of approximately $1.45 billion.

Operations: The company's revenue is generated from its U.S. Federal segment, which brought in $404.22 million, its European operations with $177.87 million, and its Alternative Fuels division contributing $121.60 million.

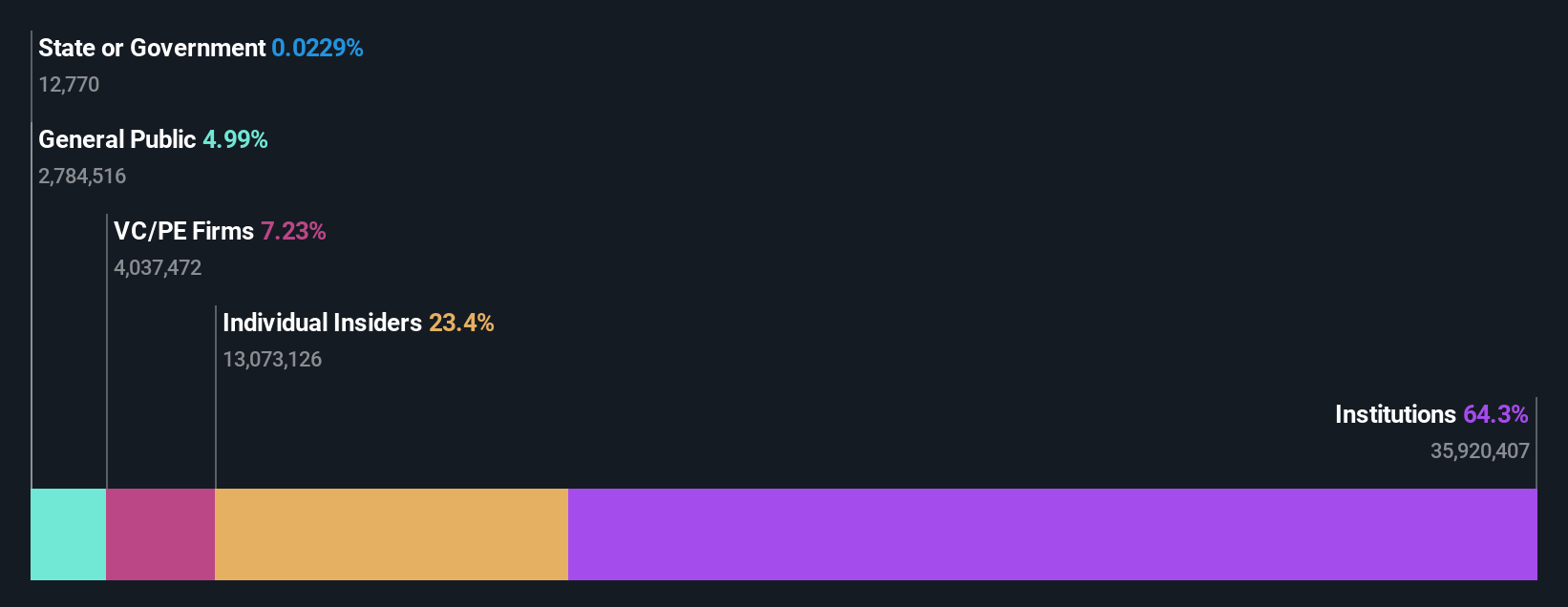

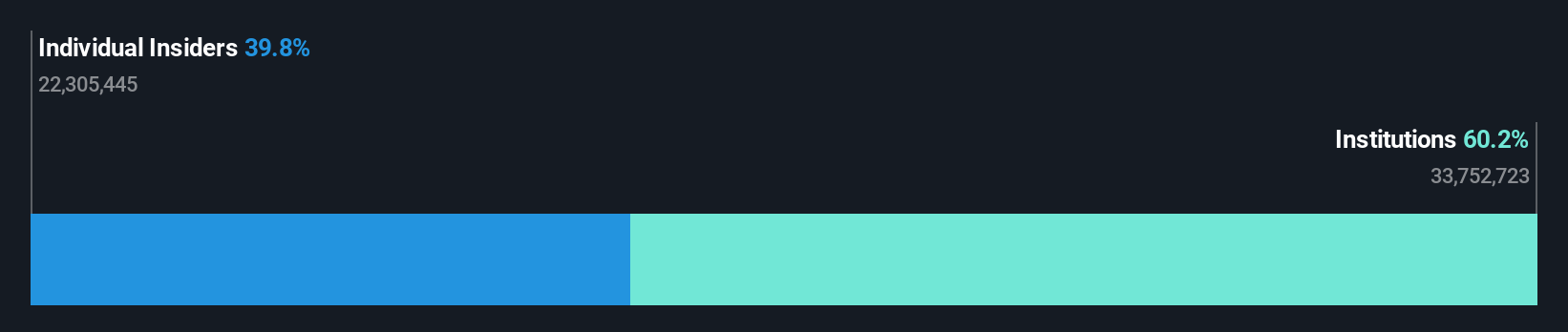

Insider Ownership: 38.8%

Ameresco, a company with substantial insider ownership, is navigating a challenging phase with a recent shift from net income to a net loss in Q1 2024. Despite this setback, Ameresco reaffirmed its annual revenue forecast between US$1.60 billion and US$1.70 billion and continues to secure significant contracts, such as the nearly US$140 million biogas cogeneration facility development in California. These projects underscore its commitment to growth through energy-efficient solutions, although it faces volatility in earnings and share price stability.

- Dive into the specifics of Ameresco here with our thorough growth forecast report.

- Our valuation report here indicates Ameresco may be undervalued.

Ryan Specialty Holdings (NYSE:RYAN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ryan Specialty Holdings, Inc. provides specialty products and solutions for insurance brokers, agents, and carriers across the United States, Canada, the United Kingdom, Europe, and Singapore, with a market capitalization of approximately $13.99 billion.

Operations: The company generates revenue primarily through its insurance brokerage segment, which earned $2.12 billion.

Insider Ownership: 19.6%

Ryan Specialty Holdings, with high insider ownership, is actively pursuing a disciplined M&A strategy to bolster growth, supported by a robust balance sheet. The company's revenue and earnings are expected to grow significantly above the market average at 16.4% and 54.37% per year respectively, although it operates with a high level of debt. Recent financial performance shows strong quarterly results with substantial year-over-year increases in revenue and net income, reinforcing its aggressive growth trajectory through strategic acquisitions and organic investments.

- Take a closer look at Ryan Specialty Holdings' potential here in our earnings growth report.

- Upon reviewing our latest valuation report, Ryan Specialty Holdings' share price might be too optimistic.

Next Steps

- Unlock our comprehensive list of 188 Fast Growing US Companies With High Insider Ownership by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Ameresco is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMRC

Ameresco

A clean technology integrator, provides a portfolio of energy efficiency and renewable energy supply solutions in the United States, Canada, Europe, and internationally.

Reasonable growth potential and slightly overvalued.