- United States

- /

- Insurance

- /

- NYSE:RNR

What Does RNR’s Buyback and Dividend Reveal About Management’s Long-Term Capital Allocation Strategy?

Reviewed by Sasha Jovanovic

- RenaissanceRe Holdings Ltd. announced a quarterly dividend of US$0.40 per share, to be paid on December 31, 2025, with an ex-date and record date of December 15, 2025; the company also reported third quarter 2025 earnings showing a year-over-year decrease in quarterly revenue and net income, alongside completion of a significant share buyback program totaling 2,179,509 shares for US$534.99 million.

- While quarterly results softened, year-to-date earnings per share increased and the repurchase completion could highlight management’s confidence in RenaissanceRe’s long-term prospects.

- We’ll now examine how the combination of lower quarterly earnings and the finished buyback tranche could influence RenaissanceRe’s investment outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

RenaissanceRe Holdings Investment Narrative Recap

To be a RenaissanceRe Holdings shareholder, you need to believe in the group’s ability to manage catastrophe reinsurance risk while navigating cyclical market swings and earnings volatility. The latest quarter’s revenue and net income decline are important, but the real short-term catalyst remains the industry’s appetite and pricing power for catastrophe risk, not quarterly fluctuations. At the same time, the most immediate risk continues to be the company’s exposure to severe U.S. natural catastrophe events, recent news does not materially change this risk profile.

Among recent announcements, the completion of the US$534.99 million share buyback stands out. Buybacks can alter the earnings per share calculation and signal management’s outlook, but investors are likely to remain focused on underwriting discipline and risk selection, as these underpin any sustainable advantage in volatile catastrophe markets.

However, investors should be alert, because if a major U.S. catastrophe hits just as market competition intensifies, the effects could...

Read the full narrative on RenaissanceRe Holdings (it's free!)

RenaissanceRe Holdings is projected to reach $10.4 billion in revenue and $1.5 billion in earnings by 2028. This outlook assumes a 7.2% annual decrease in revenue and a $0.4 billion decline in earnings from the current $1.9 billion.

Uncover how RenaissanceRe Holdings' forecasts yield a $283.43 fair value, a 5% upside to its current price.

Exploring Other Perspectives

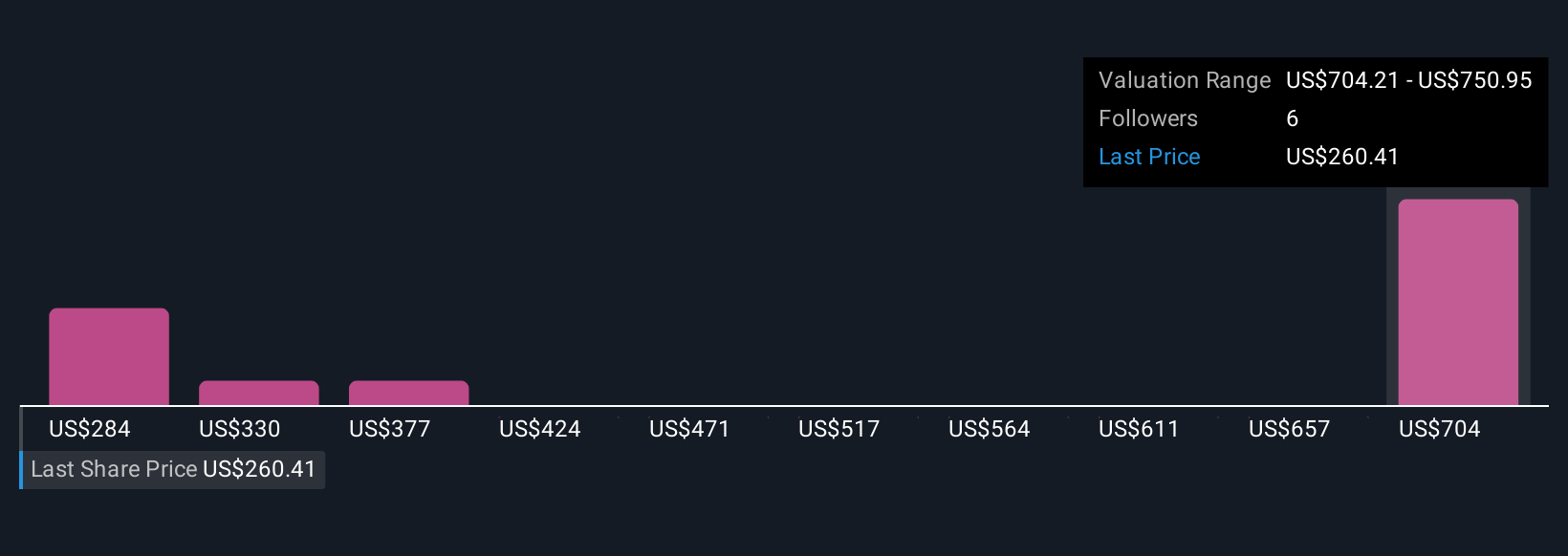

The Simply Wall St Community’s fair value targets for RenaissanceRe Holdings range widely from US$283 to US$844, across 3 estimates. While some see deep undervaluation, others highlight the risk that rising competition could limit premium growth and future profits, showing why it’s worth considering alternative viewpoints before making up your mind.

Explore 3 other fair value estimates on RenaissanceRe Holdings - why the stock might be worth just $283.43!

Build Your Own RenaissanceRe Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your RenaissanceRe Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free RenaissanceRe Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate RenaissanceRe Holdings' overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RNR

RenaissanceRe Holdings

Provides reinsurance and insurance products in the United States and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives