- United States

- /

- Insurance

- /

- NYSE:OSCR

Oscar Health's Widening Losses and Reaffirmed Outlook Might Change the Case for Investing in OSCR

Reviewed by Sasha Jovanovic

- Oscar Health reported third quarter 2025 earnings, revealing a much larger net loss of US$137.45 million versus US$54.6 million a year earlier, with basic and diluted losses per share from continuing operations worsening to US$0.53 from US$0.22; for the nine months ended September 30, 2025, the company posted a net loss of US$90.54 million versus net income of US$178.98 million for the same period last year.

- Despite these results, Oscar Health reaffirmed its full-year 2025 guidance, expecting total revenue to range between US$12.0 billion and US$12.2 billion and an operating loss between US$300 million and US$200 million.

- With the company moving from year-to-date profitability to a loss, we'll consider what these wider losses mean for Oscar Health's investment narrative.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

Oscar Health Investment Narrative Recap

Oscar Health’s investment case rests on its ability to drive margin improvement through technology, digital adoption, and disciplined pricing, despite rapid membership growth and volatile claims trends. The most recent earnings report, revealing a significantly wider quarterly loss and a swing from year-to-date profit to loss, does not materially alter the key short-term catalyst: achieving margin recovery through aggressive repricing and operating cost discipline. However, it does sharpen the spotlight on profitability risks if claims volatility continues.

Among recent announcements, the launch of new, tech-powered health plans across major markets for 2026 Open Enrollment stands out. This product expansion is directly relevant, as broader geographic reach and new offerings like the HelloMeno menopause support plan could boost future membership and revenue streams, but also bring higher upfront administrative and claims expenses, which are key to Oscar Health’s near-term path back to profitability.

Yet, with losses widening, investors should pay close attention to...

Read the full narrative on Oscar Health (it's free!)

Oscar Health's outlook anticipates $12.4 billion in revenue and $245.4 million in earnings by 2028. This projection is based on a 4.9% annual revenue growth rate and a $406.6 million increase in earnings from the current level of -$161.2 million.

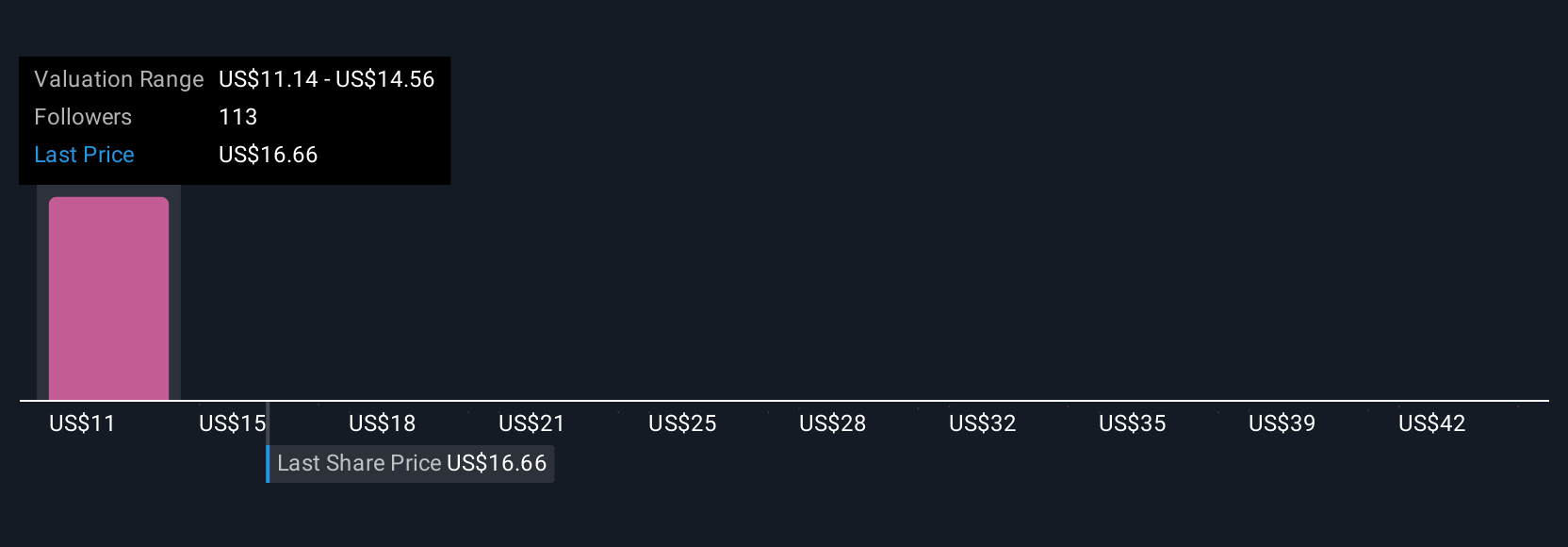

Uncover how Oscar Health's forecasts yield a $12.38 fair value, a 30% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community members estimate Oscar Health’s fair value between US$11.52 and US$66 per share from 23 analyses. In contrast, the company’s sharp reversal from profit to loss underscores the earnings risk that could weigh on future performance, making it essential to compare a variety of investor outlooks before deciding your stance.

Explore 23 other fair value estimates on Oscar Health - why the stock might be worth 35% less than the current price!

Build Your Own Oscar Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Oscar Health research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Oscar Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Oscar Health's overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OSCR

Oscar Health

Operates as a healthcare technology company in the United States.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives