- United States

- /

- Insurance

- /

- NYSE:KNSL

Kinsale Capital Group (KNSL): Evaluating Valuation After Recent Double-Digit Share Price Decline

Reviewed by Simply Wall St

Kinsale Capital Group (KNSL) shares have been on the move this month, with investors watching recent declines of nearly 17% over the past month. The company’s stock performance stands out as sentiment in the insurance sector continues to shift.

See our latest analysis for Kinsale Capital Group.

Kinsale Capital Group’s share price has seen sharp declines lately, pulling back by double digits over the past month. Momentum appears to be fading after an impressive multi-year run. While the stock’s one-year total return is down 8%, longer-term holders have still enjoyed an 86% total return over five years. This reflects significant growth despite near-term volatility.

If you’re interested in finding more standout performers beyond the insurance space, it’s a great moment to broaden your scope and discover fast growing stocks with high insider ownership

With shares now trading at a meaningful discount to recent analyst targets and earnings growth still positive, the key question for investors is whether Kinsale Capital Group offers hidden value or if future growth is already reflected in the price.

Most Popular Narrative: 20.7% Undervalued

Kinsale Capital Group’s narrative fair value stands at $490 per share, well ahead of the last close at $388.45. This backdrop sets the stage for a deep dive into how forecasts and sector shifts are shaping up.

Robust growth in small business property, high-value homeowners, and new E&S segments such as agribusiness and select homeowners markets reflects expanding opportunities from shifting risk and economic complexity in the U.S. These dynamics support future revenue growth as new business submissions and innovative product launches increase Kinsale's addressable market.

Want to know the engine driving this premium valuation? This narrative centers on bold earnings and revenue projections that surpass peers, backed by assumptions you would usually only see with high-flying growth names. Think future profit multiples, margin expansion, and a track record that is anything but average. Curious which key numbers give this stock so much upside potential? Click through and unveil the numbers that take this price target from possible to plausible.

Result: Fair Value of $490 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition in key segments and persistent inflation could threaten Kinsale's profit margins and challenge the bullish narrative outlined above.

Find out about the key risks to this Kinsale Capital Group narrative.

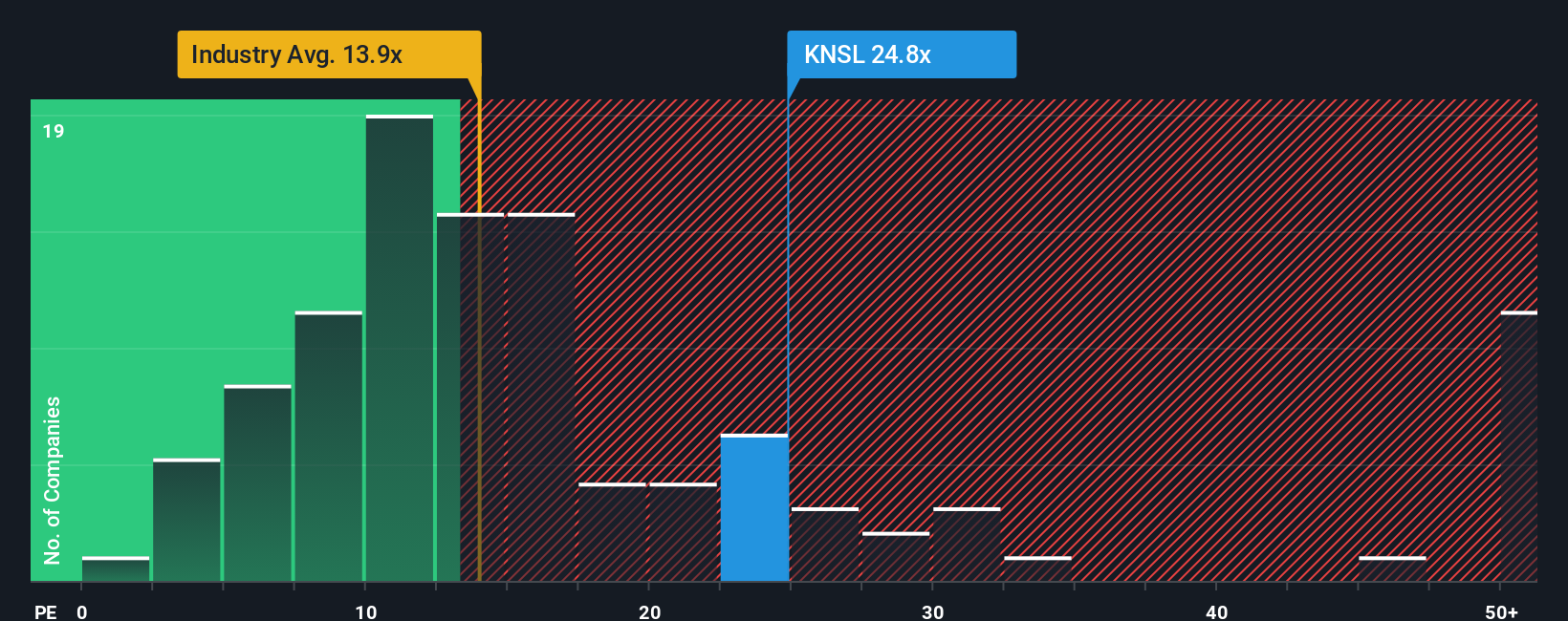

Another View: What Trading Multiples Suggest

While the narrative valuation points to shares being undervalued, the market's price-to-earnings ratio tells a different story. Kinsale trades at 19.1 times earnings, making it pricier than both its peer average of 13.6 and the industry average of 13.4. Compared to the fair ratio of 11.1, this premium hints at valuation risk if future growth falls short of expectations. This raises the question of whether the market is too optimistic, or if the company commands a premium because it deserves a higher price.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Kinsale Capital Group Narrative

If you’d like to reach your own conclusions or dig into the numbers yourself, you can construct and share your own viewpoint in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Kinsale Capital Group.

Looking for more investment ideas?

Don’t let the best opportunities pass you by. Gain an edge and unlock fresh stocks set to outperform, all automatically filtered with powerful data-driven tools.

- Seize income growth by reviewing these 18 dividend stocks with yields > 3%, which consistently offer yields above 3% and help strengthen your cash flow portfolio.

- Accelerate your portfolio’s tech exposure as you identify these 27 AI penny stocks, reshaping industries with real artificial intelligence breakthroughs and fast-moving digital innovation.

- Enhance your value investing journey with these 841 undervalued stocks based on cash flows, screened to reveal robust fundamentals and untapped upside based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kinsale Capital Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KNSL

Kinsale Capital Group

Engages in the provision of property and casualty insurance products in the United States.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives