- United States

- /

- Insurance

- /

- NYSE:KNSL

Does Recent 16.6% Drop Mean Opportunity for Kinsale Capital Group in 2025?

Reviewed by Bailey Pemberton

- Thinking about whether Kinsale Capital Group is still a good buy? Let’s dig into the numbers and see if this insurer’s current price offers real value.

- The stock has seen some turbulence lately, dropping 7.5% over the past week and down 16.6% for the last month, after an impressive 80.2% gain over five years.

- Recent headlines have highlighted shifts in the insurance industry landscape and evolving risk appetites among institutional investors. Several analysts have noted heightened competition and underwriting pressures, which might help explain why Kinsale’s valuation has come under scrutiny lately.

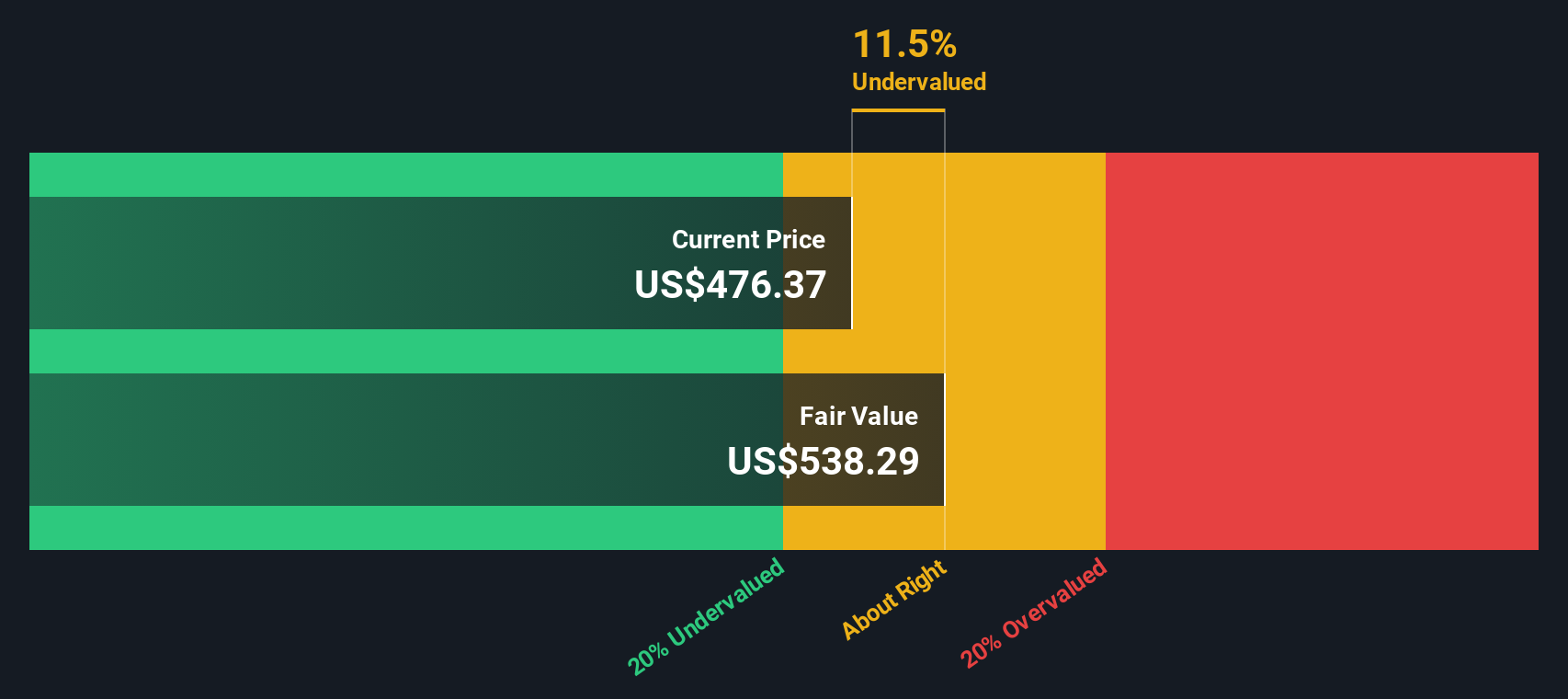

- Kinsale earns a 3 out of 6 on our value checks, suggesting it’s undervalued in half of the metrics we track. Still, there is more to the story, so let’s compare the usual valuation approaches and explore a smarter way to gauge whether Kinsale is truly good value.

Find out why Kinsale Capital Group's -9.2% return over the last year is lagging behind its peers.

Approach 1: Kinsale Capital Group Excess Returns Analysis

The Excess Returns model evaluates how much extra profit a company generates above the minimum required return for its shareholders, known as the cost of equity. This approach focuses on return on invested capital and growth, measuring sustainable profitability over time rather than just asset value.

For Kinsale Capital Group, the company’s Book Value stands at $80.19 per share. Analysts estimate a Stable EPS of $23.58 per share, based on weighted future Return on Equity projections from eight analysts. The cost of equity is $6.79 per share, so the Excess Return, or value created above that threshold, is $16.79 per share. The company’s average Return on Equity is an impressive 23.52%. Looking forward, the Stable Book Value is expected to rise to $100.26 per share, according to consensus from seven analysts.

Based on these figures, the Excess Returns model estimates Kinsale Capital Group’s intrinsic value to be about $554.53 per share. Given the current market price, this implies a 29.9% discount, suggesting the stock is significantly undervalued.

Result: UNDERVALUED

Our Excess Returns analysis suggests Kinsale Capital Group is undervalued by 29.9%. Track this in your watchlist or portfolio, or discover 843 more undervalued stocks based on cash flows.

Approach 2: Kinsale Capital Group Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation method for profitable companies because it directly relates the price investors are willing to pay to the company's ongoing earning power. This makes it especially relevant for mature, consistently profitable businesses like insurers, where earnings stability is a key focus for long-term investors.

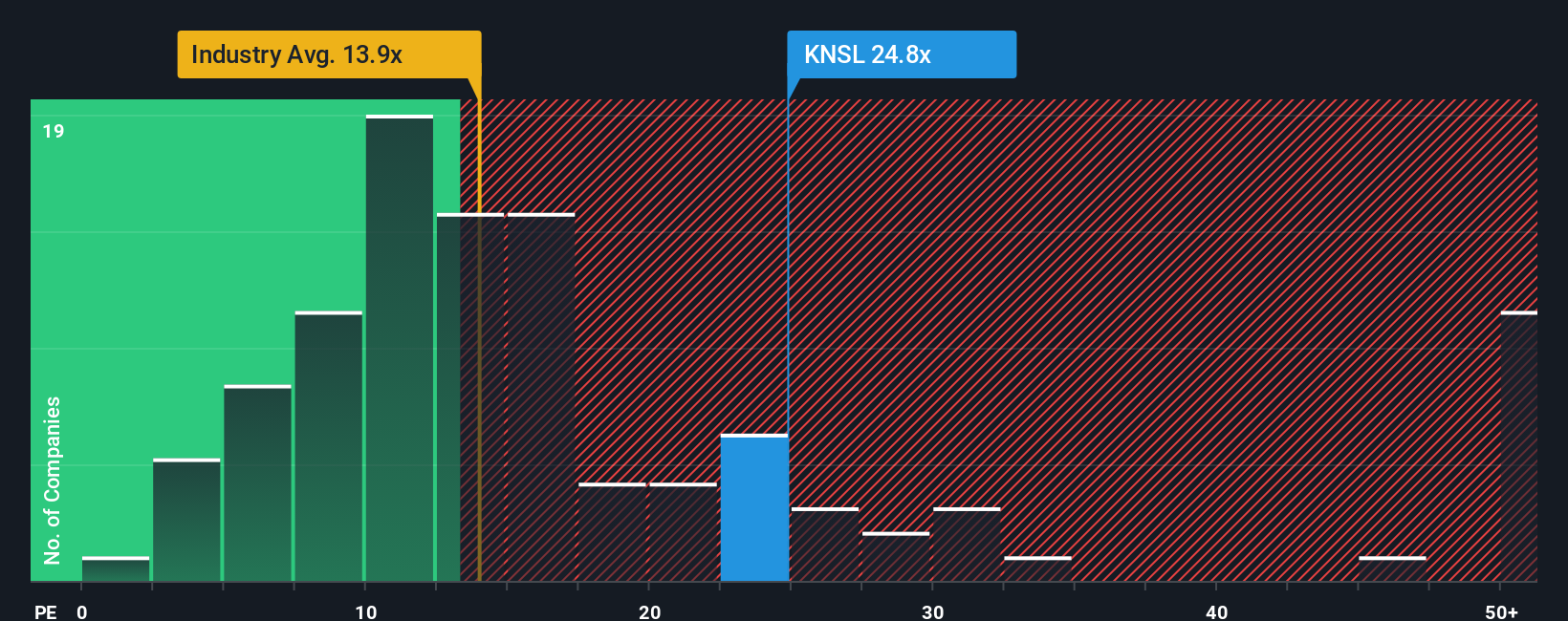

When interpreting a PE ratio, it is important to remember that the "right" ratio depends on growth prospects and risk. Companies expected to deliver higher earnings growth or facing less risk typically deserve higher PE ratios, while those with uncertain prospects or industry headwinds might trade at lower multiples. For Kinsale Capital Group, the current PE ratio is 19.1x, higher than the insurance industry average of 13.7x and the average of its direct peers at 13.3x. On the surface, this premium suggests the market expects Kinsale to outperform its peers or sees less risk in its future earnings.

To add greater context, Simply Wall St creates a proprietary "Fair Ratio," which estimates what Kinsale’s PE should be considering its growth outlook, profit margins, risk profile, size, and its position within the industry. This approach goes beyond a basic comparison with the industry or competitors by factoring in the company's individual strengths and risks. For Kinsale, the Fair Ratio is calculated at 11.1x, meaning the company is currently trading well above this custom benchmark. The gap suggests the stock’s price is higher than can be justified by these fundamentals alone.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1408 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Kinsale Capital Group Narrative

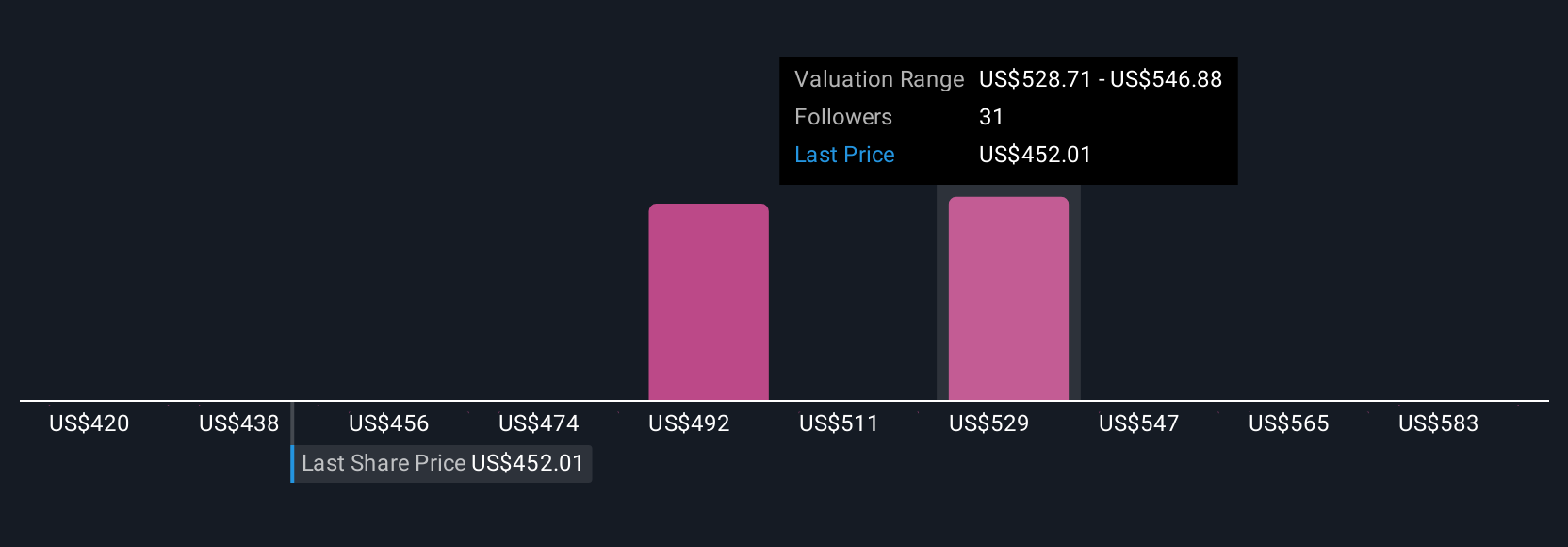

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, powerful tool that lets you define the story you believe about a company, your perspective on why it will succeed or what risks it faces, by setting your own estimates for fair value, future revenue, earnings, and margins. Narratives link a company's business story to a specific financial forecast and ultimately to a fair value, making it far easier to visualize how your view translates into numbers and potential returns.

Available to everyone in the Simply Wall St Community, Narratives are updated dynamically as new news or earnings are released, so your investment case is always built on the latest facts. They help clarify buy or sell decisions by making it easy to compare your Fair Value with the current market Price, with no spreadsheets or guesswork required. For example, some investors might create a bullish Narrative for Kinsale Capital Group based on expectations of sustained growth in specialty insurance and strong technology-driven margins, assigning a high fair value close to recent analyst targets of $560. Others may be more cautious about emerging competition and margin risks and may estimate a lower fair value closer to $448.

Do you think there's more to the story for Kinsale Capital Group? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kinsale Capital Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KNSL

Kinsale Capital Group

Engages in the provision of property and casualty insurance products in the United States.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives