- United States

- /

- Insurance

- /

- NYSE:HGTY

How Hagerty’s (HGTY) Liberty Mutual Partnership Could Shape Its Long-Term Growth Narrative

Reviewed by Sasha Jovanovic

- Hagerty, Inc. recently announced it has signed a partnership with Liberty Mutual Insurance to provide enhanced collectible car insurance to Liberty Mutual and Safeco customers, with the rollout set to begin in 2026.

- This agreement gives Hagerty access to one of the largest auto insurers' client bases in the US, opening new distribution channels and market reach.

- We'll examine how expanded access to Liberty Mutual and Safeco customers could impact Hagerty's long-term growth narrative and market position.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Hagerty Investment Narrative Recap

At the heart of the Hagerty investment story is a belief in the continued enthusiasm for collectible cars and the company’s ability to grow its insurance offerings and marketplace, despite shifting demographics and evolving customer preferences. The Liberty Mutual partnership brings significant distribution potential, but its effect on short-term catalysts may be muted until the rollout begins in 2026, while demographic risks around demand for classic cars remain the most important challenge to watch. Hagerty’s recent announcement to raise full-year 2025 guidance, following Q2 earnings growth and higher revenue targets, stands out as particularly relevant. The boost in outlook suggests positive momentum and underlines the company’s reliance on scaling new channels and partnerships, such as Liberty Mutual, for future revenue expansion. Yet, in contrast, investors should also be mindful of persistent challenges to long-term demand, particularly as...

Read the full narrative on Hagerty (it's free!)

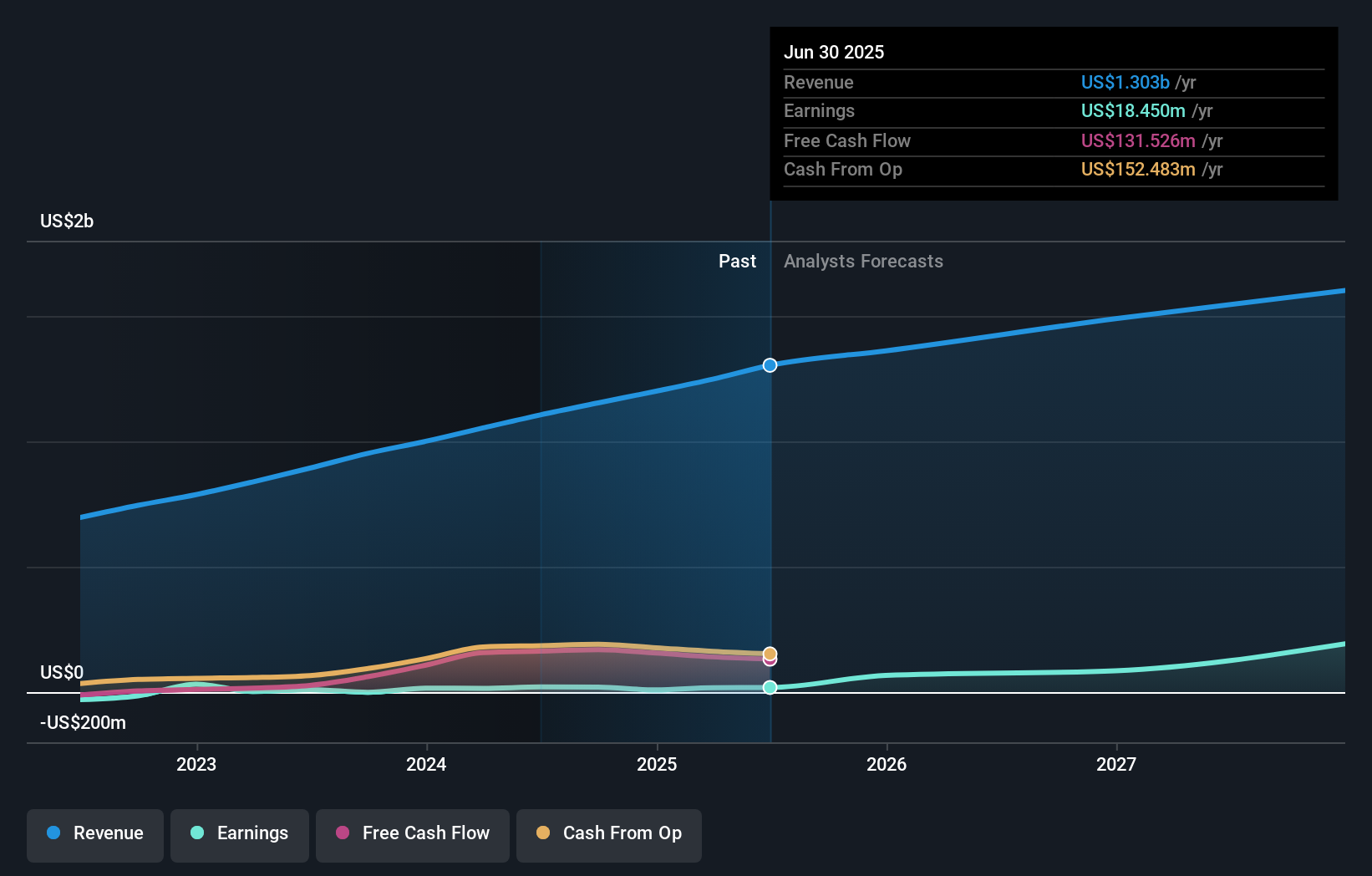

Hagerty's outlook anticipates $1.8 billion in revenue and $228.5 million in earnings by 2028. This scenario assumes an annual revenue growth rate of 11.1% and a rise in earnings of $210.1 million from the current $18.4 million.

Uncover how Hagerty's forecasts yield a $13.29 fair value, a 18% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community included 1 fair value estimate for Hagerty, all arriving at US$12.22 per share. While some see new distribution partnerships as a catalyst for growth, you will find contrasting perspectives on how much demographic headwinds can impact future returns.

Explore another fair value estimate on Hagerty - why the stock might be worth as much as 8% more than the current price!

Build Your Own Hagerty Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hagerty research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Hagerty research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hagerty's overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hagerty might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HGTY

Hagerty

Provides insurance services for collector cars and enthusiast vehicles in the United States.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives