- United States

- /

- Insurance

- /

- NYSE:HGTY

A Fresh Look at Hagerty (HGTY) Valuation Following Strong Earnings, Upgraded Guidance, and Liberty Mutual Partnership

Reviewed by Simply Wall St

Hagerty (NYSE:HGTY) grabbed investor attention after reporting strong third-quarter earnings, raising its full-year guidance, and announcing a new partnership with Liberty Mutual that expands access to its collectible car insurance products.

See our latest analysis for Hagerty.

Hagerty’s lively momentum this year reflects more than just strong third-quarter results. After a standout rally of 21.8% in the past 90 days, the share price is holding onto a year-to-date return of 15.2%. While the one-year total shareholder return sits at -4.8%, the three-year total return remains solid at 37.6%. This suggests that investors who stuck with Hagerty through recent volatility have seen healthy long-term gains. The combination of robust earnings, heightened guidance, and the Liberty Mutual partnership appears to be fueling greater optimism about Hagerty’s growth potential.

If Hagerty’s recent moves have you scanning for more opportunities, now is a good time to explore the market’s fastest-growing, insider-backed companies. Discover fast growing stocks with high insider ownership

Yet with shares climbing after these announcements and Hagerty now trading at a narrower discount to analyst price targets, the critical question for investors is whether there is still upside ahead or if the market is already factoring in the company’s brighter outlook.

Most Popular Narrative: 14.3% Undervalued

Even with Hagerty's recent share price rally, the most widely followed valuation narrative points to a fair value meaningfully above the last close. This suggests that, despite the market's positive reaction, the narrative foresees more upside based on long-term growth drivers and profit expectations.

The ramping State Farm partnership is expected to significantly accelerate new business growth, providing access to over 500,000 current program vehicles and thousands of motivated agents. This would materially expand Hagerty's customer acquisition funnel and recurring commission revenues at attractive margins over the next several years.

Want to know the logic behind this aggressive price target? The narrative's secret is ambitious growth assumptions, impressive margin forecasts, and future earnings targets that defy industry norms. Only the full narrative unveils which specific financial leaps are expected to power Hagerty's move above the current price. Dive in and see what could truly drive this stock higher.

Result: Fair Value of $13.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Hagerty's reliance on younger generations' interest in classic cars and its successful global expansion could challenge the growth narrative if these trends falter.

Find out about the key risks to this Hagerty narrative.

Another View: What Do Multiples Say?

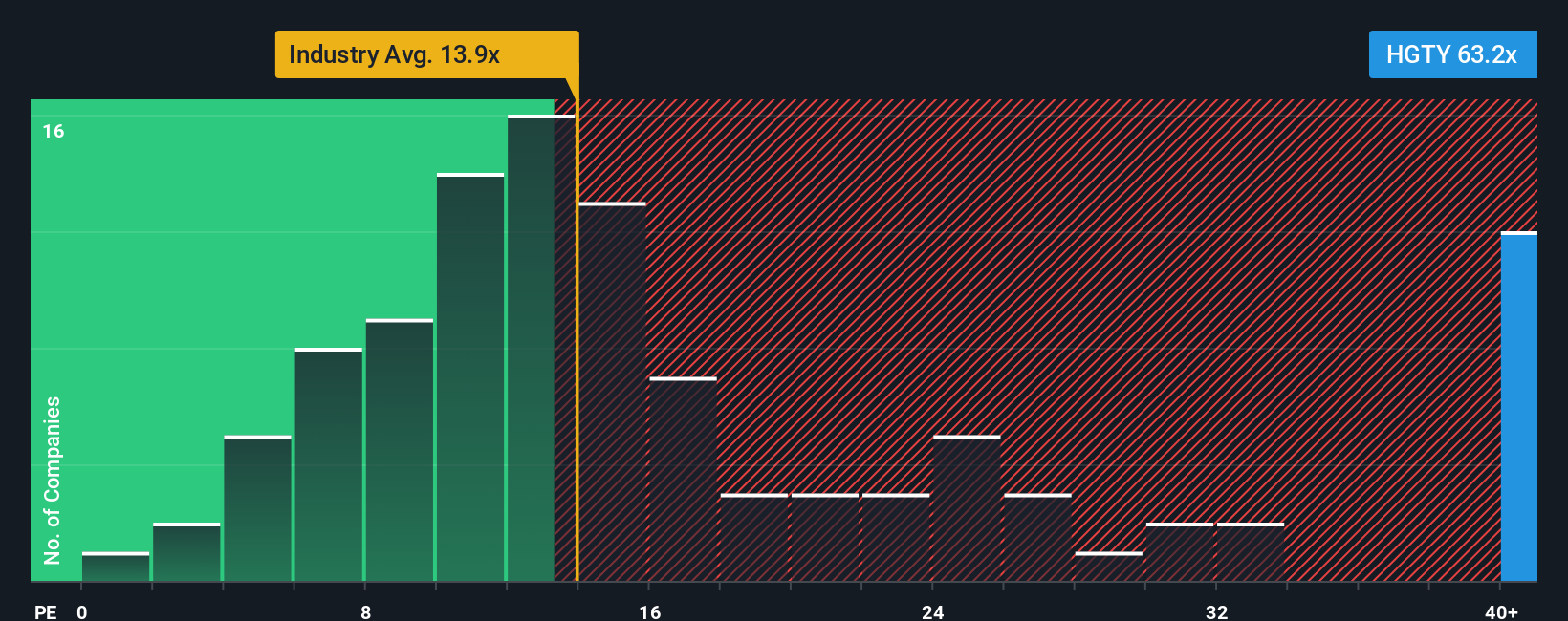

Looking at valuation through the lens of the price-to-earnings ratio, Hagerty appears expensive compared to its industry. Its P/E stands at 27.3x, almost double the US Insurance industry average of 13.7x, but it is still lower than the peer group average of 64.2x. Interestingly, our analysis suggests a fair ratio for Hagerty could be about 61.1x. This wide gap sparks debate: does the market see real risks, or is there an overlooked opportunity here?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hagerty Narrative

If you see things differently or want to take a closer look at the data yourself, it only takes a few minutes to craft your own perspective. Why not Do it your way?

A great starting point for your Hagerty research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let the next big opportunity pass you by. Power up your portfolio by checking out stocks tailored to your interests using these top screens:

- Target real income potential and boost your cash flow through these 20 dividend stocks with yields > 3%, which offers attractive yields above 3%.

- Fuel your strategy with innovation by exploring these 26 AI penny stocks, which are at the forefront of artificial intelligence advancements.

- Capture value before the crowd and find great companies trading below their true worth with these 849 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hagerty might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HGTY

Hagerty

Provides insurance services for collector cars and enthusiast vehicles in the United States.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives