- United States

- /

- Insurance

- /

- NYSE:GNW

Genworth Financial (GNW): Exploring Valuation After Steady Share Price Gains

Reviewed by Simply Wall St

See our latest analysis for Genworth Financial.

Genworth Financial’s share price has held its ground in recent months, fueled by a solid year-to-date share price return of nearly 23%. The company’s 20% one-year total shareholder return and impressive 91% gain over three years highlight growing investor confidence and a positive longer-term trend.

If Genworth’s momentum has you thinking bigger, this could be a great moment to broaden your horizons and discover fast growing stocks with high insider ownership

The real question now is whether Genworth Financial remains a bargain amid its recent gains, or if the current price already reflects all the expected growth ahead and leaves little room for upside.

Price-to-Earnings of 16.8x: Is it justified?

Genworth Financial trades at a price-to-earnings (P/E) ratio of 16.8x, placing its current valuation slightly below the overall US market P/E of 18.1x and meaningfully higher than its direct insurance industry peers.

The price-to-earnings ratio tells us how much investors are willing to pay for each dollar of the company’s earnings. For insurers, this metric helps gauge whether the market sees the business as a growth play or a value proposition, since earnings can be volatile but ultimately drive shareholder returns.

At 16.8x, Genworth’s P/E suggests some optimism compared to the wider insurance sector average of 13.7x and a notable premium to its peer average of 8.9x. This elevated multiple could reflect investor confidence in recent profit rebounds. However, it also means the stock is not a deep value play compared to its industry.

With no fair ratio benchmark available, it is important to dig deeper into what is driving this premium and whether the current share price leaves room for further upside or not.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 16.8x (OVERVALUED)

However, potential risks include uncertain future earnings and the possibility that projected price targets may not materialize as expected.

Find out about the key risks to this Genworth Financial narrative.

Another View: What Does Our DCF Model Suggest?

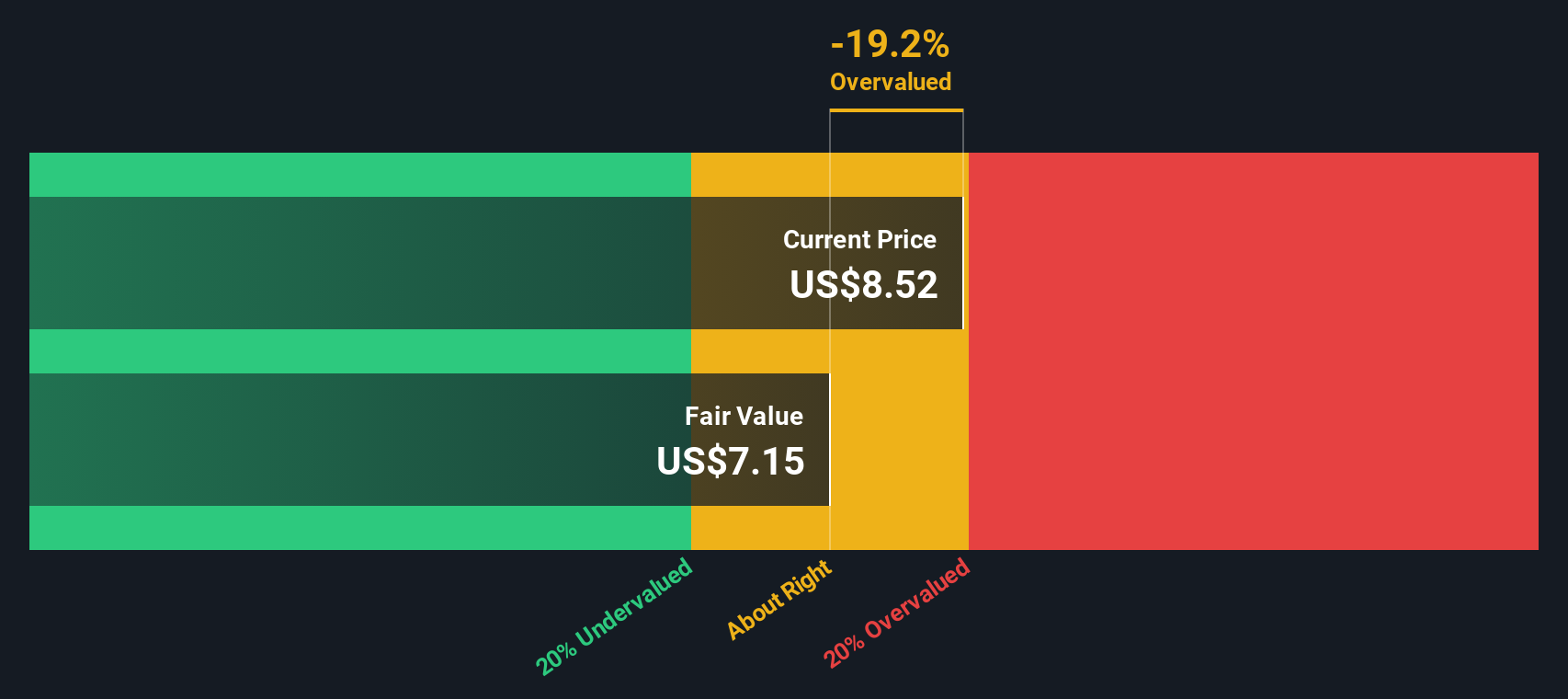

While the price-to-earnings ratio suggests that Genworth Financial is more expensive than its industry peers, our SWS DCF model uses a different approach by focusing on the company's future cash flows. According to this method, Genworth appears overvalued, with the share price trading above our estimate of fair value.

Look into how the SWS DCF model arrives at its fair value.

With these two different valuation methods offering conflicting signals, the question is whether Genworth holds hidden value that others are overlooking or if investors are dismissing important warning signs. The answer may depend on which valuation perspective you prioritize.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Genworth Financial for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 850 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Genworth Financial Narrative

If you’d rather take the reins and investigate the numbers yourself, building a personal view is always an option and only takes a few minutes. Do it your way

A great starting point for your Genworth Financial research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors keep their radar tuned for tomorrow’s opportunities. Don’t wait for headlines to reveal what you could uncover now with powerful screening tools at your fingertips.

- Capture rising dividends and enjoy steady income by checking out these 20 dividend stocks with yields > 3%, which offers yields above 3% from robust companies with solid payout histories.

- Harness the potential of future tech breakthroughs and stay ahead of the curve with these 27 quantum computing stocks, which shapes advances in computing and innovation.

- Seize early growth chances with these 3607 penny stocks with strong financials, featuring companies that combine accessible prices and strong financials for sharp-eyed investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GNW

Genworth Financial

Provides mortgage and long-term care insurance products in the United States and internationally.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives