- United States

- /

- Insurance

- /

- NYSE:EG

Everest Group (NYSE:EG) Valuation in Focus Following Leadership Change and Strategic Expertise Addition

Reviewed by Kshitija Bhandaru

Everest Group (NYSE:EG) is set for a leadership transition as Anthony Vidovich joins as Executive Vice President and General Counsel. He brings nearly three decades of global (re)insurance experience to guide the company’s strategy and governance.

See our latest analysis for Everest Group.

Everest Group’s share price has seen modest recovery in recent weeks, up 4.6% over the past month, even as the year-to-date return remains slightly negative. While recent executive changes signal a focus on stability and growth, the 1-year total shareholder return of -7.1% contrasts with a solid five-year total return of nearly 82%. This highlights the stock’s longer-term resilience amid evolving industry conditions.

If Everest’s strategic moves have you looking for what’s next, this could be the perfect moment to discover fast growing stocks with high insider ownership.

With the share price still trading below analyst targets and mixed signals from recent performance, the real question is whether Everest Group offers genuine value at current levels or if the market is already accounting for its future growth prospects.

Most Popular Narrative: 10.5% Undervalued

With Everest Group's last close at $349.13 and the most-followed narrative setting fair value at $390.20, the gap reflects optimistic analyst projections despite lingering market caution. This disconnect prompts a closer look at the key thesis fueling the bullish outlook.

Expansion into international and specialty insurance lines, including engineering, renewable energy, marine, and accident business, is leveraging global economic growth and increasing insurance penetration in emerging markets. This diversification is already delivering double-digit premium growth and is expected to provide sustained long-term revenue and earnings growth.

Want to know what’s fuelling the narrative's high target price? Hints: a seismic surge in projected earnings, wider margins, and a future profit multiple that’s surprisingly low for this sector. Which forecasts are bold enough that analysts think the market is missing a trick? The financial assumptions driving this valuation will surprise you.

Result: Fair Value of $390.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Everest’s increased catastrophe exposure and rising competition could quickly challenge the bullish narrative if losses or market pressures intensify unexpectedly.

Find out about the key risks to this Everest Group narrative.

Another View: How Do Market Multiples Stack Up?

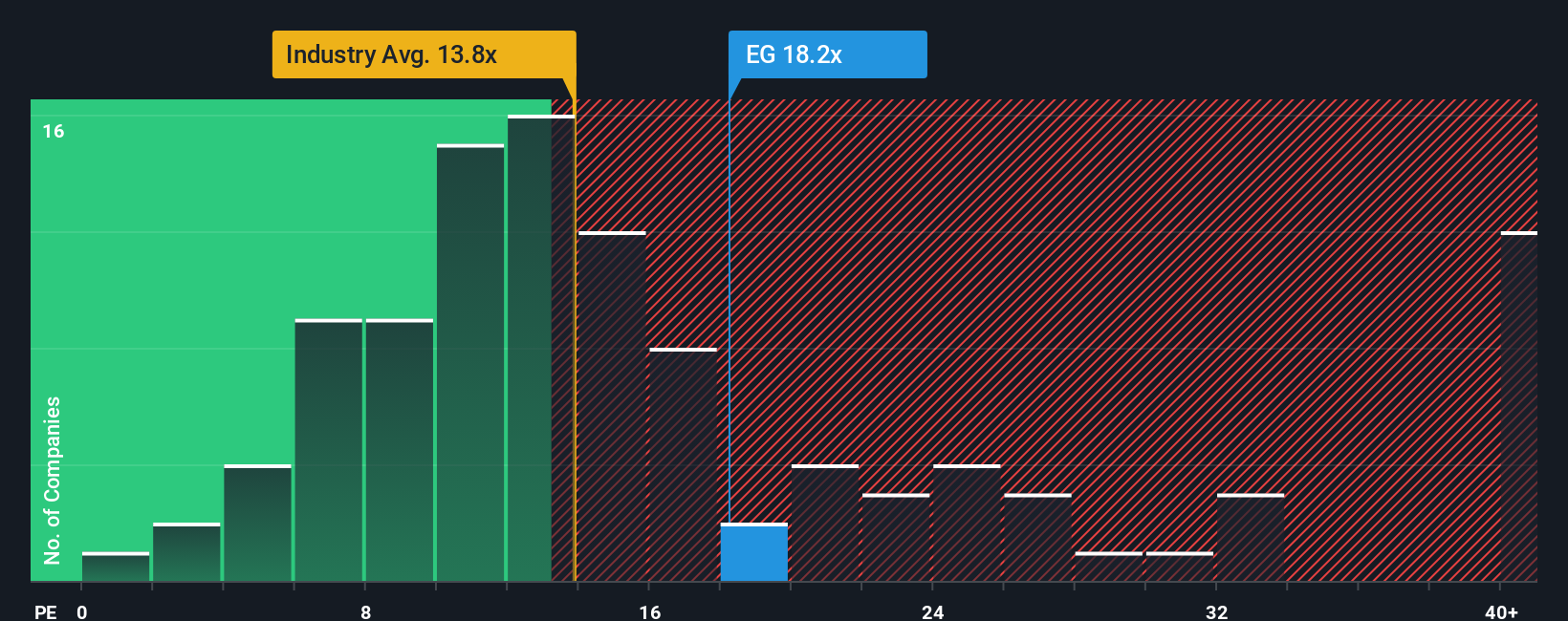

Looking beyond analysts' fair value targets, Everest Group trades at a price-to-earnings ratio of 18.4 times, which is higher than both its industry peers (13.2 times) and its fair ratio estimate (28.1 times). This suggests that while the stock looks pricey compared to rivals, there may still be headroom if the market moves toward the fair ratio. Are investors focusing too much on the premium, or is there upside being missed?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Everest Group Narrative

If you think there’s more to the story or want to weigh up the numbers yourself, you can build your own view in just minutes, Do it your way.

A great starting point for your Everest Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t limit your investing journey to just one stock. The smartest moves come from keeping an eye on emerging opportunities and future trends. Gain the edge with handpicked alternatives powered by the Simply Wall Street Screener:

- Collect rising income streams when you tap into these 18 dividend stocks with yields > 3%, featuring robust yield opportunities above 3% and reliable cash flows.

- Fuel your watchlist with innovation by targeting these 33 healthcare AI stocks, filled with companies advancing medical technology and AI-powered healthcare breakthroughs.

- Power up your portfolio by uncovering value in these 878 undervalued stocks based on cash flows, where cash flow analysis highlights stocks priced below their true potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Everest Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EG

Everest Group

Through its subsidiaries, provides reinsurance and insurance products in the United States, Europe, and internationally.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives