- United States

- /

- Insurance

- /

- NYSE:BRO

What Brown & Brown (BRO)'s Leadership Overhaul After Risk Strategies Deal Means for Shareholders

Reviewed by Sasha Jovanovic

- In recent days, Brown & Brown announced a series of leadership changes within its Retail segment, including the appointment of Mark Manzi as North American Retail Brokerage Leader, as part of its integration efforts following the acquisition of Risk Strategies.

- This move underscores the company’s push to accelerate collaboration and operational alignment across its expanding global presence, aiming to unlock new growth opportunities.

- We'll examine how these leadership changes and integration initiatives could influence Brown & Brown’s investment narrative and future market position.

Find companies with promising cash flow potential yet trading below their fair value.

Brown & Brown Investment Narrative Recap

To be a Brown & Brown shareholder, you need to believe in the firm’s ability to drive growth through integration and disciplined expansion, especially as it weaves new acquisitions into its core. The recent Retail segment leadership changes appear designed to support long-term operational alignment, but are unlikely to directly alter short-term catalysts or meaningfully reduce the biggest current risk: margin pressure from external economic conditions and potential declines in CAT property rates.

Among recent announcements, the September appointment of Steve Hearn as COO, overseeing operations outside North America, stands out for its relevance. This move aligns closely with the company’s global expansion roadmap and fits the catalyst of enhancing operational efficiency through leadership depth, a focus echoed by the latest integration efforts in the Retail segment.

However, investors should be aware that, despite the company’s growth plans, legal and regulatory uncertainty in key markets could suddenly shift operating assumptions and ...

Read the full narrative on Brown & Brown (it's free!)

Brown & Brown's narrative projects $9.0 billion revenue and $1.6 billion earnings by 2028. This requires 21.9% yearly revenue growth and a $606 million earnings increase from $994 million today.

Uncover how Brown & Brown's forecasts yield a $109.92 fair value, a 16% upside to its current price.

Exploring Other Perspectives

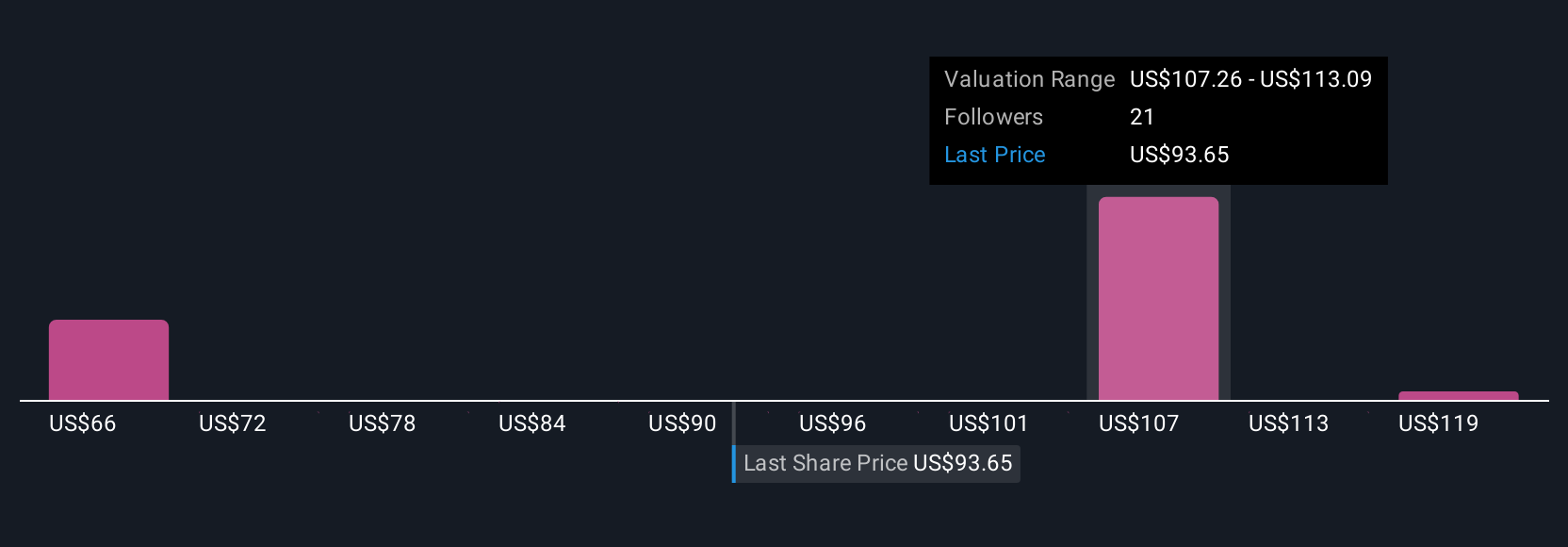

Six fair value estimates from the Simply Wall St Community range from US$66.78 to US$124.74, reflecting widely divergent views. Many see acquisition success as an opportunity, but there is ongoing concern about future margin pressure affecting performance, consider reviewing the detailed commentary for further insight.

Explore 6 other fair value estimates on Brown & Brown - why the stock might be worth as much as 31% more than the current price!

Build Your Own Brown & Brown Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Brown & Brown research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Brown & Brown research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Brown & Brown's overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 33 companies in the world exploring or producing it. Find the list for free.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brown & Brown might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BRO

Brown & Brown

Brown & Brown, Inc. markets and sells insurance products and services in the United States, Canada, Ireland, the United Kingdom, and internationally.

Average dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives