- United States

- /

- Insurance

- /

- NYSE:BRO

Brown & Brown (NYSE:BRO) Collaborates With WireX Systems For Enhanced Cybersecurity Solutions

Reviewed by Simply Wall St

Brown & Brown (NYSE:BRO) experienced a 2% price rise last week, coinciding with its new strategic collaboration with WireX Systems announced on June 17, aimed at integrating cybersecurity solutions with Brown & Brown's risk solutions. This partnership is projected to enhance risk management outcomes for their clients. Simultaneously, the company's movements in the fixed-income market, including the restructuring of co-lead underwriters for its substantial fixed-income offerings, signified its expanding financial strategies. This was set against a backdrop of a flat broader market amidst geopolitical tensions and anticipation of the Federal Reserve's decision on interest rates.

We've identified 1 weakness for Brown & Brown that you should be aware of.

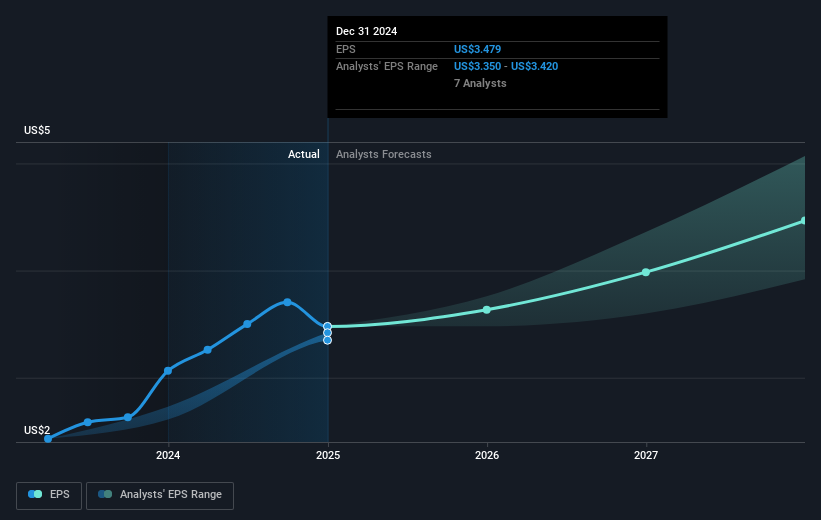

The recent collaboration between Brown & Brown and WireX Systems marks a significant enhancement in the company's cybersecurity and risk management offerings, potentially bolstering its revenue and earnings forecasts. Integrating these advanced solutions may attract a broader client base, driving revenue growth and enhancing margins. This is particularly pertinent given the company's pursuit of strategic acquisitions aimed at revenue expansion. Brown & Brown's proactive moves in restructuring its fixed-income financing signals a calculated approach to strengthen financial stability, which might reflect positively in its earnings outlook.

Over the past five years, Brown & Brown's total return, including dividends, was 171.35%, demonstrating substantial long-term growth. In the past year, its return outpaced the US Insurance industry, which saw a 14.1% increase, suggesting robust performance within its sector. Although the current share price is $110.38, which is only 7.5% below the analyst consensus price target of $119.31, this proximity indicates that the market views the stock as fairly valued. Such alignment underscores analyst expectations of consistent revenue and earnings growth to achieve the projected targets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brown & Brown might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BRO

Brown & Brown

Brown & Brown, Inc. markets and sells insurance products and services in the United States, Canada, Ireland, the United Kingdom, and internationally.

Adequate balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives