- United States

- /

- Insurance

- /

- NYSE:BRO

Brown & Brown (BRO): Exploring Valuation Following Recent Share Price Pullback

Reviewed by Simply Wall St

See our latest analysis for Brown & Brown.

Brown & Brown’s share price has cooled off so far this year, with momentum fading after a stretch of robust gains and a 12-month total shareholder return of -26%. However, its underlying long-term performance and earnings growth still set it apart from many competitors.

If recent volatility has you rethinking your next move, this could be an ideal opportunity to broaden your search and discover fast growing stocks with high insider ownership

With the price now well below recent highs but long-term metrics still looking strong, should investors consider Brown & Brown undervalued at this stage, or has the market already accounted for its future growth potential?

Most Popular Narrative: 16.9% Undervalued

Brown & Brown’s fair value, as estimated in the widely followed narrative, sits well above the latest close. This comparison raises the stakes for what might drive future upside.

Brown & Brown's strategic focus on acquisitions, having completed 13 acquisitions with projected annual revenues of $36 million, could significantly enhance future revenue streams and market presence. This aligns with their goal of sustained revenue growth through expansion.

What is behind the math? The narrative’s price target is fueled by aggressive expansion bets, evolving margin forecasts, and some bold growth assumptions. Ready to dig into which levers analysts are pulling to justify this premium? The underlying model might surprise even the most seasoned investors.

Result: Fair Value of $97.08 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, unexpected shifts in insurance regulations or continued pressure on profit margins could quickly alter the outlook for Brown & Brown’s valuation.

Find out about the key risks to this Brown & Brown narrative.

Another View: SWS DCF Model Sends a Warning

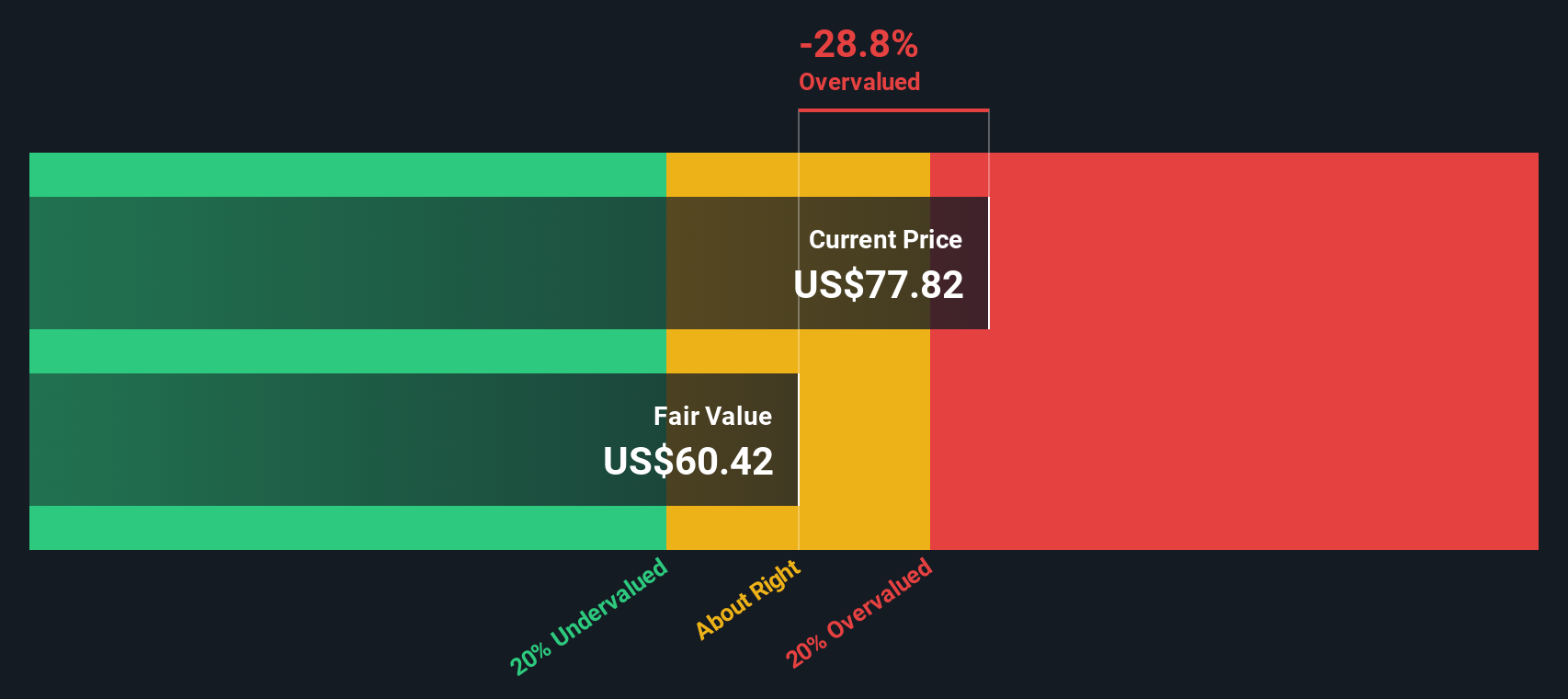

While the narrative and consensus suggest Brown & Brown is undervalued, our SWS DCF model tells a different story. According to this method, Brown & Brown’s shares actually trade well above the current estimate of fair value. This could indicate that the market is already factoring in more future growth than is realistic.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Brown & Brown for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 897 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Brown & Brown Narrative

If you would rather form your own conclusions or take a hands-on approach with the numbers, you can build a narrative from scratch in just a few minutes using our tools. Do it your way

A great starting point for your Brown & Brown research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Want More Ways to Grow Your Portfolio?

Think bigger with fresh opportunities. There is a world of top picks beyond Brown & Brown waiting to be found using the Simply Wall Street Screener. Don’t let the next market mover pass you by.

- Tap into the next innovation wave by checking out these 27 AI penny stocks powering artificial intelligence, automation, and the future of tech sectors.

- Catch potential hidden value by reviewing these 897 undervalued stocks based on cash flows that could be trading at a discount based on their cash flow potential and quality metrics.

- Boost your income stream with these 18 dividend stocks with yields > 3% offering attractive yields above 3% and stable payout records.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brown & Brown might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BRO

Brown & Brown

Brown & Brown, Inc. markets and sells insurance products and services in the United States, Canada, Ireland, the United Kingdom, and internationally.

Average dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives