- United States

- /

- Insurance

- /

- NYSE:BOW

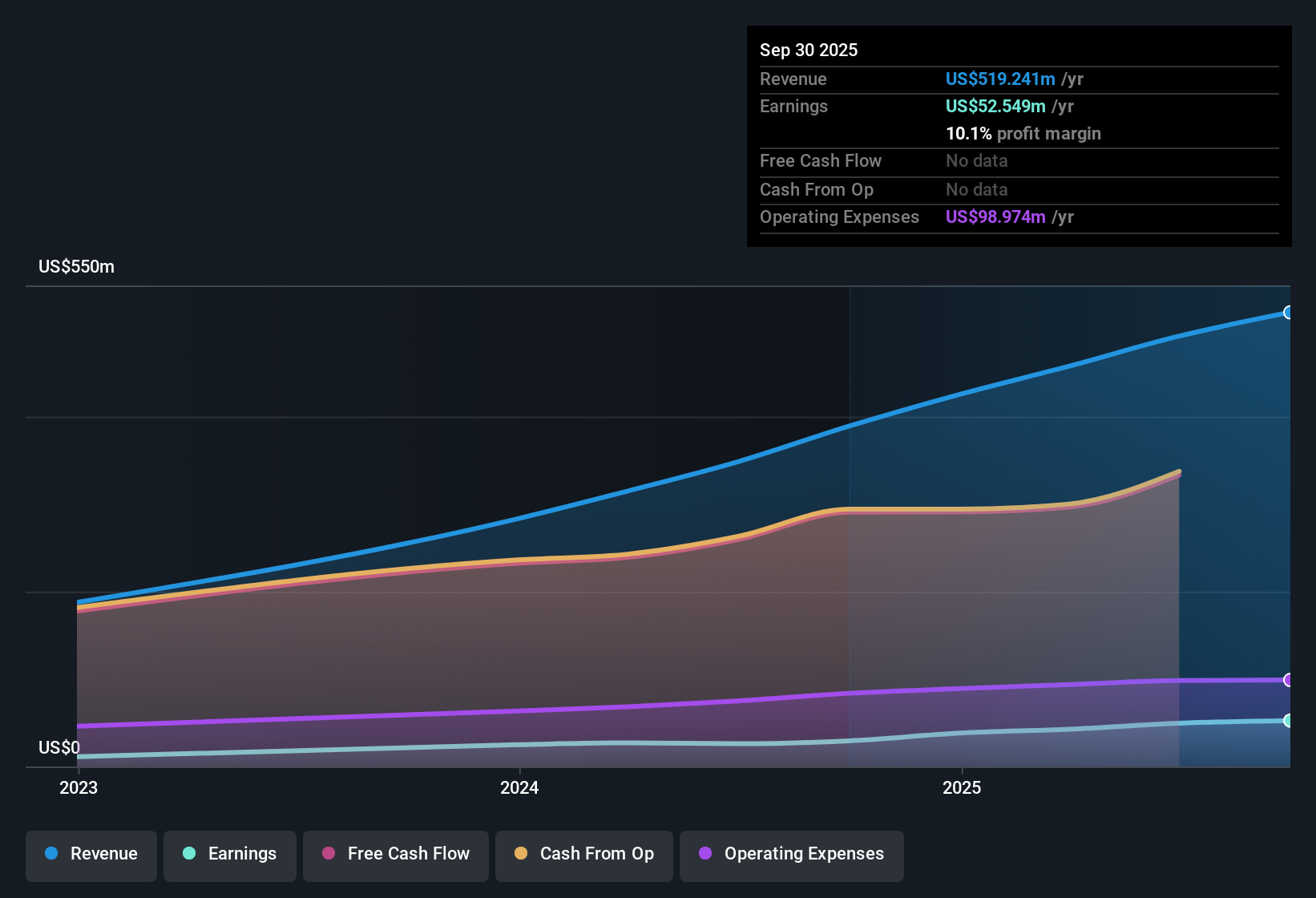

Bowhead Specialty Holdings (BOW): Net Margin Rises to 10.1% Reinforcing Bullish Growth Narratives

Reviewed by Simply Wall St

Bowhead Specialty Holdings (BOW) posted an impressive set of headline numbers, with earnings forecast to grow at 23.5% per year, well above the US market average of 16%, and revenue projected to rise 19.3% annually compared to the broader market’s 10.5%. Net profit margin improved to 10.1% from last year’s 7.6%, signaling a clear strengthening in profitability. With earnings quality described as high and expectations set for robust growth, investors are likely to focus on the company's positive earnings momentum and what it means for the share price trading above estimated fair value.

See our full analysis for Bowhead Specialty Holdings.The next section puts these results head-to-head with the most debated narratives and market expectations, highlighting where numbers back up the story or where they call it into question.

See what the community is saying about Bowhead Specialty Holdings

Tech-Driven Margin Expansion Rides on Efficiency Gains

- Expense ratios are trending toward the 30% mark, with operational scaling and technology adoption (for example, automation platforms) cited as key levers driving net margin improvement to 10.1%.

- According to the analysts' consensus view, Bowhead's disciplined underwriting and digital investments are supporting margin resilience even as complexity rises.

- Analysts highlight prudent risk selection and stable loss ratios, pointing to Bowhead's ability to grow while maintaining earnings quality.

- Consensus narrative notes that early momentum with underwriting automation is expected to support further improvement in combined ratio performance over time.

Premium Valuation Signals High Growth Hopes

- The share price of $25.45 puts Bowhead at a price-to-earnings multiple of 15.9x, exceeding both its peer group (11.2x) and US insurance industry average (13.1x), while also running above its estimated DCF fair value of $20.64.

- The analysts' consensus view reveals ongoing tension. Bulls point to forecasted annual earnings growth of 23.5% as justification for the premium, but bears can counter that investors are being asked to pay a valuation premium that already bakes in much of the positive outlook.

- Consensus narrative emphasizes that Bowhead's high quality growth is rare, but the gap above fair value means little room for error if expectations slip.

- With the current share price well above DCF fair value, the market is betting that projected margin and revenue gains will materialize as forecasted.

Long-Tail Risk Looms Despite Growth Story

- Heavy concentration in long-tail specialty lines exposes Bowhead to potential adverse claims development and net margin compression, particularly if "social inflation" accelerates large case settlements beyond industry norms.

- The analysts' consensus view flags that, while disciplined reserving and risk controls provide some buffer, Bowhead's limited operating history means actual claims may deviate from industry trends and impact future earnings.

- Ongoing competition and rising acquisition costs could further challenge Bowhead's path to sustained profitability.

- Analysts warn that premium growth in volatile segments must be matched by robust risk management to avoid surprise hits to bottom-line results.

To see how the numbers map to the big picture narrative, read the full consensus view for Bowhead Specialty Holdings and compare analyst takes to your own outlook. 📊 Read the full Bowhead Specialty Holdings Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Bowhead Specialty Holdings on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the figures? Share your perspective and craft a personalized narrative in just a few minutes by using Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Bowhead Specialty Holdings.

See What Else Is Out There

Bowhead’s lofty valuation leaves little margin for error. Any stumble in growth or margin performance could put the share price under pressure.

To steer clear of stocks where optimism has already been priced in, check out these 844 undervalued stocks based on cash flows and discover companies trading at more reasonable valuations with potential upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bowhead Specialty Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BOW

Bowhead Specialty Holdings

Provides commercial specialty property and casualty insurance products in the United States.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives