- United States

- /

- Insurance

- /

- NYSE:AON

Evaluating Aon (AON): Is the Stock Undervalued After Its Latest Share Price Move?

Reviewed by Simply Wall St

See our latest analysis for Aon.

Aon's share price jumped 3.81% today, offering a bright spot after several weeks of muted activity. While the 1-year total shareholder return is down 5.95%, the stock's strong three- and five-year total returns indicate solid long-term value, even as recent momentum appears a bit subdued.

If you're interested in tracking standout performers beyond the usual suspects, now is the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With shares edging up but trailing over the past year, the key question is whether Aon's fundamentals and steady growth signal an underappreciated bargain, or if the market is already anticipating its future upside.

Most Popular Narrative: 17.7% Undervalued

According to the most widely followed narrative, Aon's fair value is estimated at $414.20, which is notably higher than its recent closing price of $340.68. This narrative frames the valuation around operational efficiency gains, ongoing business shifts, and confident, long-term profit growth expectations.

Investment in priority hires and the expansion of Aon Business Services (ABS) capabilities are creating capacity to fund growth initiatives and drive operational efficiencies, benefiting net margins and earnings. Despite macroeconomic uncertainties, Aon sees increased demand from clients for their risk solutions as they navigate complex trade and economic environments, supporting sustainable revenue growth.

Want to know the secret behind this bullish valuation? Discover how aggressive earnings expansion, margin targets, and a premium future multiple combine to justify Aon's high fair value. These are numbers that could surprise even the most seasoned investors.

Result: Fair Value of $414.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer market conditions and Aon's higher debt load could challenge its earnings growth, particularly if cash flows do not improve as projected.

Find out about the key risks to this Aon narrative.

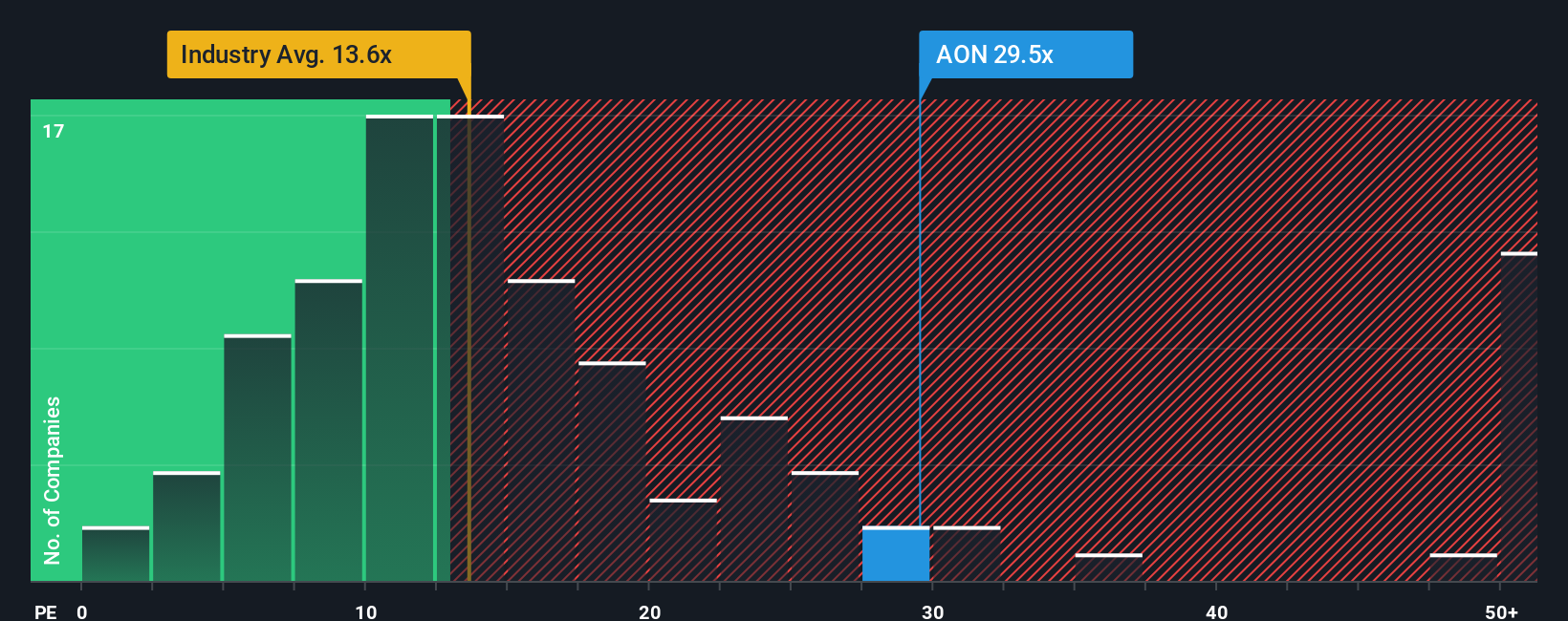

Another View: Peer Ratios Tell a Different Story

While the fair value narrative paints Aon as a bargain, its current price-to-earnings ratio of 26.9x stands noticeably above both the US Insurance industry average of 13.4x and the peer average of 25.7x. It is also well above the fair ratio of 16.5x that the market could migrate toward. This gap signals that while expectations for Aon's growth and profitability are high, the stock may carry heightened valuation risk if results do not keep pace. Is the premium fully justified, or could the market's optimism eventually cool?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Aon Narrative

If you think you see things differently or want to dive deeper into the numbers yourself, it's easy to shape your own perspective in just minutes. Do it your way

A great starting point for your Aon research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let your next winning opportunity pass by. Use the Simply Wall Street Screener to target stocks that fit your strategy and ignite your portfolio’s potential.

- Unlock superior yields by targeting stocks with strong payouts. Start with these 22 dividend stocks with yields > 3% featuring consistent dividends above 3%.

- Catch the most undervalued opportunities by tracking these 840 undervalued stocks based on cash flows, which is based on robust cash flow metrics and deep value signals.

- Capitalize on future breakthroughs by following these 33 healthcare AI stocks, which focuses on advances in cutting-edge health tech and medical AI innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AON

Aon

A professional services firm, provides a range of risk and human capital solutions worldwide.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives