- United States

- /

- Insurance

- /

- NYSE:AON

Aon (AON) Valuation in Focus After Extended 3-Month Share Price Decline

Reviewed by Simply Wall St

See our latest analysis for Aon.

After a challenging run so far this year, Aon's share price has slipped by 3.05% year-to-date and recent momentum remains negative. While short-term price trends have faded, long-term investors have still seen a 72% total shareholder return over five years. This highlights the company's strong multi-year performance despite this rough patch.

If recent shifts in the insurance sector have piqued your curiosity, it is a perfect moment to broaden your horizons and discover fast growing stocks with high insider ownership

With Aon's shares still well below recent analyst price targets and a track record of solid growth, the key question for investors is whether the current weakness means opportunity or if the market already reflects future expectations.

Most Popular Narrative: 14.5% Undervalued

With Aon's most widely followed narrative suggesting a fair value significantly above the last close, the company's growth strategy and margin outlook take center stage.

The acquisition of NFP has provided Aon with high-quality middle-market EBITDA through targeted acquisitions. This is expected to contribute significantly as the year progresses and impact revenue growth. Aon's 3x3 Plan and the deployment of Risk Analyzers have increased new business and improved client retention, strengthening the foundation for ongoing revenue growth and margin expansion.

Curious how this ambitious valuation stacks up? The narrative hinges on aggressive profit margin gains and declining share count. The real surprise is the premium multiple applied to future earnings. Unlock these assumptions and see the hidden drivers for yourself.

Result: Fair Value of $402.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing macroeconomic volatility and uncertainties in commercial insurance pricing could challenge Aon's outlook and undermine the bullish margin expansion narrative.

Find out about the key risks to this Aon narrative.

Another View: Market Relativity Raises Questions

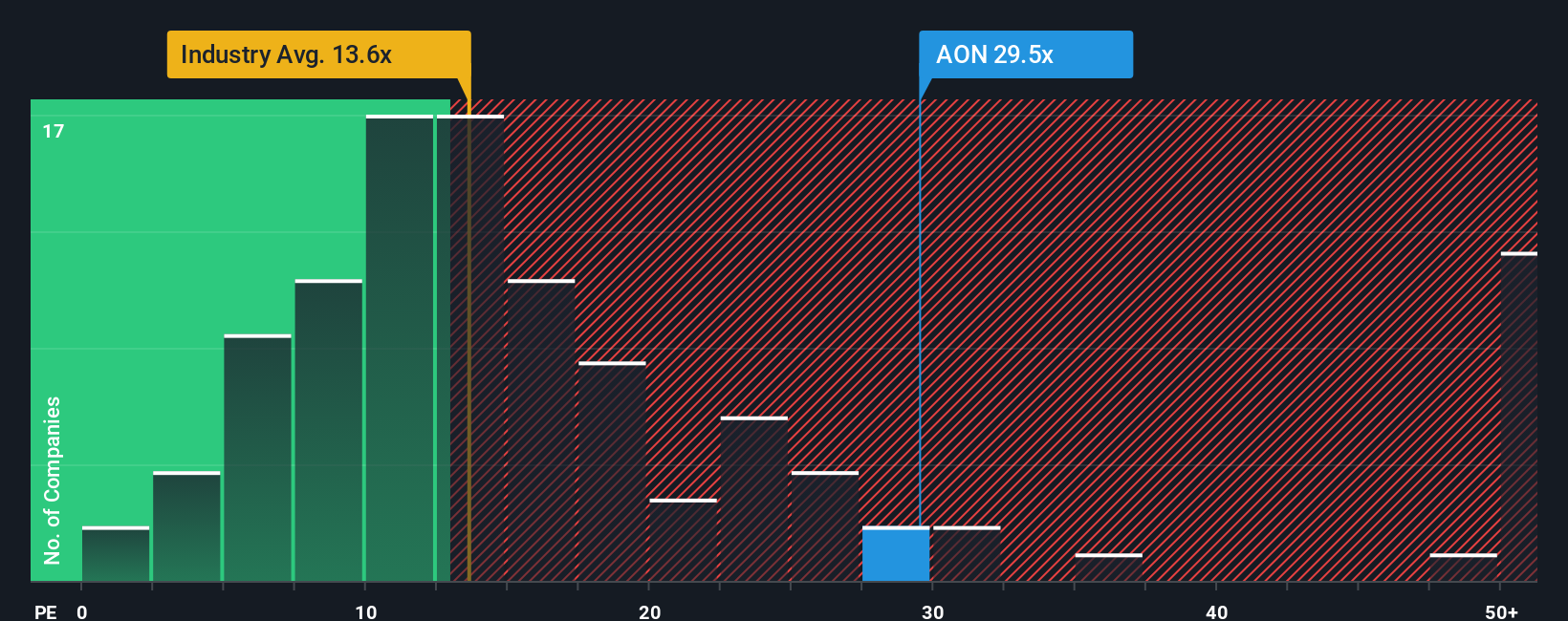

Taking a step back from fair value estimates, Aon is trading at a price-to-earnings ratio of 27.2x, which is noticeably higher than its industry average of 13x and its peer group at 25.6x. Even compared to the fair ratio of 16.5x, the current premium suggests investors are paying up for perceived strength. Does this premium reflect future growth, or could it signal valuation risk ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Aon Narrative

If you see things differently or want to shape your own story with the numbers, try creating a personal view in just a few minutes. Do it your way

A great starting point for your Aon research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Open new doors for your portfolio by acting now. The best opportunities can move quickly, so don’t wait and let them pass you by.

- Capture high yields when you check out these 15 dividend stocks with yields > 3%, which delivers reliable payouts above 3% for income-focused investors.

- Accelerate your growth strategy by considering these 27 AI penny stocks, a selection of companies already at the forefront of the artificial intelligence boom.

- Get ahead of the market by targeting these 896 undervalued stocks based on cash flows, which features stocks currently trading below their calculated fair value based on real cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AON

Aon

A professional services firm, provides a range of risk and human capital solutions worldwide.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives