- United States

- /

- Insurance

- /

- NYSE:AJG

Arthur J. Gallagher (AJG): A Fresh Look at Valuation After Recent Share Price Volatility

Reviewed by Simply Wall St

See our latest analysis for Arthur J. Gallagher.

Despite its recent dip, Arthur J. Gallagher’s share price still reflects a strong long-term story. While the past month saw an 11% decline and the year-to-date share price return is negative, the company’s five-year total shareholder return sits at an impressive 125%. This suggests that momentum may be taking a breather after substantial gains.

If you’re looking to discover what else is working in today’s market environment, now’s the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

Given recent price declines and the fact that shares are still trading at a notable discount to analyst targets, the big question for investors now is whether Arthur J. Gallagher is undervalued or if the market is already reflecting all future growth in the current price.

Most Popular Narrative: 22.7% Undervalued

Compared to the last close price of $247.30, the most popular narrative sees Arthur J. Gallagher’s shares priced well below their estimated fair value. The gap in valuation reflects bullish future assumptions and a focus on sustained earnings momentum through 2026 and beyond.

“Successful, disciplined execution of the ongoing M&A strategy, including the Assured Partners acquisition and a deep pipeline of additional bolt-on deals, broadens AJG's geographic reach, service offerings, and client base. This serves as a catalyst for both revenue and earnings accretion. Continued demand growth for employee benefits and health solutions, fueled by workforce demographic trends and increasing global health complexities, is creating recurring, higher-margin business and supporting both organic revenue growth and diversification away from more cyclical lines.”

Want to find out which ambitious forecasts power this surprisingly high fair value? The narrative hinges on relentless earnings growth, disciplined acquisitions, and a margin profile that bucks the industry norm. See the exact targets and bold assumptions that set this estimate apart.

Result: Fair Value of $319.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent pricing pressures and potential disruption from digital competitors could quickly shift sentiment and challenge the outlook that supports current valuation forecasts.

Find out about the key risks to this Arthur J. Gallagher narrative.

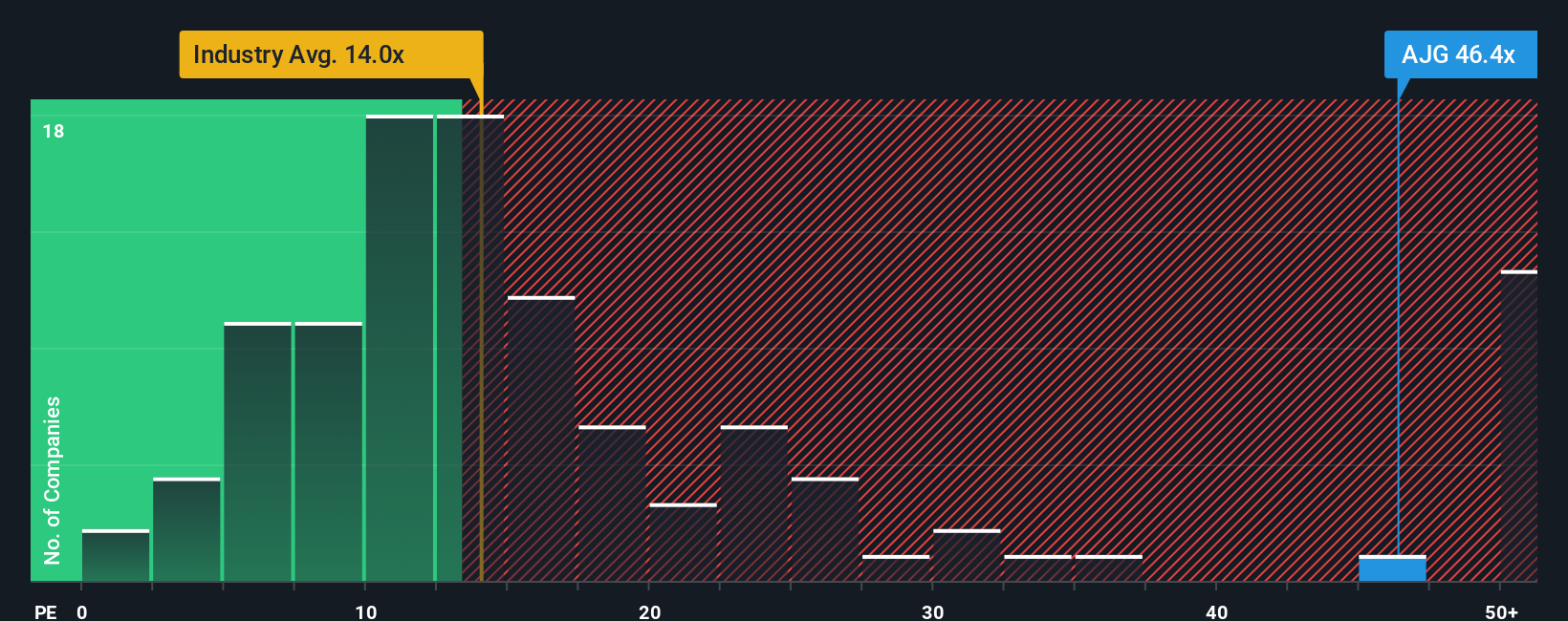

Another View: Valuation by Multiples Tells a Different Story

While the discount to fair value looks appealing based on the first method, looking at current earnings multiples raises caution. Arthur J. Gallagher trades at almost 40 times earnings, which is much higher than the industry average near 13 and the fair ratio of 20. This leaves little room for error if growth expectations falter. Are investors paying too much for recent momentum?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Arthur J. Gallagher Narrative

If you want to dig into the numbers yourself or see things from a different angle, you can map out your own perspective in just a few minutes. Do it your way

A great starting point for your Arthur J. Gallagher research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never settle for the obvious. Level up your portfolio strategy with hand-picked stock lists that reveal hidden value, fresh momentum, and high-potential trends.

- Unlock potential growth by targeting these 919 undervalued stocks based on cash flows where the market may have overlooked attractive discounts and future gains.

- Capture reliable income streams with these 16 dividend stocks with yields > 3%, focusing on businesses rewarding investors today and in the future.

- Position yourself at the forefront of technological innovation by tapping into these 25 AI penny stocks that are reshaping entire industries and unlocking new possibilities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AJG

Arthur J. Gallagher

Provides insurance and reinsurance brokerage, consulting, and third-party property/casualty claims settlement and administration services to entities and individuals worldwide.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives