- United States

- /

- Insurance

- /

- NYSE:AIZ

Assurant (AIZ): Margin Compression Challenges Bullish Community Narratives Despite Fair Value Discount

Reviewed by Simply Wall St

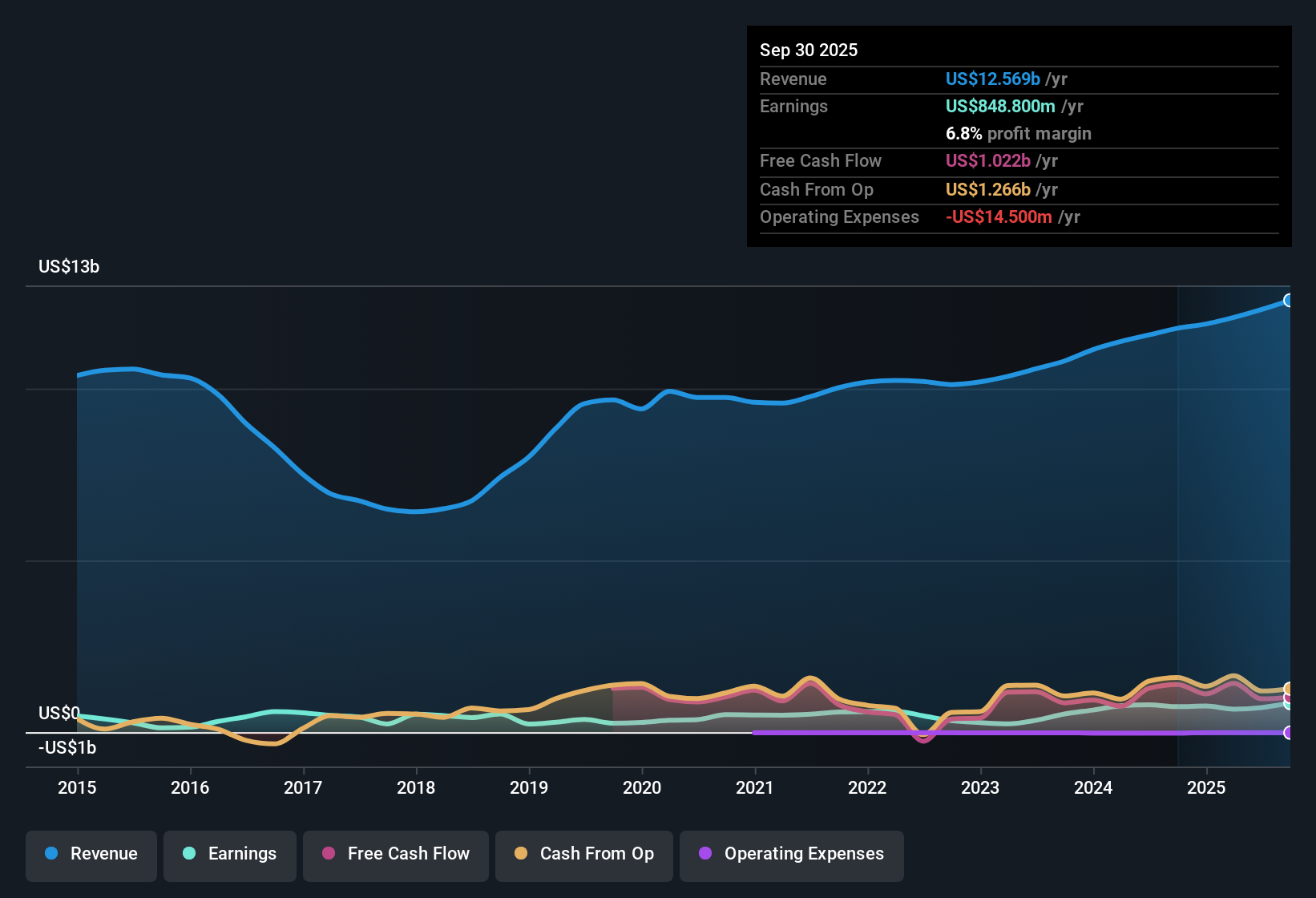

Assurant (AIZ) posted a net profit margin of 5.8%, down from last year's 6.9%, while earnings have grown at an average rate of 9.7% annually over the past five years. Market forecasts suggest earnings and revenue will continue to rise at 11.9% and 4.1% per year respectively, both trailing the broader US market’s growth outlook. Shares currently trade at a P/E of 15.4x, above industry and peer averages, but the price remains below an internally estimated fair value, putting the spotlight on moderate growth amid compressed margins.

See our full analysis for Assurant.The next section puts these earnings results side by side with the latest community and market narratives to see where perceptions hold up, and where expectations might need to shift.

See what the community is saying about Assurant

Margin Expansion Projected Despite Recent Compression

- Analysts expect profit margins to rise from 5.8% today to 8.4% by 2027. This suggests room for operational leverage and efficiency gains, even as margins have recently contracted.

- According to the analysts' consensus view, ongoing investments in AI and automation are modeled to drive improvements in cost efficiency and support expanding margins over the next three years.

- Consensus narrative notes that these technology upgrades are anticipated to offset margin pressure from regulatory and compliance cost challenges.

- It also highlights that stable recurring revenue streams in both Housing and Lifestyle are expected to underpin this projected margin increase despite current headwinds.

Consensus forecasts position margin growth as a major differentiator, even as regulatory and macro risks persist. 📊 Read the full Assurant Consensus Narrative.

Device Protection and B2B2C Deals Drive Revenue Stability

- Over the next three years, revenue is expected to grow by 4.9% annually, which is well below the 10.5% US market average, but underpinned by 2.4 million net new device protection subscribers and several international acquisitions.

- Analysts' consensus view points out that broader diversification across new partnerships, embedded insurance models, and regional expansion helps offset the slower headline growth rate.

- Consensus narrative highlights that recurring fee income from smart home and renters insurance products, along with new B2B2C deals, is expected to support sustained, albeit moderate, top-line growth.

- Rapidly expanding the Lifestyle segment is seen as a positive for revenue stability, despite overall growth lagging the broader market.

Valuation: Market Premium, But Shares Trade Below DCF Fair Value

- The current P/E ratio of 15.4x is higher than both the US Insurance industry average of 13.7x and the peer average of 11.6x. Yet, today's share price of $218.31 remains meaningfully below the DCF fair value estimate of $463.36.

- Analysts' consensus view sees this mismatch as a potential opportunity for long-term investors:

- Despite the earnings multiple premium, the discounted cash flow valuation signals Assurant may be undervalued, particularly if margin expansion and steady revenue trends materialize as projected.

- The 12.4% gap between current share price and the analyst consensus target of $247.67 also suggests there may be more upside if forecasts play out and regulatory risks do not derail growth.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Assurant on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on the latest results? It only takes a few minutes to turn your outlook into a fresh narrative, and Do it your way.

A great starting point for your Assurant research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Assurant’s earnings and revenue growth are both expected to trail the broader US market, which points to slower expansion compared to many alternatives.

If you want more consistent upside, use stable growth stocks screener (2074 results) to focus on companies delivering steady revenue and earnings growth year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AIZ

Assurant

Provides protection services to connected devices, homes, and automobiles in North America, Latin America, Europe, and the Asia Pacific.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives