- United States

- /

- Insurance

- /

- NYSE:AIZ

Assurant (AIZ): Evaluating Valuation After Strong Q3 Earnings Beat and Dividend Raise

Reviewed by Simply Wall St

Assurant (AIZ) announced an increased quarterly dividend of $0.88 per share, following a strong third quarter. The company’s revenue climbed nearly 9% and adjusted EPS surged 91% from the previous year. Investors are taking notice.

See our latest analysis for Assurant.

Assurant’s upbeat quarter seems to have left a mark on its stock, with a 7.7% share price return over the past month and steady momentum building through the year. While this performance has lifted its standing among peers, the 3-year total shareholder return of 89% really sets it apart for longer-term investors.

If the recent strength here has you thinking bigger, now could be the right moment to broaden your horizons and discover fast growing stocks with high insider ownership

With solid growth numbers and analysts still seeing upside to the price target, the question now is whether Assurant shares remain undervalued, or if the market has already priced in all that future momentum.

Most Popular Narrative: 10.1% Undervalued

With Assurant’s last close of $228.17 sitting well below the popular narrative’s fair value estimate of $253.67, the latest valuation points to clear upside from here. A higher price target reflects a shift in analyst models, and the drivers behind this view go beyond short-term market moves.

“Assurant is capitalizing on the proliferation of connected devices and increasing device protection needs, demonstrated by 2.4 million net new device protection subscribers, international acquisitions expanding repair capabilities, and strong new partnerships. This positions the company for sustained revenue growth and improved recurring earnings in its Lifestyle segment.”

Want to know the growth blueprint powering this bullish price target? The narrative hinges on ambitious assumptions for revenue, profit margins, and an attractive future multiple. Find out which surprising forecasts justify the gap between today’s price and that higher fair value.

Result: Fair Value of $253.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent regulatory scrutiny or fresh digital competition could quickly change the outlook. This could challenge Assurant's growth story in the months ahead.

Find out about the key risks to this Assurant narrative.

Another View: What Do the Numbers Say?

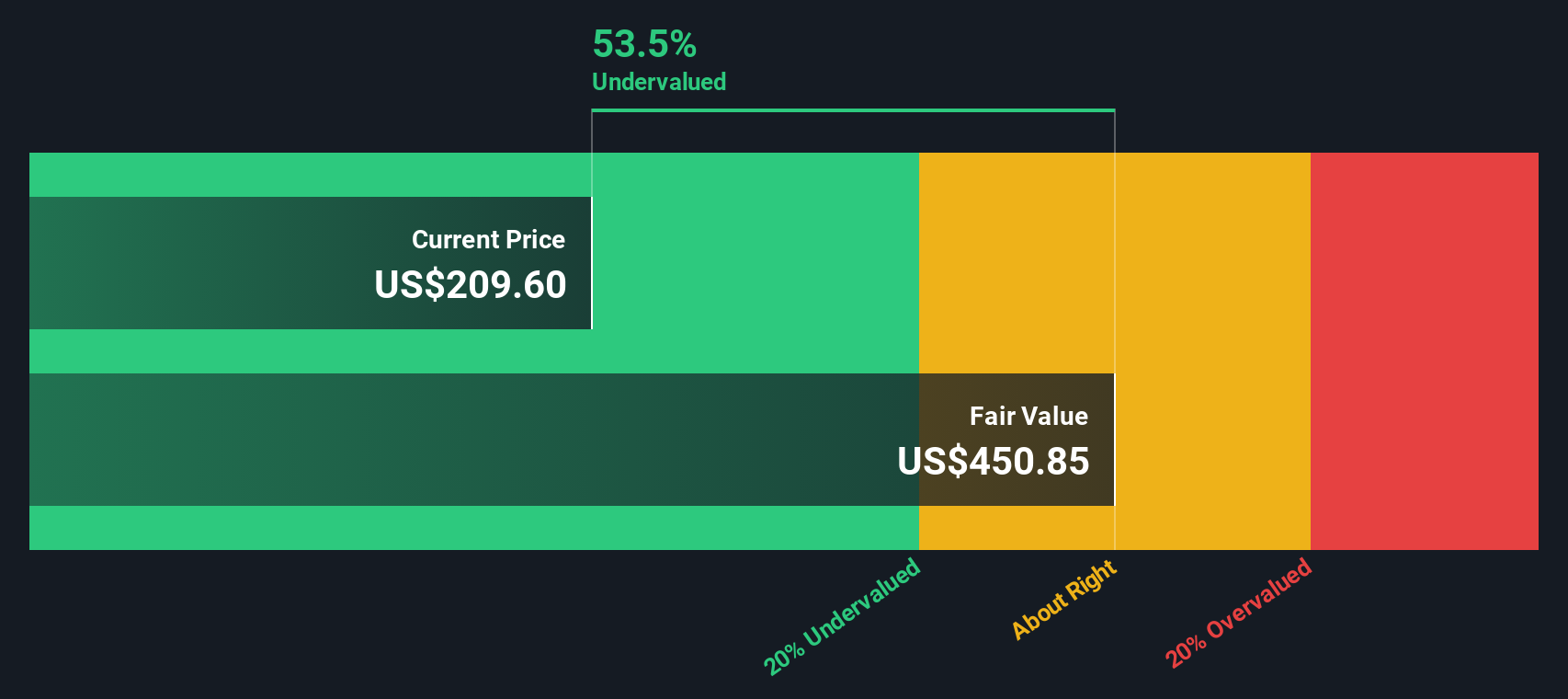

Looking from a different angle, our DCF model suggests Assurant shares might be trading far below intrinsic value, with a fair value closer to $475. This method relies on projected cash flows rather than peer comparisons and highlights major upside if those forecasts play out. Which approach gives you more confidence?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Assurant Narrative

If you see things differently or want to dig deeper into the numbers yourself, crafting your own perspective is quick and easy. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Assurant.

Looking for More Investment Ideas?

You’re just a click away from finding new opportunities that can supercharge your portfolio. Don’t let the next breakout or steady earner pass you by.

- Catch the momentum of AI innovation with these 26 AI penny stocks, focused on tomorrow’s biggest winners in artificial intelligence.

- Target high yields and consistent income by reviewing these 14 dividend stocks with yields > 3%, designed for those who prioritize strong dividend performance.

- Position yourself ahead of the curve in quantum computing and emerging tech with these 26 quantum computing stocks, highlighting leaders in this frontier sector.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AIZ

Assurant

Provides protection services to connected devices, homes, and automobiles in North America, Latin America, Europe, and the Asia Pacific.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success