- United States

- /

- Insurance

- /

- NYSE:AIZ

Assessing Assurant’s Value After Partnership Expansion and 3.2% Weekly Share Price Gain

Reviewed by Bailey Pemberton

- Thinking about whether Assurant is fairly priced? You are not alone, especially with so many investors trying to figure out if they are seeing hidden value or just chasing trends.

- Recently, Assurant's share price has seen a 3.2% gain over the last week, even after dipping 2.5% this past month, and the stock is up 12.8% over the past year. Long-term investors have been well rewarded, with 84% gains over three years.

- This price action has come alongside news that Assurant is expanding its partnership with a major automaker and investing in technology to streamline customer operations, which has sparked more interest and optimism among analysts.

- On valuation, Assurant scores a 3 out of 6 on our value checks, suggesting there may be hidden opportunities and pitfalls. Let us break down what that means. Plus, stay tuned for an even better way to assess value at the end of our analysis.

Approach 1: Assurant Excess Returns Analysis

The Excess Returns model helps assess a company by measuring the returns it generates on its invested capital compared to the cost of that capital. This approach highlights how much value a business is creating for shareholders over and above what similar, lower-risk investments might offer.

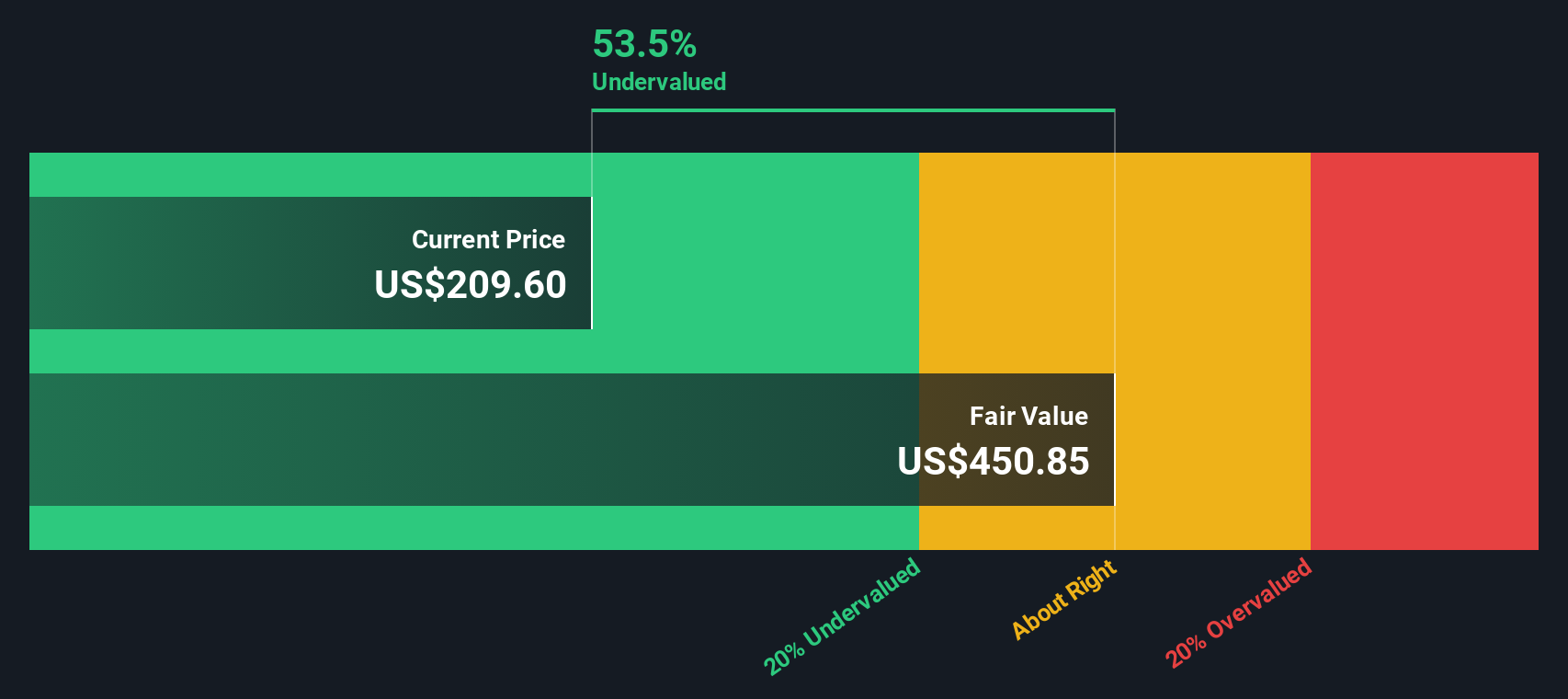

For Assurant, the current Book Value stands at $108.81 per share, and estimated Stable EPS is $20.91 per share, based on the consensus of six analysts’ future Return on Equity estimates. The company’s calculated Cost of Equity is $8.69 per share, which means Assurant is generating an Excess Return of $12.22 for each share it owns. The average future Return on Equity is projected at 16.31%, indicating robust profitability over time. In addition, the Stable Book Value estimate is $128.26 per share, further reinforcing the underlying financial strength of the business.

Under this methodology, the Excess Returns valuation puts Assurant’s intrinsic value at $458.99 per share. This suggests the stock is currently 53.2% undervalued compared to the market price.

Result: UNDERVALUED

Our Excess Returns analysis suggests Assurant is undervalued by 53.2%. Track this in your watchlist or portfolio, or discover 841 more undervalued stocks based on cash flows.

Approach 2: Assurant Price vs Earnings

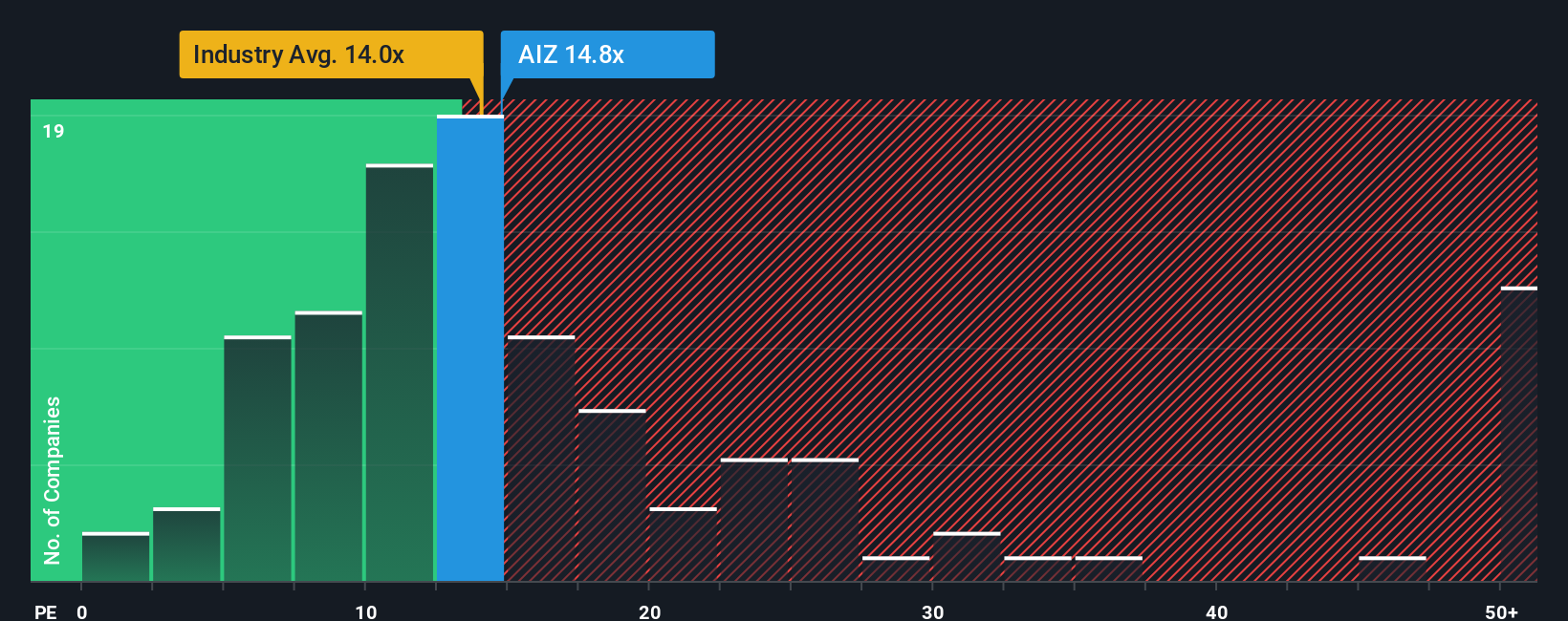

The Price-to-Earnings (PE) ratio is widely used to value established, profitable companies like Assurant because it measures how much investors are willing to pay for each dollar of a company’s earnings. Since Assurant has consistent profits, the PE ratio offers a solid benchmark for comparing its stock to peers and the wider insurance industry.

Growth prospects and company risks both play a big part in shaping what a "normal" or "fair" PE ratio should be. Companies expected to grow faster or with lower risk typically command higher multiples, while slower growth or riskier firms tend to trade at lower ones.

Currently, Assurant trades at a PE ratio of 15.10x, compared to the industry average of 13.68x and the peer group’s average of 11.40x. While this means the stock is priced higher than many competitors, a higher PE can be justified if investors expect stronger growth or lower risk.

Simply Wall St’s proprietary “Fair Ratio” is an all-in-one PE benchmark tailored to each company. Unlike simple peer or industry comparisons, the Fair Ratio incorporates key factors like earnings growth, profit margins, business risks, industry dynamics, and market cap, providing a more complete view of fair value.

For Assurant, the Fair Ratio is 16.31x. Since its actual PE of 15.10x is below this level, it suggests the stock may actually be attractively valued versus its true potential based on all those other factors.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1409 companies where insiders are betting big on explosive growth.

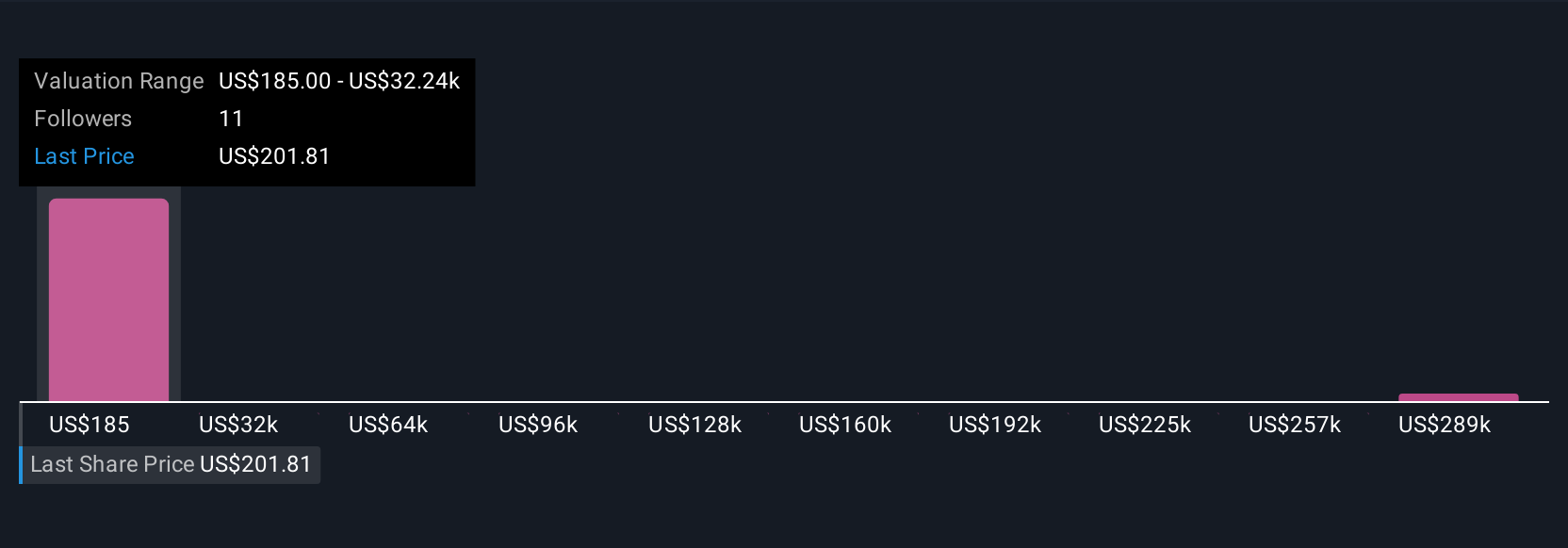

Upgrade Your Decision Making: Choose your Assurant Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is a simple, interactive story you create about a company by connecting your own view of its business prospects to the numbers. You choose your assumptions for future revenues, earnings, and profit margins, which then generates a fair value based on those beliefs.

Narratives bridge the gap between a company’s story and its valuation, helping you express your personal perspective on where the business is headed and see how those beliefs affect what you think the stock is worth. This tool is easy to use and is available right within the Community page on Simply Wall St, where millions of investors share their viewpoints.

With Narratives, you can quickly compare your estimated fair value to the current share price to help decide if it is a good time to buy, sell, or hold. Plus, every Narrative automatically updates as new information such as news headlines or earnings reports becomes available, ensuring your view always reflects the latest reality.

For example, with Assurant, some investors have a bullish Narrative driven by growth in device protection and international expansion, putting their fair value well above $245. Others are more cautious about competition and regulatory risks, estimating a much lower fair value near $211. This means you can easily see and compare a wide range of perspectives and decide which story makes the most sense to you.

Do you think there's more to the story for Assurant? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AIZ

Assurant

Provides protection services to connected devices, homes, and automobiles in North America, Latin America, Europe, and the Asia Pacific.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives