- United States

- /

- Insurance

- /

- NasdaqGS:WTW

Willis Towers Watson (WTW) Margin Plunge Challenges Bullish Narratives Despite Growth Forecasts

Reviewed by Simply Wall St

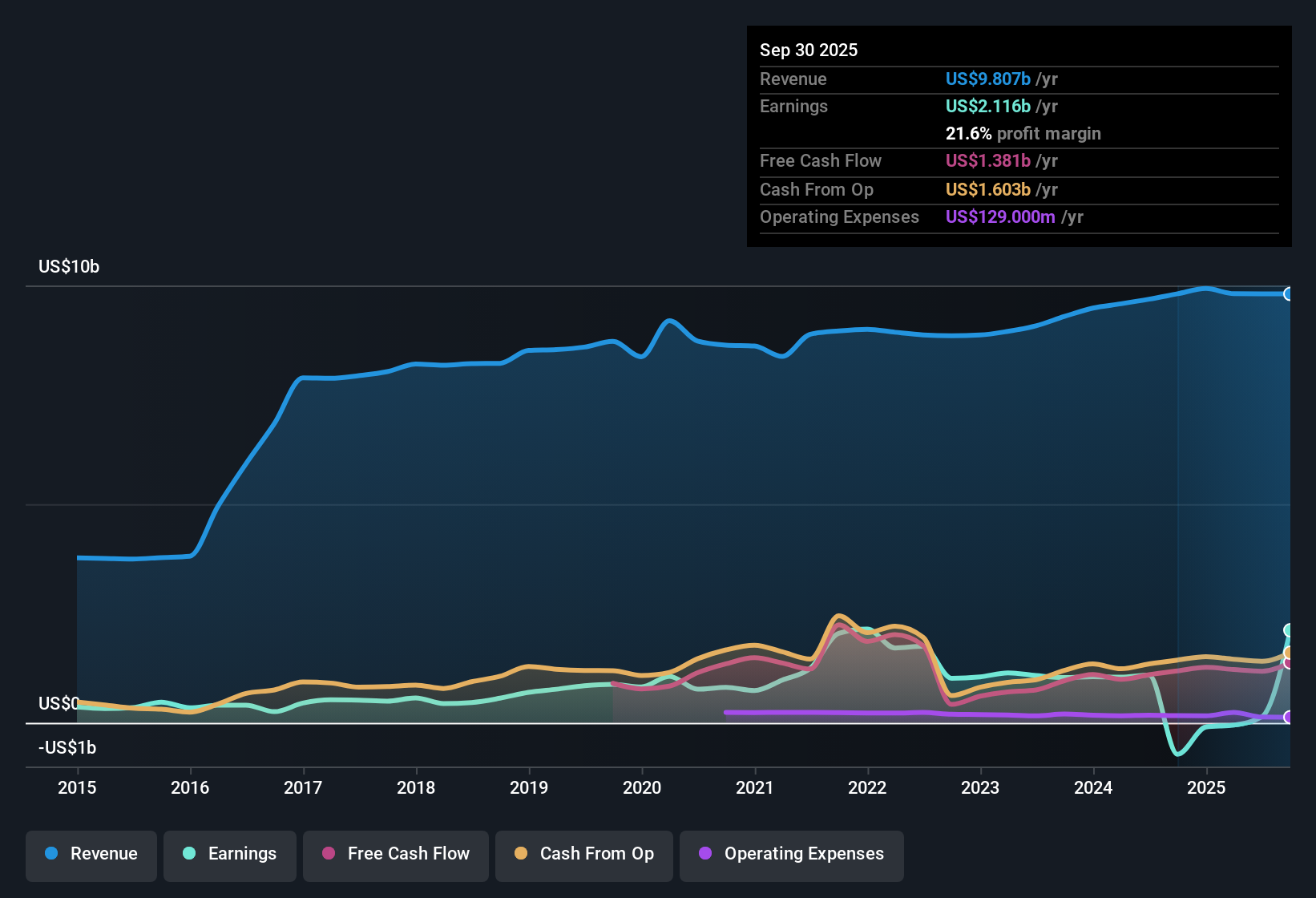

Willis Towers Watson (WTW) reported earnings growth forecasts of 8.7% per year with revenue projected to rise 6.5% annually, but the net profit margin for the latest 12 months fell sharply to 1.4% from 11.2% last year. The company’s bottom line was hit by a one-off loss of $1.6 billion, contributing to a five-year earnings decline averaging 27.7% per year. Forward-looking investors are weighing these recent setbacks against signs of moderate growth and an attractive valuation compared to peers.

See our full analysis for Willis Towers Watson.Next up, we put these headline numbers in context by comparing them to the narratives that regularly shape market sentiment around WTW. We look at where the consensus still holds, and where new questions emerge.

See what the community is saying about Willis Towers Watson

Analysts Bet on Margin Leap by 2028

- While profit margins are currently just 1.4%, analysts forecast a dramatic improvement to 23.3% over the next three years. This turnaround would require a major shift in cost structure or recurring revenue growth.

- According to the analysts' consensus view, such margin expansion depends on WTW’s success in capturing demand in specialized consulting and optimizing its portfolio for recurring, higher-margin business.

- Consensus narrative notes ongoing investments in digital risk management and healthcare consulting should deepen operating leverage and stabilize future margins even as competition grows.

- At the same time, recent one-off losses and integration risks from acquisitions present hurdles that could delay or weaken the path to higher profitability if not carefully managed.

One-Time $1.6B Hit Masks Growth Moves

- The latest period’s $1.6 billion one-off charge hammered net income, driving annualized earnings down 27.7% per year for the past five years. This is a sharp contrast with the company’s current growth guidance.

- Analysts' consensus view notes that while these charges have raised short-term red flags, continued growth in advisory demand, portfolio streamlining, and expansion into emerging high-margin sectors offer a longer runway.

- This perspective stresses that as one-off costs roll off, the underlying recurring revenue streams and segment-level investments could help restore and grow earnings.

- Still, persistent regulatory costs or under-delivered synergies from recent deals may limit how quickly WTW can bounce back to prior profitability levels.

Trading Below DCF Fair Value, But at Industry Premium

- WTW’s current share price of $317.00 sits about 17% below the DCF fair value of $383.32. Its price-to-sales ratio remains lower than peers but above the US insurance industry average.

- According to the analysts' consensus view, the market discounts WTW’s potential given recent profitability setbacks, yet its valuation looks attractive versus peers if management delivers on margin and growth targets.

- Consensus narrative highlights that the company’s exposure to higher-growth consulting and data-driven industries may justify its relative premium, as recurring revenues could outpace more cyclical industry players.

- That said, achieving these valuation gains requires flawless execution and may be difficult if competition or cost escalation eats into the projected turnaround.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Willis Towers Watson on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the data? Share your viewpoint and shape the story in under three minutes with Do it your way.

A great starting point for your Willis Towers Watson research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

WTW’s large one-off loss and volatile margins reveal just how quickly unpredictable costs and integration challenges can derail steady profit growth.

If you would rather focus on reliability, sift for companies posting consistent performance in revenue and earnings by using our stable growth stocks screener (2112 results) screener right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Willis Towers Watson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WTW

Willis Towers Watson

Operates as an advisory, broking, and solutions company worldwide.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives