- United States

- /

- Insurance

- /

- NasdaqGS:WTW

Should the Launch of Radar 5’s Generative AI Drive a Rethink for Willis Towers Watson (WTW) Investors?

Reviewed by Sasha Jovanovic

- Willis Towers Watson recently announced the launch of Radar 5, the latest version of its end-to-end rating and analytics software for insurers, with advanced Generative AI, enhanced machine learning, and SaaS capabilities for improved pricing, underwriting, and portfolio management.

- This upgrade positions WTW as a technology leader in insurance analytics, leveraging over 30 years of expertise to deliver real-time insights, personalization, and scalability for both personal and commercial insurance lines.

- We'll now explore how Radar 5’s Generative AI capabilities and SaaS expansion could reshape Willis Towers Watson's investment narrative.

These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Willis Towers Watson Investment Narrative Recap

To be a shareholder in Willis Towers Watson, you need to believe in the company’s ability to drive increased productivity and operating leverage by embedding advanced analytics and AI across its insurance and consulting services. The launch of Radar 5 supports WTW’s pursuit of higher-margin specialties, but does not materially change the biggest near-term catalyst, faster adoption of digital risk management technology, nor does it offset ongoing risks around pricing pressure if core broking and consulting services become more commoditized in a digital era.

Among recent announcements, WTW's new partnership with Sompo Holdings to deploy Radar across Japanese auto insurance highlights sustained international demand for advanced pricing solutions. This move aligns with the broader industry shift toward analytics-driven offerings, reinforcing the importance of WTW’s technology roadmap as insurers seek greater speed, accuracy, and differentiation.

By contrast, technology-driven advances like Radar 5 only deepen the need for investors to watch how fee compression from digital competition could impact WTW’s long-term...

Read the full narrative on Willis Towers Watson (it's free!)

Willis Towers Watson's narrative projects $10.9 billion revenue and $2.5 billion earnings by 2028. This requires 3.7% yearly revenue growth and a $2.36 billion increase in earnings from $137.0 million today.

Uncover how Willis Towers Watson's forecasts yield a $368.78 fair value, a 9% upside to its current price.

Exploring Other Perspectives

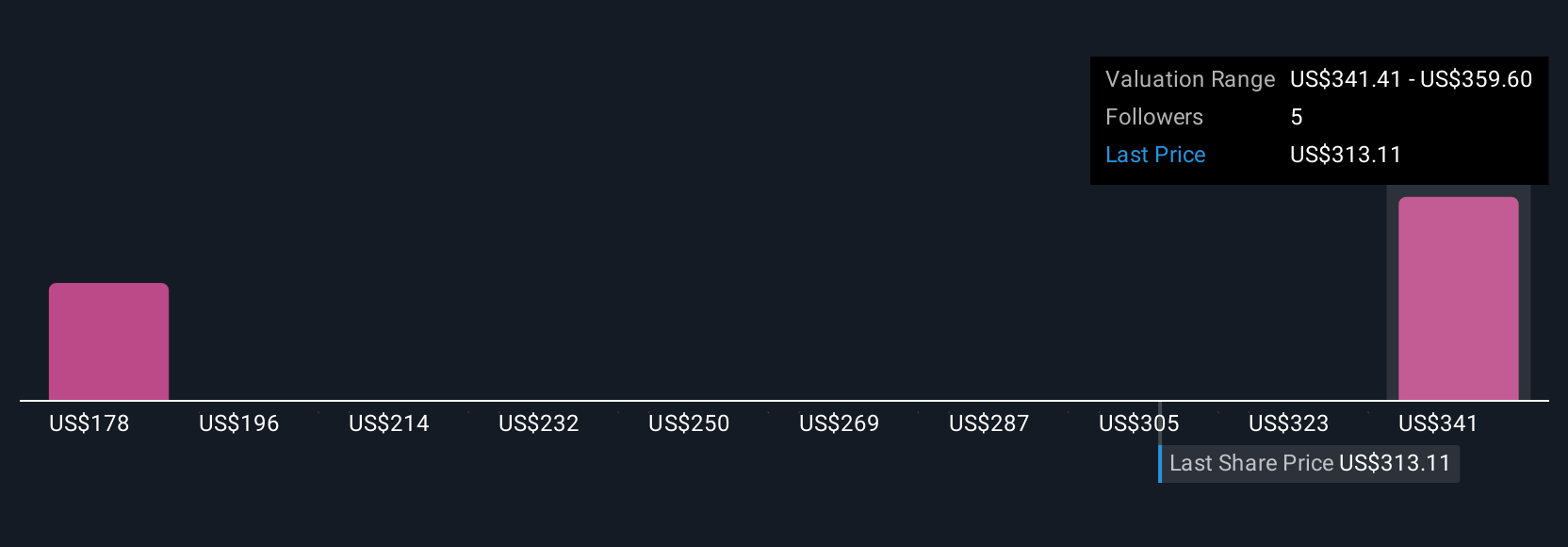

Simply Wall St Community contributors provided two fair value estimates ranging from US$368.78 to US$383.32 per share before the latest news. While opinions differ, many expect WTW’s investment in analytics and AI-enabled solutions to shape future operating margins and pricing power.

Explore 2 other fair value estimates on Willis Towers Watson - why the stock might be worth just $368.78!

Build Your Own Willis Towers Watson Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Willis Towers Watson research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Willis Towers Watson research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Willis Towers Watson's overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are the new gold rush. Find out which 39 stocks are leading the charge.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Willis Towers Watson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WTW

Willis Towers Watson

Operates as an advisory, broking, and solutions company worldwide.

Adequate balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026