- United States

- /

- Insurance

- /

- NasdaqCM:TIPT

Tiptree (TIPT) Profit Margin Expansion Reinforces Bullish Narratives in Latest Earnings

Reviewed by Simply Wall St

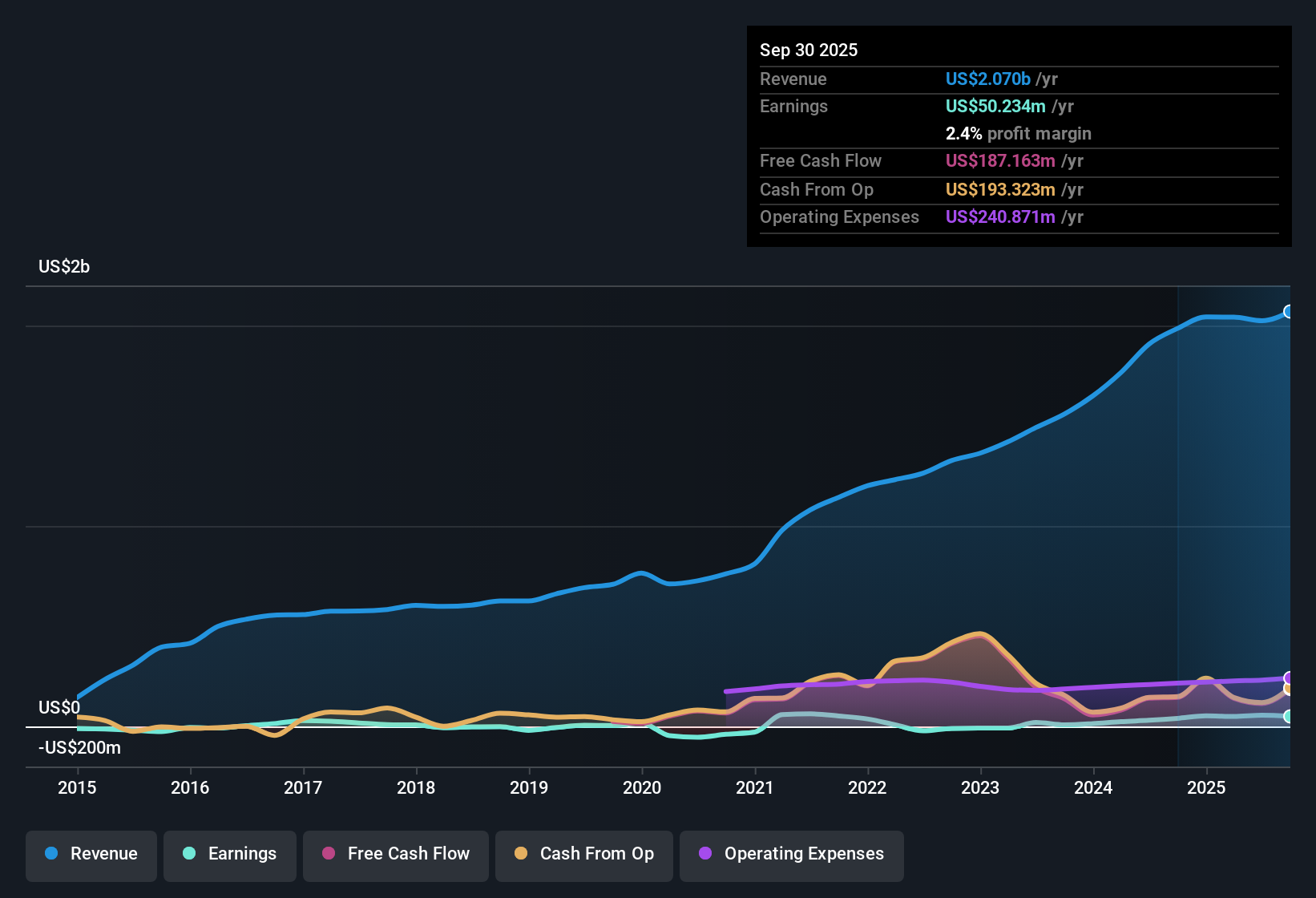

Tiptree (TIPT) delivered an impressive 81.4% annual earnings growth over the past twelve months, with net profit margins rising to 2.8% compared to last year’s 1.6%. While the current share price sits at $17.71, well above the $12.24 analyst fair value estimate, the company’s consistent profitability and margin expansion over the last five years are clear positives for investors.

See our full analysis for Tiptree.Next up, we’ll see how these results stack up against prevailing narratives, highlighting where the data supports the consensus and where it might defy expectations.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Growth Far Outpaces Five-Year Average

- Tiptree's annual earnings growth reached 81.4% over the last twelve months, far exceeding its five-year average growth rate of just 25.5% per year.

- Prevailing market view heavily supports the idea that Tiptree has effectively transitioned from merely steady results to a “high quality” growth phase,

- with recent news coverage and analyst commentary emphasizing the outsized jump in profitability as a standout driver versus sector peers.

- What is especially notable is that this surge in the pace of profit growth comes amid ongoing industry volatility, underpinning the case for Tiptree as a stable compounder in the specialty insurance space.

Margins Climb Despite Industry Pressure

- Net profit margins rose from 1.6% last year to 2.8% this year, a 120 basis point improvement. This demonstrates considerable expansion even as insurers often face margin compression.

- The prevailing market view notes that bulls will see this margin strength as a key sign of disciplined operations,

- since margin improvement has arrived alongside rapid profit growth,

- and the company's ability to scale profitably stands out within the typically risk-averse insurance sector.

Valuation Signals a Mixed Picture

- At a price-to-earnings ratio of 11.9x, Tiptree trades below the industry average (13.2x) yet above its peer average (7.5x). Its $17.71 share price remains above DCF fair value of $12.24, suggesting investors pay a premium for recent performance.

- The prevailing market view frames this valuation as a double-edged sword,

- with value-focused investors encouraged by the discount to the broader insurance industry,

- but critics noting the price premium to fair value and certain peers tempers sentiment, leading to debate over how much of the strong growth is already in the stock.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Tiptree's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite Tiptree’s standout earnings growth, valuation concerns remain as its share price trades well above intrinsic fair value and some peer benchmarks.

If you want to focus on opportunities trading closer to their underlying worth, discover greater value and less premium with these 833 undervalued stocks based on cash flows now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tiptree might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:TIPT

Tiptree

Through its subsidiaries, provides specialty insurance products and related services in the United States and Europe.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives