- United States

- /

- Insurance

- /

- NasdaqGS:SIGI

Assessing Selective Insurance Group After a 11% Drop and Industry Headwinds in 2025

Reviewed by Bailey Pemberton

- Wondering if Selective Insurance Group is a hidden value play or if its recent price drops have opened a real opportunity? You are not alone, and today we are putting the spotlight directly on what the numbers are telling us.

- After a challenging year, shares have slipped by 18.2% over the past 12 months, with a steep 11.4% drop just in the last month. This may signal that investors are reassessing the company’s outlook or risk profile.

- Recent headlines have focused on shifts within the broader insurance market, as well as regulatory developments affecting insurers nationwide. These updates provide essential context, making it clear that industry headwinds and shifting sentiment could be big drivers behind the stock’s latest moves.

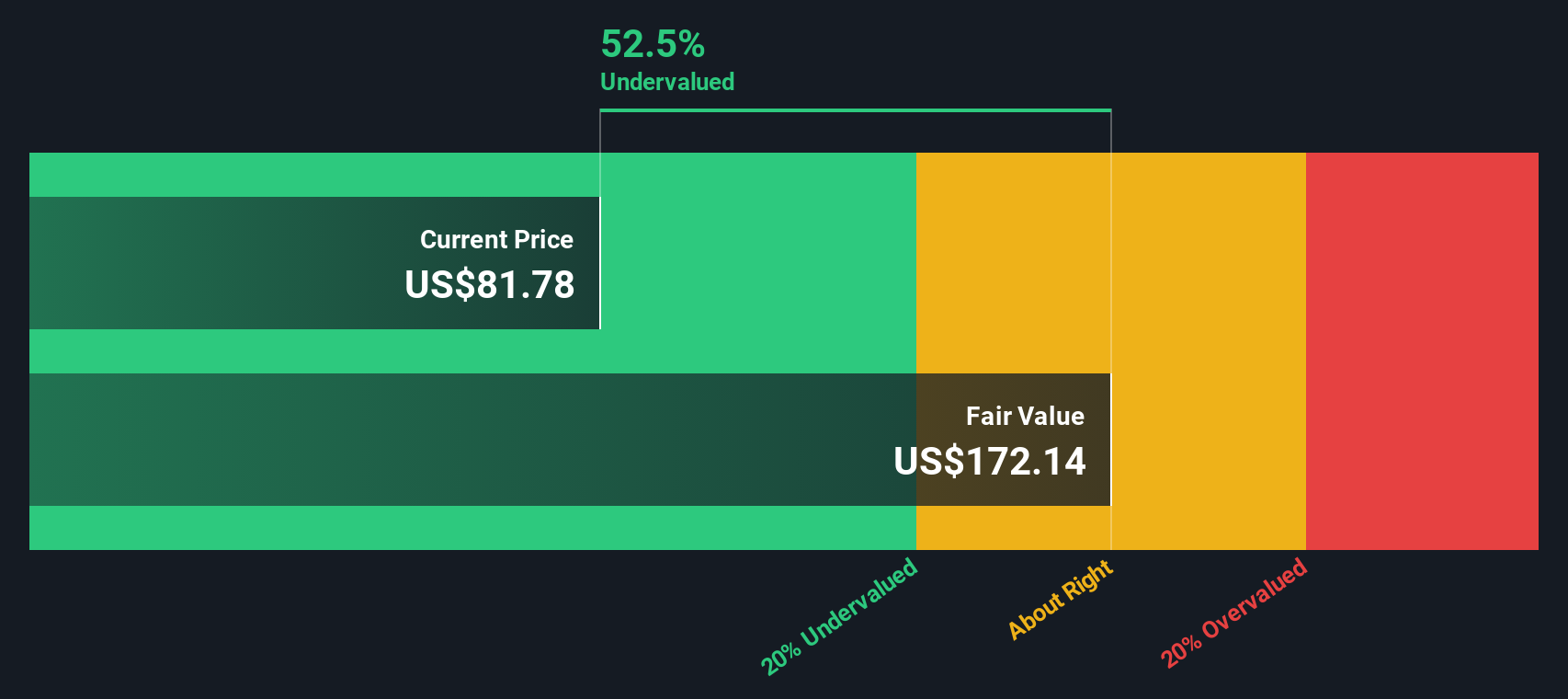

- Right now, Selective Insurance Group scores a 4 out of 6 on our valuation checks, suggesting it is undervalued in several key areas. Let’s break down the main valuation methods you need to know, but stick around for a more insightful way to judge a stock’s real worth later in the article.

Approach 1: Selective Insurance Group Excess Returns Analysis

The Excess Returns valuation model measures how efficiently a company generates profits above its cost of equity by focusing on the profitability of reinvested earnings and the value created for shareholders beyond the required return.

For Selective Insurance Group, key inputs reveal:

- Book Value: $54.46 per share

- Stable EPS: $8.46 per share (based on weighted future Return on Equity estimates from 5 analysts)

- Cost of Equity: $4.25 per share

- Excess Return: $4.21 per share

- Average Return on Equity: 13.49%

- Stable Book Value: $62.69 per share (from analyst estimates)

This analysis shows that Selective Insurance Group consistently earns an attractive return above its equity cost, which suggests durable value creation. Based on these inputs and the methodology, the Excess Returns model estimates an intrinsic value of $176.66 per share.

Compared to current prices, this implies the stock is roughly 58.1% undervalued, which strengthens the case for Selective Insurance Group as a compelling opportunity relative to its underlying fundamentals.

Result: UNDERVALUED

Our Excess Returns analysis suggests Selective Insurance Group is undervalued by 58.1%. Track this in your watchlist or portfolio, or discover 841 more undervalued stocks based on cash flows.

Approach 2: Selective Insurance Group Price vs Earnings

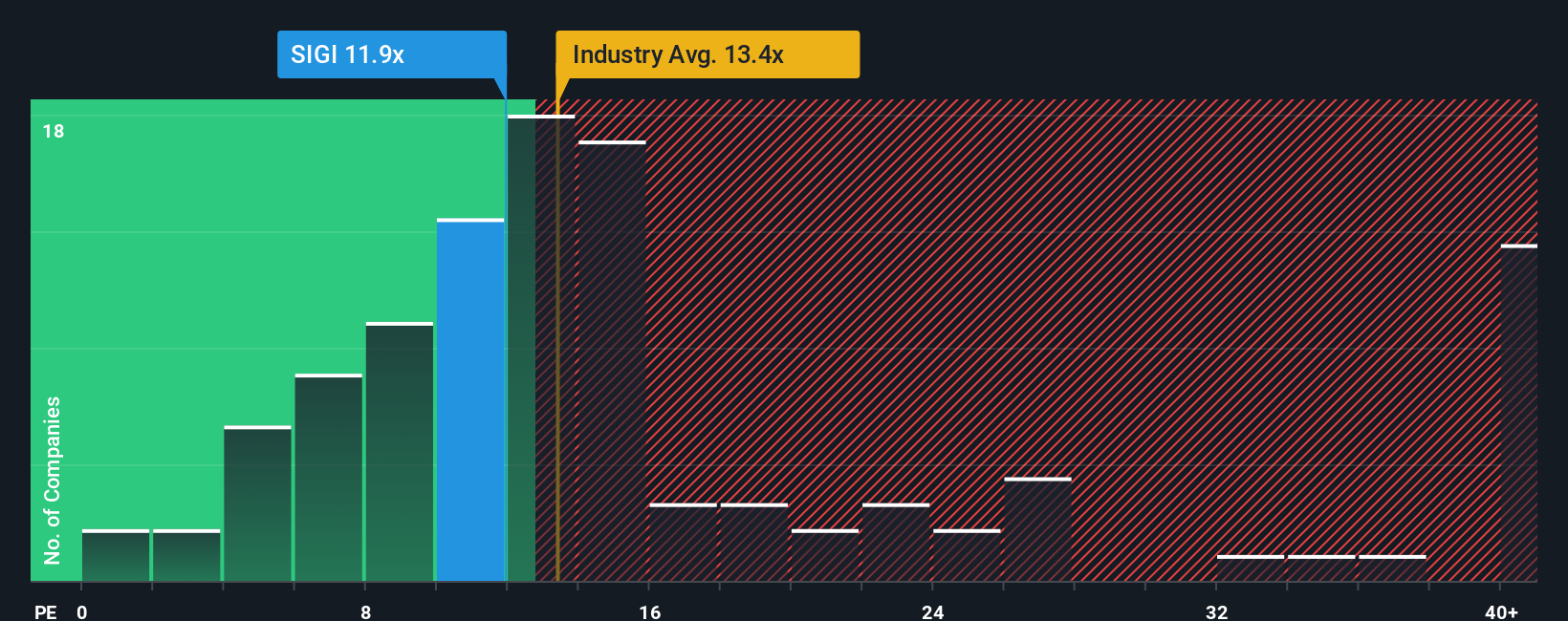

The price-to-earnings (PE) ratio is a widely used metric for valuing profitable companies, like Selective Insurance Group, because it directly relates a company’s share price to its current earnings. Since earnings are the bedrock of stock valuations, especially for established businesses, the PE ratio offers a straightforward snapshot of what investors are willing to pay for each dollar of profit.

Growth outlook and perceived risks play a major role in what is considered a “fair” PE ratio for a particular company. Higher anticipated growth or greater stability typically justify a higher PE, while lower growth prospects or above-average risks warrant a lower multiple.

Currently, Selective Insurance Group trades at an 11.2x PE ratio. This compares closely to the peer average of 11.1x and sits below the broader insurance industry average of 13.1x. However, benchmarks like industry and peer averages may overlook company-specific dynamics that matter for valuation.

This is where Simply Wall St’s “Fair Ratio” comes in. The Fair Ratio for Selective Insurance Group is 14.3x, calculated based on factors including its earnings growth, profit margins, industry position, market cap and risk profile. Unlike basic comparisons to the averages, the Fair Ratio accounts for whether a company deserves a premium or discount by looking at a holistic set of fundamentals.

Comparing Selective Insurance Group’s actual PE (11.2x) to its Fair Ratio (14.3x) suggests the stock trades at a meaningful discount to what it could be worth given its financial profile. This points to potential undervaluation if the company can execute on its earnings trajectory.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Selective Insurance Group Narrative

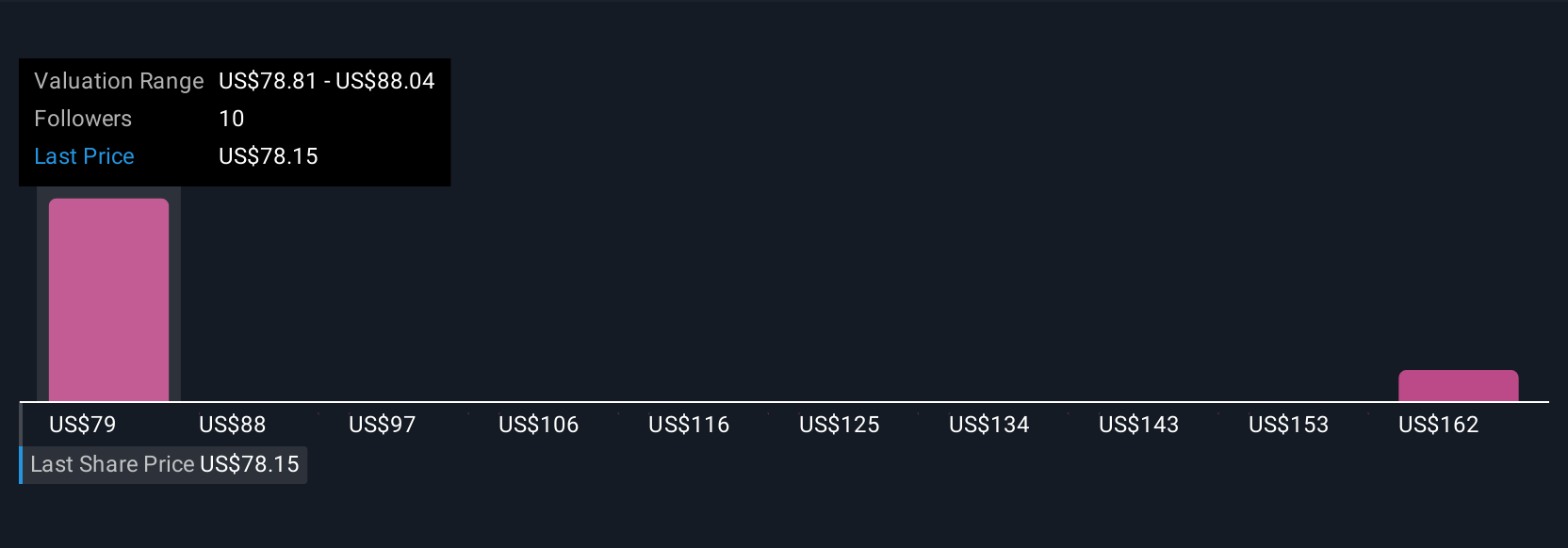

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. In the world of investing, a Narrative is quite simply the story you believe about a company, based on your own view of its prospects and future performance. It connects what’s happening in the business, your estimates of future revenue, earnings, and margins, and what you think is a fair value for the stock.

Narratives bring together facts and forecasts so you can easily see the link between your expectations, the company’s potential, and the price you would be willing to pay. They are designed to be user-friendly and accessible, even if you are not a financial expert. On Simply Wall St, millions of investors actively build, share, and explore Narratives right on the Community page, making this tool available to everyone who wants to upgrade their decision making.

With Narratives, investors can quickly compare their own fair value to the current share price, which can help clarify whether it is time to buy, hold, or reconsider. Importantly, Narratives automatically update when fresh news, earnings, or other key information is released, so your investing story adapts as the real world changes.

For example, one investor might be optimistic and set a fair value for Selective Insurance Group at $90 per share, expecting strong revenue growth and margin improvement. Another could be more cautious and see fair value at $72 if they view rising reserve risks as a major headwind, yet both are using the same Narrative framework to guide their choices.

Do you think there's more to the story for Selective Insurance Group? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SIGI

Selective Insurance Group

Provides insurance products and services in the United States.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives