- United States

- /

- Insurance

- /

- NasdaqGS:SAFT

If You Like EPS Growth Then Check Out Safety Insurance Group (NASDAQ:SAFT) Before It's Too Late

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Safety Insurance Group (NASDAQ:SAFT). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

View our latest analysis for Safety Insurance Group

How Quickly Is Safety Insurance Group Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). That makes EPS growth an attractive quality for any company. It certainly is nice to see that Safety Insurance Group has managed to grow EPS by 21% per year over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be smiling.

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Not all of Safety Insurance Group's revenue last year was revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. Unfortunately, Safety Insurance Group's revenue dropped 2.6% last year, but the silver lining is that EBIT margins improved from 13% to 17%. That's not ideal.

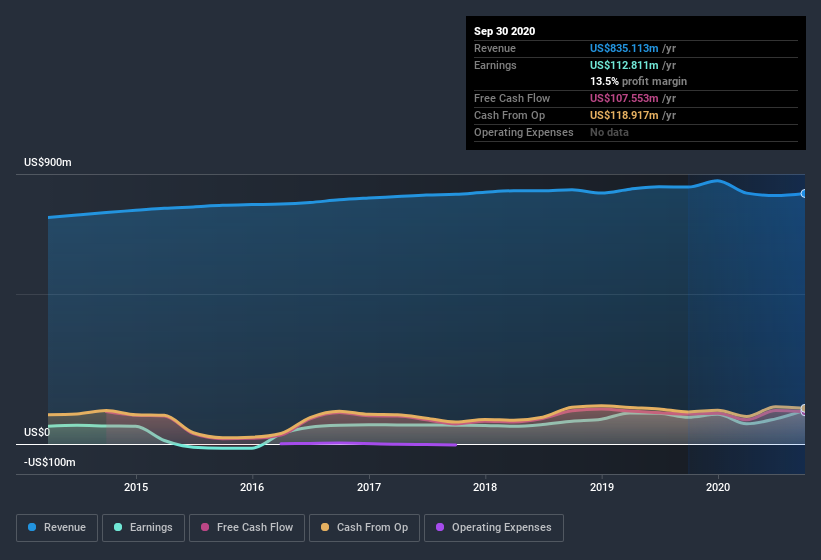

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Safety Insurance Group Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Insider selling of Safety Insurance Group shares was insignificant compared to the one buyer, over the last twelve months. Specifically the Independent Director, Frederic Lindeberg, spent US$562k, paying about US$72.10 per share. That certainly pricks my ears up.

On top of the insider buying, it's good to see that Safety Insurance Group insiders have a valuable investment in the business. Given insiders own a small fortune of shares, currently valued at US$63m, they have plenty of motivation to push the business to succeed. That's certainly enough to make me think that management will be very focussed on long term growth.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because on our analysis the CEO, George Murphy, is paid less than the median for similar sized companies. For companies with market capitalizations between US$1.0b and US$3.2b, like Safety Insurance Group, the median CEO pay is around US$3.9m.

The Safety Insurance Group CEO received US$3.3m in compensation for the year ending . That comes in below the average for similar sized companies, and seems pretty reasonable to me. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add Safety Insurance Group To Your Watchlist?

For growth investors like me, Safety Insurance Group's raw rate of earnings growth is a beacon in the night. The cranberry sauce on the turkey is that insiders own a bunch of shares, and one has been buying more. So I do think this is one stock worth watching. Of course, identifying quality businesses is only half the battle; investors need to know whether the stock is undervalued. So you might want to consider this free discounted cashflow valuation of Safety Insurance Group.

The good news is that Safety Insurance Group is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you decide to trade Safety Insurance Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:SAFT

Safety Insurance Group

Provides private passenger and commercial automobile, and homeowner insurance in the United States.

Established dividend payer with proven track record.