- United States

- /

- Insurance

- /

- NasdaqCM:IGIC

What Is The Ownership Structure Like For International General Insurance Holdings Ltd. (NASDAQ:IGIC)?

A look at the shareholders of International General Insurance Holdings Ltd. (NASDAQ:IGIC) can tell us which group is most powerful. Large companies usually have institutions as shareholders, and we usually see insiders owning shares in smaller companies. Warren Buffett said that he likes "a business with enduring competitive advantages that is run by able and owner-oriented people." So it's nice to see some insider ownership, because it may suggest that management is owner-oriented.

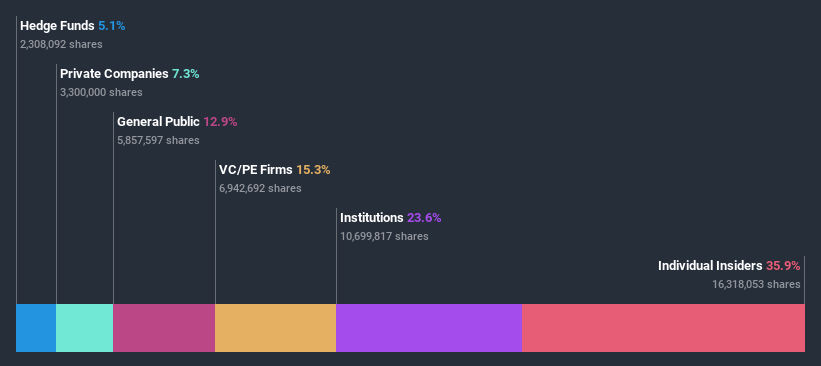

With a market capitalization of US$366m, International General Insurance Holdings is a small cap stock, so it might not be well known by many institutional investors. Taking a look at our data on the ownership groups (below), it seems that institutions are noticeable on the share registry. We can zoom in on the different ownership groups, to learn more about International General Insurance Holdings.

Check out our latest analysis for International General Insurance Holdings

What Does The Institutional Ownership Tell Us About International General Insurance Holdings?

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.

International General Insurance Holdings already has institutions on the share registry. Indeed, they own a respectable stake in the company. This implies the analysts working for those institutions have looked at the stock and they like it. But just like anyone else, they could be wrong. It is not uncommon to see a big share price drop if two large institutional investors try to sell out of a stock at the same time. So it is worth checking the past earnings trajectory of International General Insurance Holdings, (below). Of course, keep in mind that there are other factors to consider, too.

It looks like hedge funds own 5.1% of International General Insurance Holdings shares. That catches my attention because hedge funds sometimes try to influence management, or bring about changes that will create near term value for shareholders. The company's CEO Wasef Jabsheh is the largest shareholder with 30% of shares outstanding. Oman International Development and Investment Company SAOG is the second largest shareholder owning 15% of common stock, and Argo Group International Holdings, Ltd., Asset Management Arm holds about 10% of the company stock.

A more detailed study of the shareholder registry showed us that 3 of the top shareholders have a considerable amount of ownership in the company, via their 56% stake.

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock's expected performance. There is a little analyst coverage of the stock, but not much. So there is room for it to gain more coverage.

Insider Ownership Of International General Insurance Holdings

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. The company management answer to the board and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board themselves.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

It seems insiders own a significant proportion of International General Insurance Holdings Ltd.. Insiders own US$131m worth of shares in the US$366m company. This may suggest that the founders still own a lot of shares. You can click here to see if they have been buying or selling.

General Public Ownership

With a 13% ownership, the general public have some degree of sway over International General Insurance Holdings. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run.

Private Equity Ownership

With an ownership of 15%, private equity firms are in a position to play a role in shaping corporate strategy with a focus on value creation. Some might like this, because private equity are sometimes activists who hold management accountable. But other times, private equity is selling out, having taking the company public.

Private Company Ownership

It seems that Private Companies own 7.3%, of the International General Insurance Holdings stock. It's hard to draw any conclusions from this fact alone, so its worth looking into who owns those private companies. Sometimes insiders or other related parties have an interest in shares in a public company through a separate private company.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 3 warning signs for International General Insurance Holdings you should be aware of.

Ultimately the future is most important. You can access this free report on analyst forecasts for the company.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

If you’re looking to trade International General Insurance Holdings, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:IGIC

International General Insurance Holdings

International General Insurance Holdings Ltd.

Excellent balance sheet and fair value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026