- United States

- /

- Insurance

- /

- NasdaqCM:IGIC

IGI Holdings (IGIC) Profit Margin Improves to 23.3%, Reinforcing Bullish Earnings Narratives

Reviewed by Simply Wall St

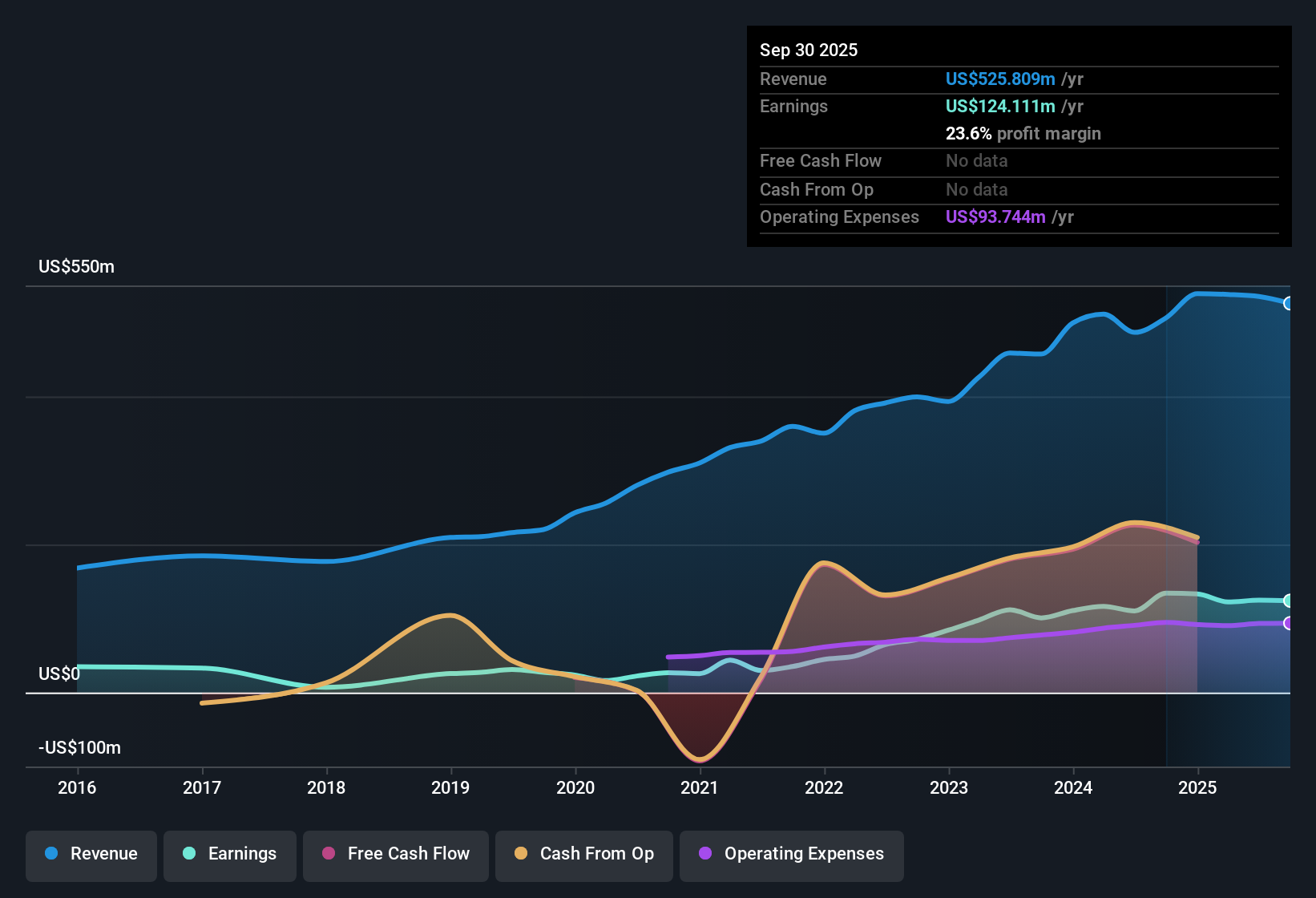

International General Insurance Holdings (NasdaqCM:IGIC) reported steady profitability with EPS growth averaging 30.9% annually over the past five years. Net profit margin improved to 23.3% from last year’s 22.6%, while earnings for the past year rose 13.2%, trailing its five-year trend. At a share price of $22.46, the stock trades well below the estimated fair value of $30.41. IGIC’s price-to-earnings ratio of 7.8x is also well under both industry and peer averages. With no risks highlighted and a record of ongoing profit growth, investors are likely to view the results positively, particularly given IGIC’s proven ability to sustain high-quality earnings and improve margins.

See our full analysis for International General Insurance Holdings.Next up, we'll see how these financial results hold up when compared with widely followed market narratives. Some beliefs may be confirmed while others could be upended.

See what the community is saying about International General Insurance Holdings

Portfolio Shifts Drive Margin Resilience

- Net profit margin increased to 23.3%, up from 22.6% last year, even as annual earnings growth slowed to 13.2%, well below the five-year average pace of 30.9%.

- Consensus narrative highlights that consistent margin strength has come from reshaping IGIC's portfolio and exiting unprofitable lines to keep loss ratios low.

- Prudent underwriting moves, such as the strategic withdrawal from certain professional indemnity products, have supported stronger margins and cushioned overall results against revenue softness.

- Digital initiatives and disciplined portfolio management are credited for underpinning both capital efficiency and steady income. This aligns with the narrative's argument for resilient profitability even as top-line expansion moderates.

Bulls and skeptics alike are watching whether IGIC's focus on profitable business lines can keep margins steady as competitive threats grow. 📊 Read the full International General Insurance Holdings Consensus Narrative.

Premium Base Expands Into New Markets

- IGIC’s expansion into infrastructure, construction, and marine insurance is diversifying revenues and scaling gross written premiums, as noted by the consensus narrative.

- According to analysts' consensus view, the move into MENA, Asia-Pacific, and Europe is poised to drive long-term growth, but new business must compensate for the recent $60 million reduction from dropped underperforming books.

- Portfolio changes are expected to enable a 3.7% revenue CAGR over the next three years, while presumed increased insurance penetration in emerging markets looks to support top-line resilience.

- At the same time, greater currency volatility and aggressive competition in these geographies have already pressured premiums. This challenge could crimp the benefits of diversification if not managed proactively.

Valuation Still at a Discount to Peers

- IGIC's P/E ratio of 7.8x is notably below both the US insurance industry average of 13.7x and peers’ 10.8x, with the current share price of $22.46 staying well under the $30.41 DCF fair value and an analyst price target of $32.00.

- Analysts' consensus view points out that this wide valuation gap reflects ongoing skepticism about sustainable earnings. Yet it also offers material upside if IGIC delivers on projected earnings growth to $146.3 million by 2028 and profit margins rise to 24.5%.

- To justify these targets, the company would need to achieve a future P/E of 11.6x, which is still lower than today's US insurance sector average of 14.3x.

- With shares trading at a 25% discount to the consensus price target, the market appears cautious on whether recent margin gains and business expansion are durable.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for International General Insurance Holdings on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on these figures? Shape your perspective into a unique narrative in under three minutes. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding International General Insurance Holdings.

See What Else Is Out There

While IGIC’s profit margins remain strong, overall earnings growth has slowed and revenue expansion now trails behind past years and rivals.

If dependable growth matters to you, focus on companies delivering proven consistency with stable growth stocks screener (2073 results) so you never have to settle for slowing trends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:IGIC

International General Insurance Holdings

International General Insurance Holdings Ltd.

Excellent balance sheet and good value.

Market Insights

Community Narratives