- United States

- /

- Insurance

- /

- NasdaqGS:GLRE

Greenlight Capital Re (GLRE): Losses Narrow 25.2% Annually, Valuation Remains Discounted vs Peers

Reviewed by Simply Wall St

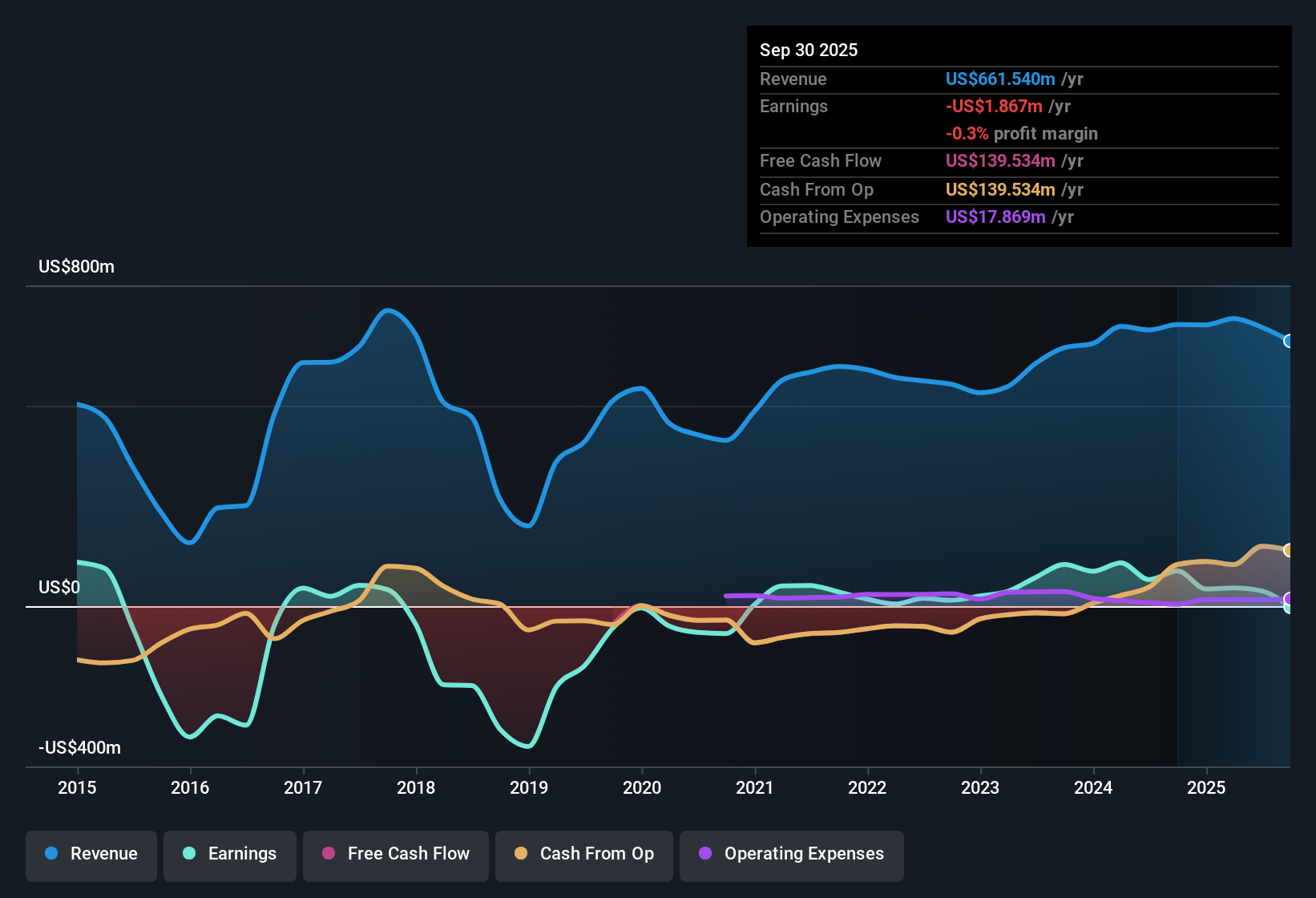

Greenlight Capital Re (GLRE) remains unprofitable, but the company has narrowed its losses over the last five years at an annual rate of 25.2%. Despite the ongoing challenges to net profit margin, the stock is drawing investor attention thanks to a low Price-To-Sales Ratio of 0.6x versus a peer average of 4.9x and a trading price of $11.95, well below an estimated fair value of $20.06. With risk sentiment steady and no major negative headlines, the current results put the spotlight on compelling valuation rather than improving margins.

See our full analysis for Greenlight Capital Re.Next up, we will see how these headline numbers stack up against the most widely followed GLRE narratives. This will highlight where the numbers support the story and where they might raise new questions.

Curious how numbers become stories that shape markets? Explore Community Narratives

Losses Narrow by 25.2% Annually

- Greenlight Capital Re has reduced its annual losses at a compound rate of 25.2% over the past five years, a significant trend that reflects management’s actions to cut costs or improve underwriting without necessarily reaching profitability.

- What is notable is that, despite this rate of loss reduction, the company’s net profit margin has not shown improvement over the last year. This underscores that progress has come mainly from lowering the magnitude of losses rather than fundamentally boosting underlying operating outcomes.

- This dynamic aligns with the prevailing view that GLRE’s turnaround remains incomplete as core earnings power is still lacking.

- Investors weighing a recovery story have not yet seen evidence of stabilized or growing core profitability in recent filings.

Valuation Still Deeply Discounted to Peers

- The company trades at a Price-To-Sales Ratio of 0.6x, significantly lower than the US insurance industry average of 1.1x and peer average of 4.9x. The current share price sits at $11.95 compared to a DCF fair value of $20.06.

- This heavy discount to both fair value and sector norms provides a cushion for value-focused investors, especially as no major negative headlines or insider selling have emerged to explain the disconnect between price and estimated worth.

- The divergence puts focus squarely on a valuation-driven thesis rather than traditional growth or earnings momentum factors.

- What stands out is the sheer scale of the discount, which creates the potential for re-rating if the company can make sustained progress toward profitability.

Stabilized Risk Profile With Market Sentiment Contained

- No notable risk events or large-scale insider selling have been reported in recent periods, signaling a relatively stable backdrop for fundamental investors monitoring downside factors.

- Rather than driving a renewed bullish or bearish narrative, this stability supports the view that GLRE’s risk/reward is now mostly shaped by valuation metrics instead of immediate business threats or surprises.

- With the absence of dramatic changes in risk exposure, attention shifts back to whether the current discount in valuation will hold if unprofitability persists.

- Recent results have left the key debate squarely on the balance between ongoing losses and long-term deep value potential.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Greenlight Capital Re's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Greenlight Capital Re continues to reduce its losses, but persistent unprofitability and an unchanged net margin highlight a lack of steady and consistent earning power.

If stable growth and dependable results are your priorities, check out stable growth stocks screener (2077 results) to pinpoint companies that consistently deliver results regardless of market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GLRE

Greenlight Capital Re

Through its subsidiaries, operates as a property and casualty reinsurance company worldwide.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives