Stock Analysis

- United States

- /

- Insurance

- /

- NasdaqGS:ESGR

Enstar Group (NASDAQ:ESGR) Shareholders Booked A 45% Gain In The Last Five Years

If you buy and hold a stock for many years, you'd hope to be making a profit. But more than that, you probably want to see it rise more than the market average. Unfortunately for shareholders, while the Enstar Group Limited (NASDAQ:ESGR) share price is up 45% in the last five years, that's less than the market return. Over the last twelve months the stock price has risen a very respectable 20%.

See our latest analysis for Enstar Group

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

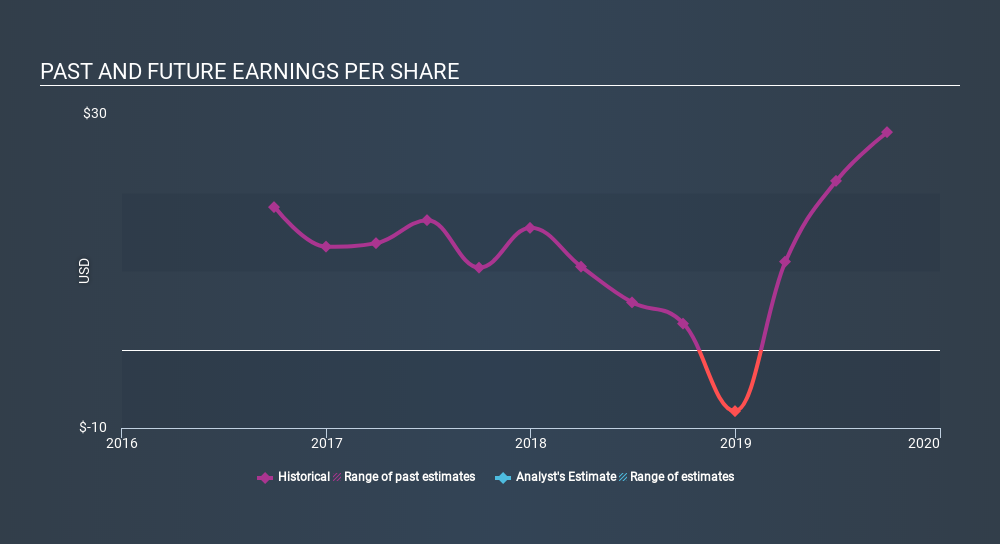

During five years of share price growth, Enstar Group achieved compound earnings per share (EPS) growth of 15% per year. This EPS growth is higher than the 7.6% average annual increase in the share price. Therefore, it seems the market has become relatively pessimistic about the company. This cautious sentiment is reflected in its (fairly low) P/E ratio of 7.30.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. Dive deeper into the earnings by checking this interactive graph of Enstar Group's earnings, revenue and cash flow.

A Different Perspective

Enstar Group shareholders are up 20% for the year. Unfortunately this falls short of the market return. On the bright side, that's still a gain, and it's actually better than the average return of 7.6% over half a decade This suggests the company might be improving over time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 1 warning sign for Enstar Group which any shareholder or potential investor should be aware of.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGS:ESGR

Enstar Group

Acquires and manages insurance and reinsurance companies and portfolios in run-off in Bermuda and internationally.

Good value with mediocre balance sheet.