- United States

- /

- Insurance

- /

- NasdaqGS:ERIE

What Does Erie Indemnity’s (ERIE) Pause on Buybacks Reveal About Its Growth Strategy?

Reviewed by Sasha Jovanovic

- Erie Indemnity Company reported strong third-quarter 2025 earnings, with revenue rising to US$1.07 billion and net income reaching US$182.85 million, both higher than the prior year.

- An interesting takeaway is that no share repurchases occurred this quarter, even as the company achieved higher earnings per share and revenue growth over nine months.

- We'll explore how Erie Indemnity's consistent revenue and net income growth informs the company's ongoing investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Erie Indemnity's Investment Narrative?

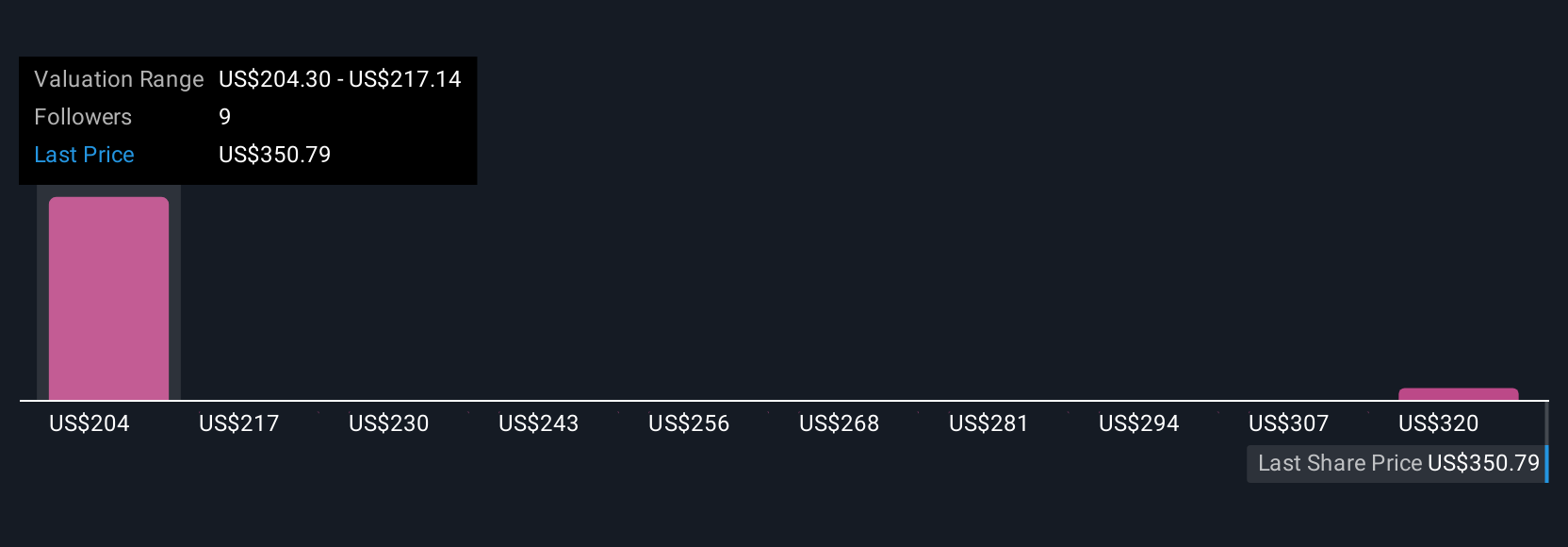

Owning Erie Indemnity shares means having conviction in the long-term strength of its fee-based business model, both its ability to generate consistent revenue from servicing Erie Insurance Exchange and to convert those revenues into solid cash flows. The latest quarterly results reinforce this story, with revenue and net income both up year-over-year, even amid ongoing market volatility and after a steep share price decline of more than 30% year-to-date. However, the news that no shares were repurchased for another quarter could signal a shift in how the company allocates capital in the short term, a potentially relevant change for anyone looking to the buyback program as a near-term catalyst. Despite sound results and continued dividend reliability, this absence removes a possible floor for the stock and means that recent strong results may have less of an immediate impact on share price. The key risks remain valuation headwinds and the ongoing question about how management may choose to support the stock if price weakness continues. On the other hand, investors should not overlook the risk posed by valuation pressures given current trading multiples.

Erie Indemnity's share price has been on the slide but might be up to 27% below fair value. Find out if it's a bargain.Exploring Other Perspectives

Explore 2 other fair value estimates on Erie Indemnity - why the stock might be worth 21% less than the current price!

Build Your Own Erie Indemnity Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Erie Indemnity research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Erie Indemnity research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Erie Indemnity's overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Erie Indemnity might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ERIE

Erie Indemnity

Operates as a managing attorney-in-fact for the subscribers at the Erie Insurance Exchange in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives