- United States

- /

- Insurance

- /

- NasdaqGS:ERIE

Reassessing Erie Indemnity’s (ERIE) Valuation After Strong Q3 2025 Earnings Growth

Reviewed by Simply Wall St

Erie Indemnity (ERIE) released its third quarter 2025 earnings, showing higher revenue and net income compared to the previous year. This solid performance has drawn renewed attention from investors.

See our latest analysis for Erie Indemnity.

After these strong Q3 results, Erie Indemnity remains in the spotlight, but the share price paints a more complex picture. The latest close of $284.84 is down 12.2% for the month and has fallen 30.4% year-to-date. Despite impressive fundamentals and a notable buyback history, momentum has clearly faded, with the one-year total shareholder return slipping to -32.3%. Over the longer haul, though, patient investors have seen total returns of 18.2% over three years and 32.7% over five years.

If you're wondering what else the market has to offer right now, it's the perfect moment to broaden your investing radar and discover fast growing stocks with high insider ownership

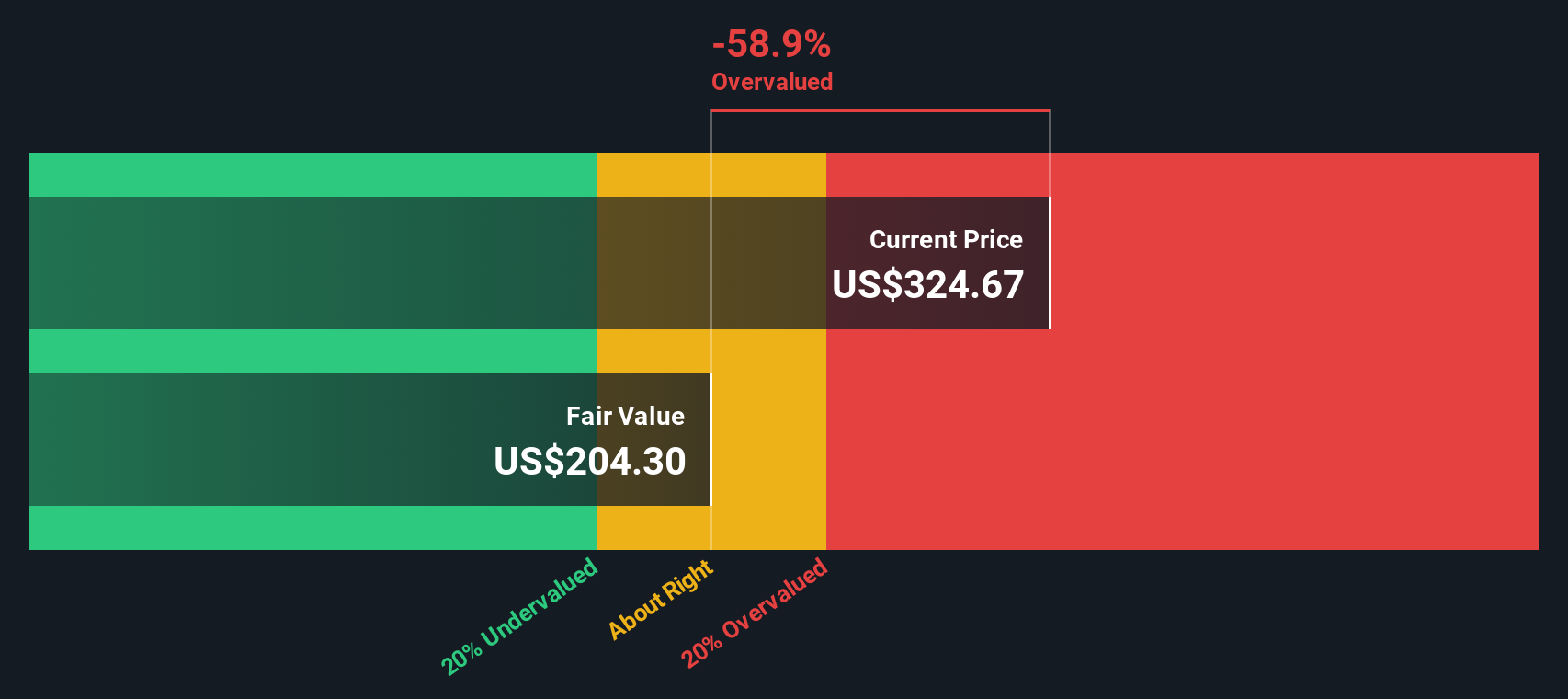

With strong earnings growth but a faltering share price, the big question now is whether Erie Indemnity represents a true bargain at current levels or if the market has already priced in all future gains.

Price-to-Earnings of 23x: Is it justified?

Erie Indemnity’s stock price currently reflects a Price-to-Earnings (P/E) ratio of 23x, well above both industry and peer group averages. Despite the company’s recent financial strength, this elevated multiple raises questions about how much optimism is already included at $284.84 per share.

The P/E ratio measures how much investors are paying for each dollar of company earnings. It is a go-to yardstick, especially in sectors like insurance, where steady profits are typical and comparisons to peers can reveal pockets of overpricing.

Currently, the company’s 23x P/E is significantly higher than the US Insurance industry average of 13.2x. Compared to estimates of a fair ratio at just 14.1x, the market is demanding a substantial premium for future earnings, which is well above what valuation models would suggest might be reasonable if sentiment shifts or growth slows.

Explore the SWS fair ratio for Erie Indemnity

Result: Price-to-Earnings of 23x (OVERVALUED)

However, slowing revenue growth and the risk of further multiple contraction may limit upside for Erie Indemnity, even after recent operational gains.

Find out about the key risks to this Erie Indemnity narrative.

Another View: What Does the DCF Say?

While Erie Indemnity appears expensive based on its current price-to-earnings ratio, our DCF model offers a different angle. It estimates fair value for the shares at $221.51, which is well below today’s price of $284.84. Could market optimism be overlooking underlying risks?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Erie Indemnity for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 876 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Erie Indemnity Narrative

If you see things differently or want a hands-on approach, you can easily create your own Erie Indemnity narrative using the latest figures in just a few minutes, and Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Erie Indemnity.

Ready for Smarter Investment Moves?

Unlock exclusive opportunities beyond Erie Indemnity and set yourself up with fresh investment ideas by using the Simply Wall Street Screener. Don’t let the next big winner slip away.

- Unearth potential high-flyers and see which companies stand out among these 25 AI penny stocks, as they reshape industries with machine intelligence and automation.

- Boost your returns by pinpointing income-generating opportunities with these 16 dividend stocks with yields > 3%, which offer attractive yields and reliable payouts above 3%.

- Capitalise on tomorrow’s disruption by targeting these 28 quantum computing stocks, as they forge new paths in quantum tech, computing, and advanced applications.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Erie Indemnity might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ERIE

Erie Indemnity

Operates as a managing attorney-in-fact for the subscribers at the Erie Insurance Exchange in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives