- United States

- /

- Insurance

- /

- NasdaqGS:BWIN

BRP Group, Inc.'s (NASDAQ:BRP) 33% Jump Shows Its Popularity With Investors

BRP Group, Inc. (NASDAQ:BRP) shares have continued their recent momentum with a 33% gain in the last month alone. Looking further back, the 13% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

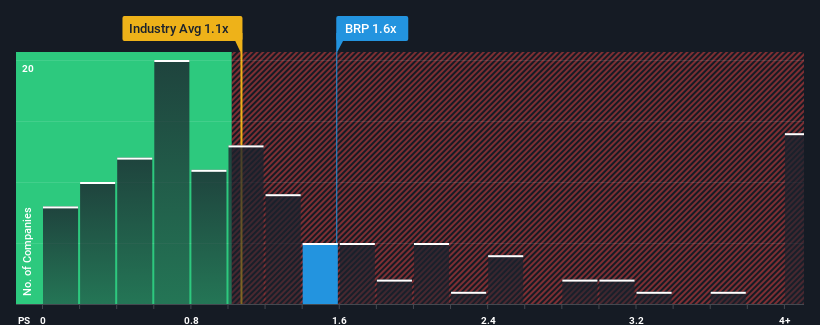

Since its price has surged higher, when almost half of the companies in the United States' Insurance industry have price-to-sales ratios (or "P/S") below 1.1x, you may consider BRP Group as a stock probably not worth researching with its 1.6x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for BRP Group

What Does BRP Group's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, BRP Group has been doing relatively well. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

Keen to find out how analysts think BRP Group's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, BRP Group would need to produce impressive growth in excess of the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 24%. This great performance means it was also able to deliver immense revenue growth over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 16% per annum as estimated by the eight analysts watching the company. That's shaping up to be materially higher than the 6.7% per annum growth forecast for the broader industry.

With this information, we can see why BRP Group is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On BRP Group's P/S

The large bounce in BRP Group's shares has lifted the company's P/S handsomely. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of BRP Group's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for BRP Group with six simple checks will allow you to discover any risks that could be an issue.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Baldwin Insurance Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:BWIN

Baldwin Insurance Group

Operates as an independent insurance distribution firm that delivers insurance and risk management solutions in the United States.

High growth potential with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.