- United States

- /

- Household Products

- /

- NYSE:SPB

Is Weaker Organic Revenue and Negative Free Cash Flow Altering the Investment Case for Spectrum Brands Holdings (SPB)?

Reviewed by Sasha Jovanovic

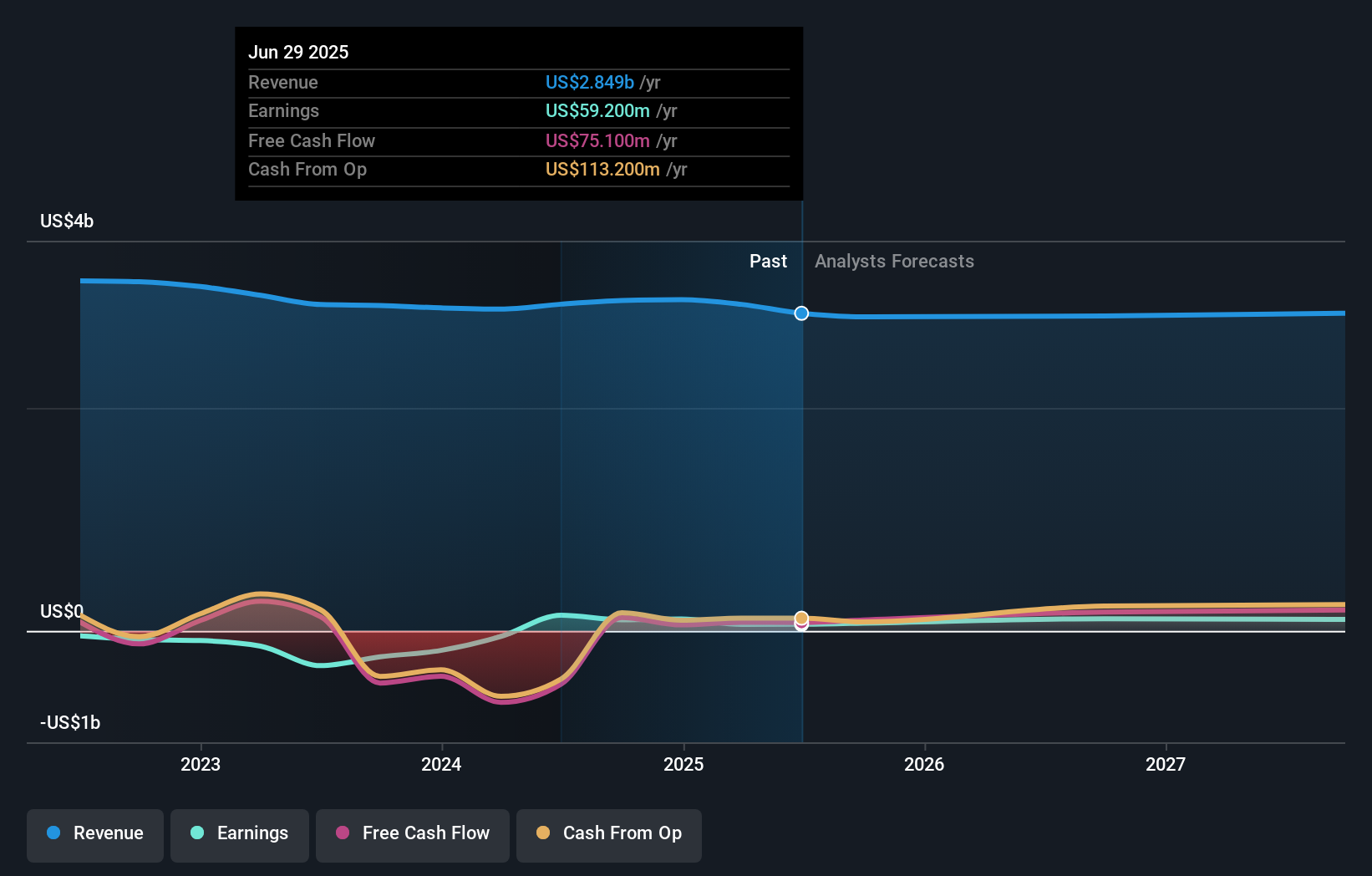

- In early October 2025, Spectrum Brands Holdings reported disappointing results with weaker-than-expected organic revenue and negative free cash flow, raising questions about operational effectiveness and growth potential.

- This financial setback amplifies investor concerns about Spectrum Brands' ability to counter competitive pressures and deliver sustainable long-term performance improvements.

- We'll assess how recent negative free cash flow and revenue underperformance could reshape Spectrum Brands' outlook and future prospects.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Spectrum Brands Holdings Investment Narrative Recap

Spectrum Brands investors are likely focused on the company's ability to achieve consistent revenue growth and margin recovery amid ongoing pressures in its core markets. The recent report of negative free cash flow and disappointing organic revenue may temper sentiment around a near-term turnaround, while highlighting the immediate risk of further margin compression and uncertain demand trends. The most important short-term catalyst, restoring sales momentum through product innovation and supply chain normalization, faces added scrutiny, and operational execution remains under the microscope.

Of recent company announcements, the appointment of Mr. Faisal Qadir as Chief Financial Officer in September stands out. This leadership transition arrives as Spectrum Brands intensifies its cost-reduction efforts, putting renewed focus on financial discipline at a time when headwinds to organic growth have become more apparent. Investors will watch closely to see if these changes help address structural profitability challenges.

By contrast, the company’s exposure to continued input cost escalation, particularly for chemicals and plastics, could quietly undermine improvement efforts that investors should be aware of if...

Read the full narrative on Spectrum Brands Holdings (it's free!)

Spectrum Brands Holdings' narrative projects $2.9 billion in revenue and $126.2 million in earnings by 2028. This requires a -0.6% annual revenue decline and a $67 million increase in earnings from the current $59.2 million.

Uncover how Spectrum Brands Holdings' forecasts yield a $78.71 fair value, a 50% upside to its current price.

Exploring Other Perspectives

Two members of the Simply Wall St Community estimate Spectrum Brands’ fair value between US$78.71 and US$235.12. While some are drawn to potential future earnings growth, caution remains with recent free cash flow negativity shaping expectations moving forward. Explore these alternative viewpoints to inform your own perspective.

Explore 2 other fair value estimates on Spectrum Brands Holdings - why the stock might be worth over 4x more than the current price!

Build Your Own Spectrum Brands Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Spectrum Brands Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Spectrum Brands Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Spectrum Brands Holdings' overall financial health at a glance.

No Opportunity In Spectrum Brands Holdings?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPB

Spectrum Brands Holdings

Operates as a branded consumer products and home essentials company in North America, Europe, the Middle East, Africa, Latin America, and Asia-Pacific regions.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives