- United States

- /

- Household Products

- /

- NYSE:SPB

A Fresh Look at Spectrum Brands Holdings (SPB) Valuation After Recent Volatility

Reviewed by Simply Wall St

See our latest analysis for Spectrum Brands Holdings.

Spectrum Brands Holdings' 1-year share price return of -35.5% has weighed on sentiment, especially after a weak start to the year. However, a 27% total shareholder return over three years suggests that long-term investors who weathered recent declines have seen real gains as the business adapts and market sentiment fluctuates.

If this kind of volatility has you thinking more broadly about your investments, it might be the right moment to discover fast growing stocks with high insider ownership.

With shares still trading well below analyst price targets and recent volatility shaking out some investors, the central question remains: is Spectrum Brands Holdings currently undervalued or is the market already pricing in its longer-term growth potential?

Most Popular Narrative: 31.5% Undervalued

With Spectrum Brands Holdings closing at $53.88, the most widely followed narrative suggests fair value sits significantly higher, hinting at untapped upside. This outlook contrasts sharply with recent investor caution, as it rests on several transformative business drivers and future growth projections.

Restored supply chains and improved customer relationships support revenue growth. Ongoing cost reductions and diversification boost profitability and stability. Focus on pet care innovation and expanded home improvement offerings taps into strong consumer demand, increasing recurring revenue and market share.

Curious how this forecast expects double-digit earnings acceleration, expanding profit margins, and a rapidly shifting business mix to support a premium valuation? Just what kind of operational turnaround are the narrative’s assumptions banking on? Unlock the details to see the bold financial predictions and strategies keeping bulls optimistic about Spectrum Brands’ true potential.

Result: Fair Value of $78.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy dependence on Asian sourcing and soft consumer demand could threaten Spectrum Brands’ ability to sustain momentum and achieve projected growth.

Find out about the key risks to this Spectrum Brands Holdings narrative.

Another View: Market Valuation Signals Caution

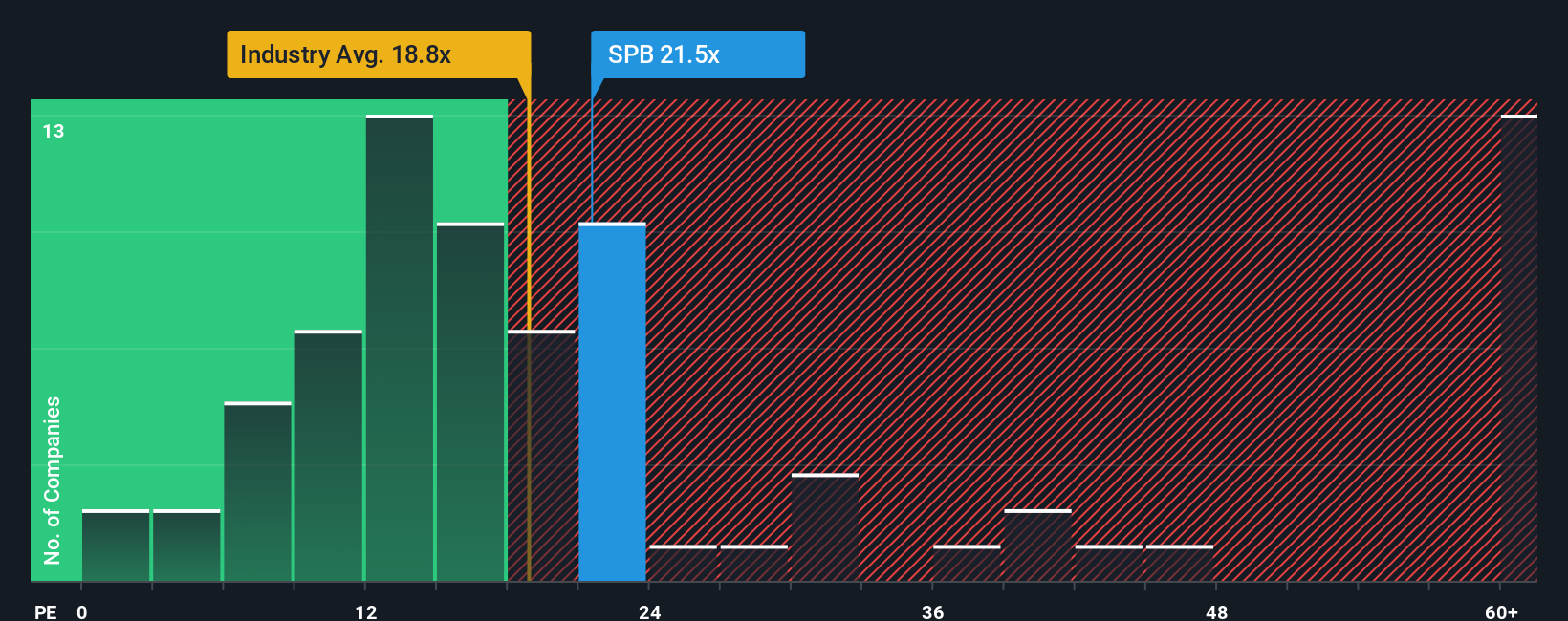

Although Spectrum Brands looks undervalued based on long-term growth forecasts, the market is telling a more cautious story. Its price-to-earnings ratio of 22x stands well above both peer (16.2x) and industry averages (18.7x), and also exceeds the fair ratio of 19.3x. This premium suggests investors could be overpaying for future growth that may not materialize. Is this a warning sign, or a mispriced opportunity?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Spectrum Brands Holdings Narrative

If you believe there’s more to the story, or want to dive into Spectrum Brands’ numbers firsthand, you can quickly build your own outlook in just minutes. Do it your way

A great starting point for your Spectrum Brands Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t hold back on your future gains. Let’s boost your watchlist with high-potential stocks you might otherwise miss. Here are three powerful ways to spot your next winner:

- Supercharge your income by targeting steady cashflow with these 22 dividend stocks with yields > 3% outperformers yielding above 3%, built for those who refuse to settle for average returns.

- Lead the innovation curve by tapping into these 26 AI penny stocks that are redefining industries through artificial intelligence, automation, and next-level data analytics.

- Catch early growth waves and seek big upside in these 3582 penny stocks with strong financials with robust financials that can move the needle in your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPB

Spectrum Brands Holdings

Operates as a branded consumer products and home essentials company in North America, Europe, the Middle East, Africa, Latin America, and Asia-Pacific regions.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives