- United States

- /

- Household Products

- /

- NYSE:PG

Procter & Gamble (PG): Exploring Valuation After Surge in Unusual Options Activity and Upbeat Analyst Sentiment

Reviewed by Simply Wall St

Recent activity among large investors has drawn fresh attention to Procter & Gamble (PG), as a surge in uncommon options trades signals renewed confidence in the stock. This uptick comes as favorable analyst ratings highlight underlying optimism.

See our latest analysis for Procter & Gamble.

While Procter & Gamble's share price has slipped about 11% so far this year as consumer sentiment and economic headwinds weigh on the stock, it still attracts investors seeking stability. Over a five-year horizon, total shareholder returns of 21% reflect the company’s resilient long-term appeal even as near-term momentum remains subdued.

If this mix of steady blue-chip performance and renewed investor interest has you searching for more opportunities, now is a smart time to broaden your strategy and explore fast growing stocks with high insider ownership

This raises a crucial question for investors: is Procter & Gamble’s recent dip an attractive entry point, or has the market already priced in all of its future growth potential?

Most Popular Narrative: 23.7% Overvalued

With Procter & Gamble closing at $148.19 against a fair value estimate of $119.81 according to andre_santos, the current market price significantly exceeds the narrative valuation. This gap puts investor assumptions and the company’s near-term outlook under the spotlight.

To assess P&G’s intrinsic value, four valuation methods are used, with different weightings to reflect relevance and reliability: Discounted Cash Flow (DCF), Dividend Discount Model (DDM), Historical Dividend Yield, and Historical P/E Ratio. Since both Historical methods assume a mean reversion that may not occur, DCF and DDM valuation methods receive higher weightings.

Want to know the potent mix that drives this valuation call? The story is all about future growth normalizing, but that is not the only twist. Next, dive into how a single shift in payout ambitions could tip the scales and why this narrative leans so heavily on cash flows and dividend momentum. Intrigued? The full breakdown holds the answers.

Result: Fair Value of $119.81 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, unexpected margin expansion or a strong rebound in consumer demand could quickly change the outlook and increase Procter & Gamble’s valuation.

Find out about the key risks to this Procter & Gamble narrative.

Another View: What Does the SWS DCF Model Say?

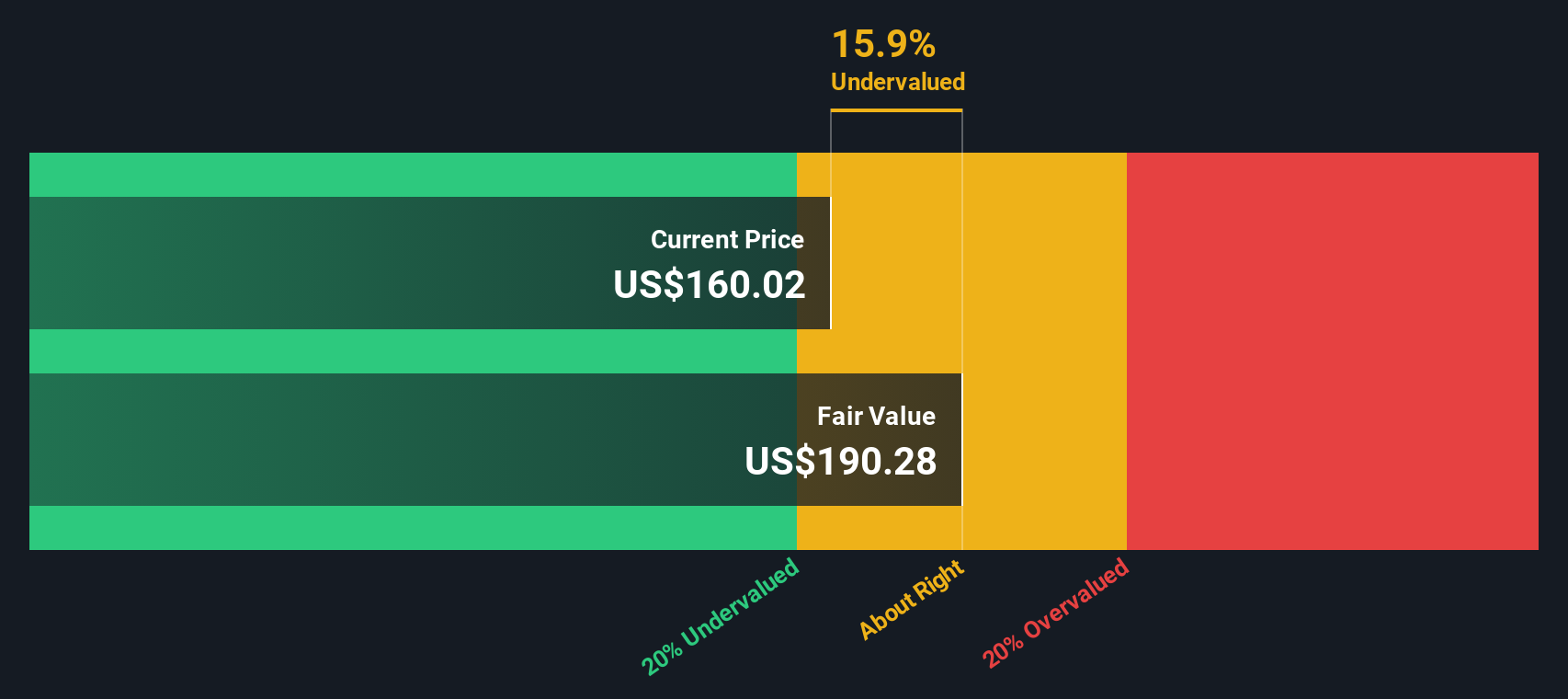

While the previous approach suggests Procter & Gamble is overvalued, our SWS DCF model tells a different story. According to this method, the stock is actually trading about 20.6% below its fair value estimate of $185.05, which hints at a potential upside for patient investors. So which perspective gives the truest picture? Are markets overlooking value, or is optimism clouding reality?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Procter & Gamble for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 916 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Procter & Gamble Narrative

If you see things differently or want to dig deeper on your own, it only takes a few minutes to craft your personal take: Do it your way

A great starting point for your Procter & Gamble research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always stay ahead by finding the next opportunity before it hits the headlines. If you want to grow your portfolio faster and catch trends early, don’t let these possibilities pass you by. Use the Simply Wall Street Screener to tap into fresh ideas right now.

- Tap into potential high yields and steady income with these 16 dividend stocks with yields > 3% that consistently reward shareholders above the market average.

- Uncover growth opportunities in rapidly evolving industries through these 26 AI penny stocks, where pioneers are transforming sectors with artificial intelligence.

- Step ahead of the crowd and capture outsized gains with these 3592 penny stocks with strong financials built on strong fundamentals and promising outlooks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PG

Outstanding track record established dividend payer.

Similar Companies

Market Insights

Community Narratives