- United States

- /

- Household Products

- /

- NYSE:PG

Did Pantene's New Abundant & Strong Line Just Shift Procter & Gamble's (PG) Innovation Story?

Reviewed by Sasha Jovanovic

- Pantene, a Procter & Gamble brand, recently launched the Abundant & Strong Collection, an innovative three-step hair care system clinically proven to target hair shedding and scalp oxidative stress using a unique blend of antioxidants and vitamins.

- This product launch responds to a widespread consumer need for effective, affordable hair loss solutions, demonstrating P&G's ongoing commitment to research and development and its leadership in the personal care segment.

- We'll explore how this R&D-driven product innovation can influence Procter & Gamble's growth outlook and competitive positioning.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

Procter & Gamble Investment Narrative Recap

Investors in Procter & Gamble typically look for stable returns fueled by steady demand for consumer staples and ongoing innovation, while keeping an eye on potential margin pressures from raw material costs. The recent Pantene Abundant & Strong Collection launch reinforces P&G’s strength in product innovation, but is unlikely to materially alter the biggest near-term catalyst, improvement in consumer sentiment, or mitigate the persistent risk of tariff impacts and input cost inflation.

Among recent announcements, P&G’s quarterly dividend declaration stands out. This reflects the company’s financial stability and ongoing commitment to returning cash to shareholders, aligning with the defensive qualities many investors prize, especially relevant as market volatility and consumer confidence ebb and flow.

However, despite these positives, investors should not overlook the lingering threat of rising costs tied to tariffs and global supply pressures, especially as...

Read the full narrative on Procter & Gamble (it's free!)

Procter & Gamble's outlook anticipates $92.8 billion in revenue and $17.8 billion in earnings by 2028. This is based on a projected annual revenue growth rate of 3.3% and an earnings increase of $2.1 billion from the current $15.7 billion.

Uncover how Procter & Gamble's forecasts yield a $169.05 fair value, a 12% upside to its current price.

Exploring Other Perspectives

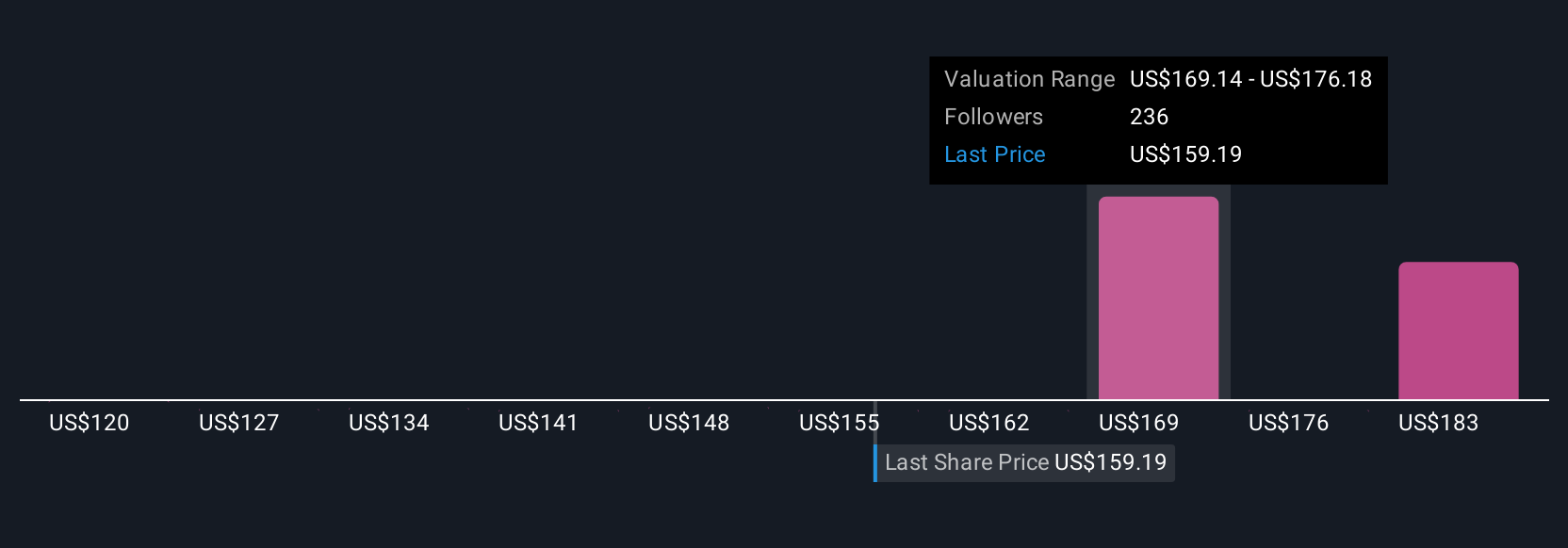

Fair value estimates for P&G from 18 Simply Wall St Community members span from US$119.81 to US$185.05 per share. While product innovation remains a catalyst, ongoing cost pressures could affect returns, so consider several viewpoints before deciding.

Explore 18 other fair value estimates on Procter & Gamble - why the stock might be worth 21% less than the current price!

Build Your Own Procter & Gamble Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Procter & Gamble research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Procter & Gamble research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Procter & Gamble's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PG

Outstanding track record established dividend payer.

Similar Companies

Market Insights

Community Narratives