- United States

- /

- Personal Products

- /

- NYSE:KVUE

Is There an Opportunity in Kenvue After Its 29% Drop in 2025?

Reviewed by Bailey Pemberton

If you find yourself thinking about what to do with Kenvue stock right now, you are not alone. After all, it is tough to ignore a stock that has seen both volatility and fresh headlines lately. In just the past week, Kenvue returned 0.8%, yet that barely makes a dent in the big picture: over the past month, shares have slid -8.2%, and the year-to-date drop sits at a hefty -29.1%. Stretch that out to a year, and Kenvue is down -31.6%, making some investors wonder whether the recent declines are a sign of deeper issues or if upside could be lurking beneath the surface.

The news cycle has not helped steady nerves. There has been ongoing debate about the company's strategic positioning after its spin-off, with conversations heating up about its path as a stand-alone consumer health giant. Market watchers point to sector shifts and some regulatory scrutiny that have weighed on broader sentiment. Still, none of these moves have fundamentally altered Kenvue's underlying business strength so far. Instead, these pressures may have simply changed how the market views risk and growth potential across the sector.

With the stock now trading near $15, valuation starts looking more interesting. According to a multi-step scoring model that checks whether companies are trading below their intrinsic value on six key measures, Kenvue earns a value score of 5 out of 6. That is a strong signal the stock may be priced cheaply in today's market, at least by conventional standards.

So how should you evaluate if Kenvue's current price really offers a bargain? Let us break down the different valuation methods analysts use, and explore why those numbers might not tell the whole story just yet.

Why Kenvue is lagging behind its peers

Approach 1: Kenvue Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a firm's intrinsic value by projecting its future free cash flows and discounting them back to their present value. This approach focuses on what the business will generate in actual cash, making it a widely used method for valuing established companies like Kenvue.

Kenvue's most recent reported Free Cash Flow is $1.62 billion, signaling strong cash-generating ability. Analyst estimates forecast steady increases over the next several years, with projected Free Cash Flow reaching $2.83 billion by 2029. Beyond analyst coverage, longer-term projections through 2035 are extrapolated to continue this growth, though these are naturally less certain.

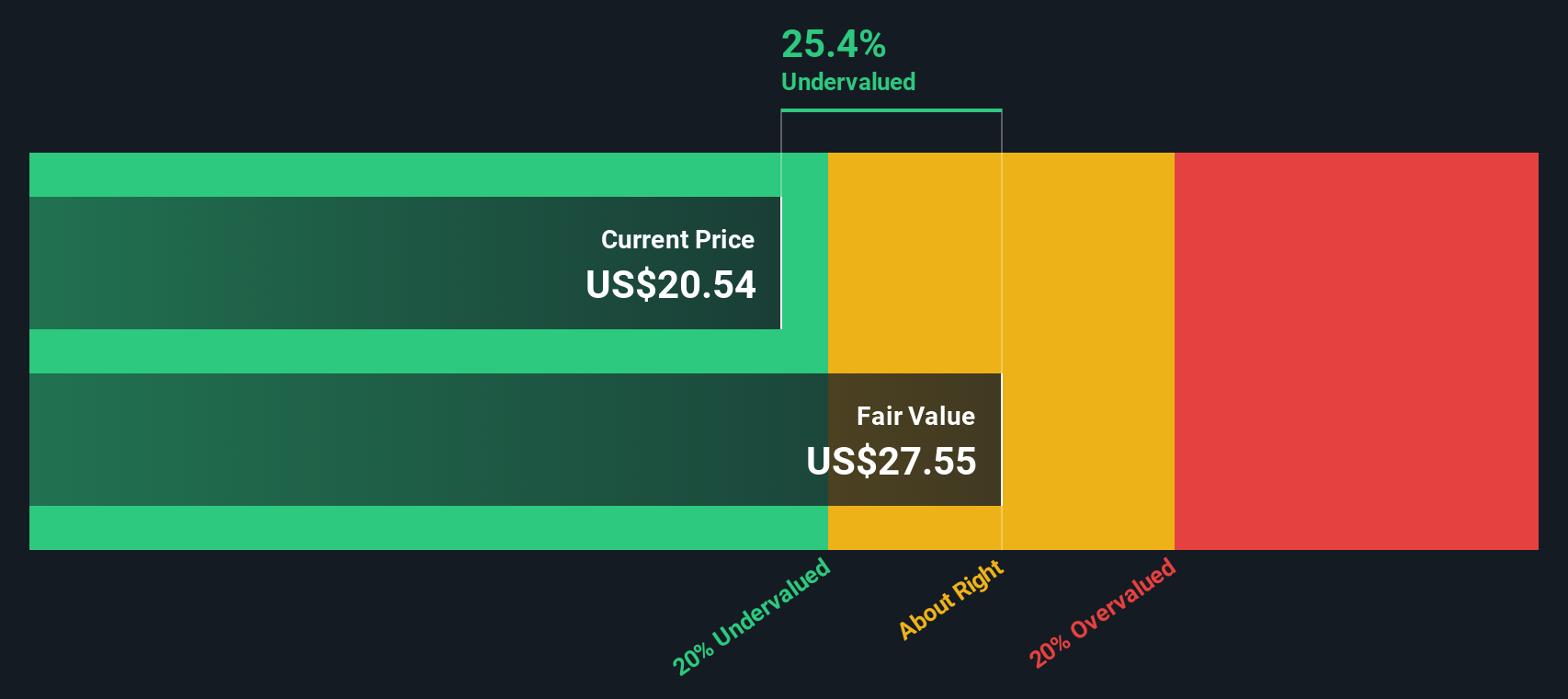

Using these cash flow estimates, the DCF model values Kenvue shares at $26.89 each. Compared to the current trading price near $15, this implies the shares are trading at a 43.9% discount to their estimated intrinsic value.

In summary, the DCF model suggests Kenvue stock is significantly undervalued at today's price, assuming that growth projections prove reliable.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Kenvue is undervalued by 43.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Kenvue Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies like Kenvue because it directly compares what investors are willing to pay for every dollar of earnings. For businesses with consistent profits, the PE ratio provides a clear snapshot of how the market values current and future earning potential.

Growth prospects and risks play a big role in determining whether a stock’s PE is “fair.” Companies expected to grow rapidly often command higher PE multiples, while those facing greater risks or slower growth tend to trade at lower ratios. So, simply scanning for “low” PE stocks isn’t enough if the underlying risks are elevated, or growth is lagging peers.

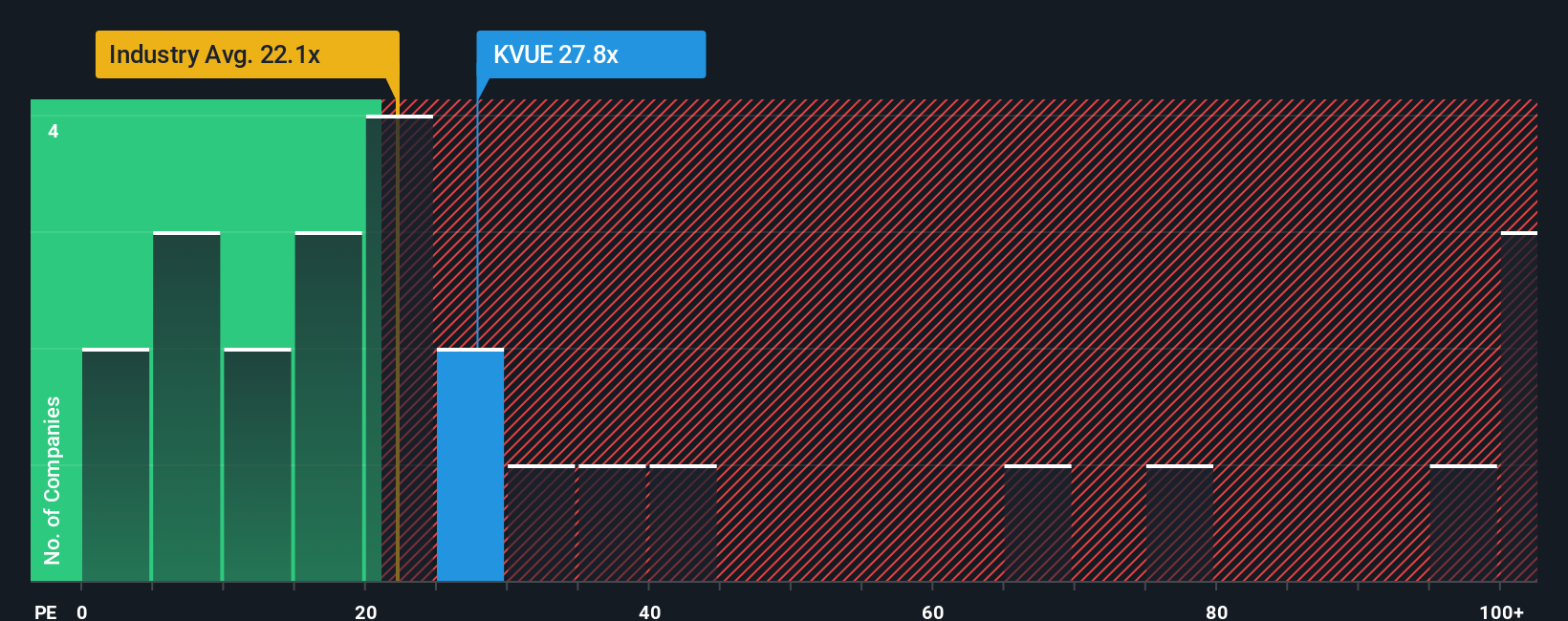

Kenvue currently trades at a PE ratio of 20.4x. That is slightly below both the industry average PE of 22x and well under the average of close peers, which stands at 34.4x. However, comparing to just the industry or peers can miss important context, such as company size, risk, or unique profit drivers. That is why Simply Wall St introduces a proprietary “Fair Ratio,” which, for Kenvue, sits at 24.5x. This Fair Ratio considers factors like Kenvue’s earnings growth outlook, market cap, profit margins, and risk factors, making it a more tailored benchmark than any industry average alone.

With Kenvue’s current PE ratio at 20.4x and its Fair Ratio at 24.5x, the stock appears undervalued on this metric, implying the market may not be fully appreciating its earning potential when adjusting for these company-specific factors.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Kenvue Narrative

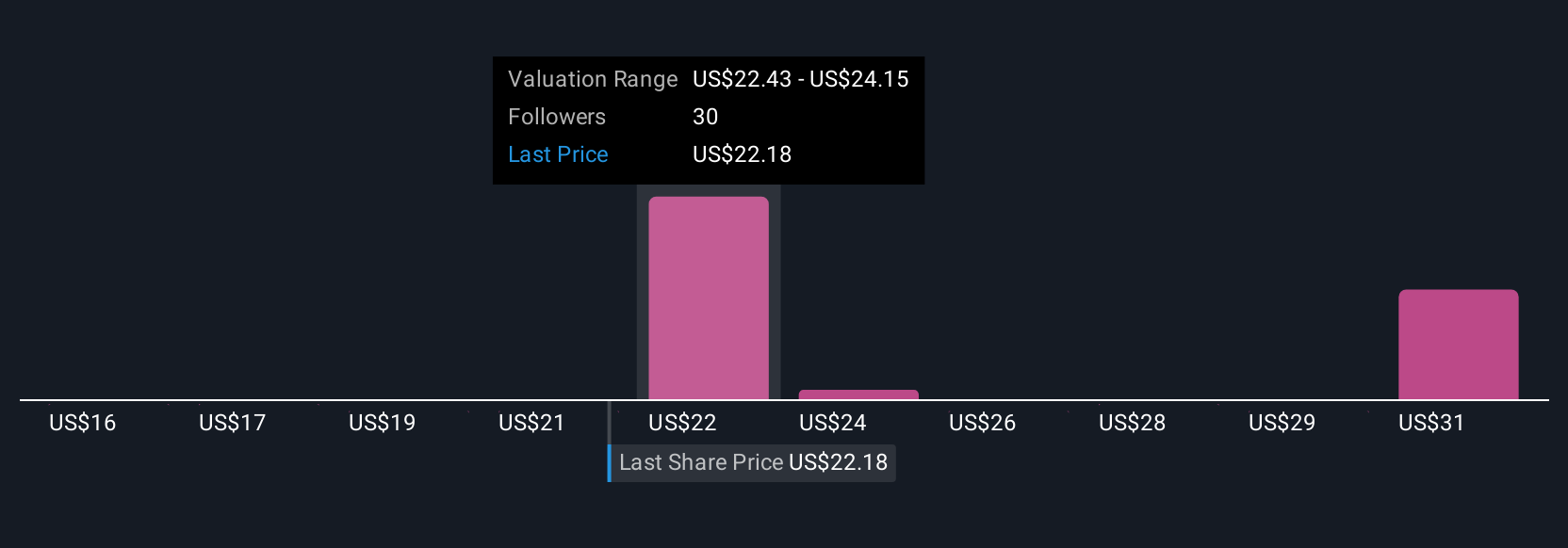

Earlier, we mentioned there is an even better way to understand valuation, so let us introduce you to Narratives. Rather than relying only on numbers and financial ratios, a Narrative is the story investors tell themselves about a company's future, combining their beliefs about Kenvue's industry position, future earnings, and resilience with their own assumptions for revenue, profit margins, and risk.

In practice, a Narrative links the company’s story to a financial forecast, which then determines a personalized fair value. This approach makes investment decisions less about guesswork and more about your unique perspective. Narratives are available right on Simply Wall St's Community page, used by millions of investors, and are designed to be easy to create or adjust as your view of the company evolves.

This means you can quickly see how your Narrative compares to the current market price, helping you decide when you believe it is time to buy, sell, or wait. As new news or quarterly results emerge, Narratives update automatically, so your investment logic always reflects the latest information.

For Kenvue, one investor might see robust digital innovation, cost-cutting, and long-term demand growth justifying a fair value near $26. Another, more cautious investor might focus on legal risks and slower innovation, landing closer to $19. Narratives put you in the driver's seat, allowing your view to shape your decisions, not just the consensus.

Do you think there's more to the story for Kenvue? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kenvue might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KVUE

Kenvue

Operates as a consumer health company in the United States, Europe, the Middle East, Africa, Asia-Pacific, and Latin America.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives