- United States

- /

- Personal Products

- /

- NYSE:ELF

A Fresh Look at e.l.f. Beauty (ELF) Valuation After Profit Warnings and Tariff Concerns

Reviewed by Simply Wall St

Shares of e.l.f. Beauty (NYSE:ELF) slid after the company posted its latest earnings. The report revealed strong revenue growth, but a marked drop in profits driven by higher tariff burdens and increased marketing expenses.

See our latest analysis for e.l.f. Beauty.

Over the past year, momentum has dramatically shifted for e.l.f. Beauty. After a remarkable multi-year run, sentiment soured sharply as the stock plunged on disappointing profit guidance and ongoing tariff pressures. This has put the focus on margins rather than growth. The 1-year total shareholder return has dropped by 40.5%, even as management acts to expand internationally and integrate new brands, showing that investor anxiety about near-term profits now outweighs confidence in e.l.f.’s growth story.

If the volatility in e.l.f. Beauty has you watching for new opportunities, this could be a smart moment to broaden your search and discover fast growing stocks with high insider ownership

So, after a year of profit pressure and a sharp reset in expectations, is e.l.f. Beauty an overlooked bargain amid the volatility, or is the market correctly looking past near-term growth prospects to price in the risks?

Most Popular Narrative: 47.8% Undervalued

According to the consensus narrative, e.l.f. Beauty’s current price of $79.85 stands well below the suggested fair value of $152.93, creating a dramatic gap that has grabbed investors’ attention and triggered debate about whether the market is overlooking key drivers behind this stock.

The company is highly effective at leveraging influencer marketing, social media virality, and community-driven innovation (for example, TikTok Shop exclusives and a rapid launch cadence), enabling lower customer acquisition costs and highly efficient brand-building, supporting both top-line growth and sustainable net margin expansion.

Want to know the recipe behind this sky-high fair value? This narrative centers on bold projections about international expansion, aggressive digital innovation, and a dramatic leap in future profits. Find out which ambitious financial forecasts are fueling this price target. Are you ready to see the real numbers shaping investor sentiment?

Result: Fair Value of $152.93 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent tariff risks and any missteps integrating new brands could quickly undermine the bullish case that is driving current fair value estimates.

Find out about the key risks to this e.l.f. Beauty narrative.

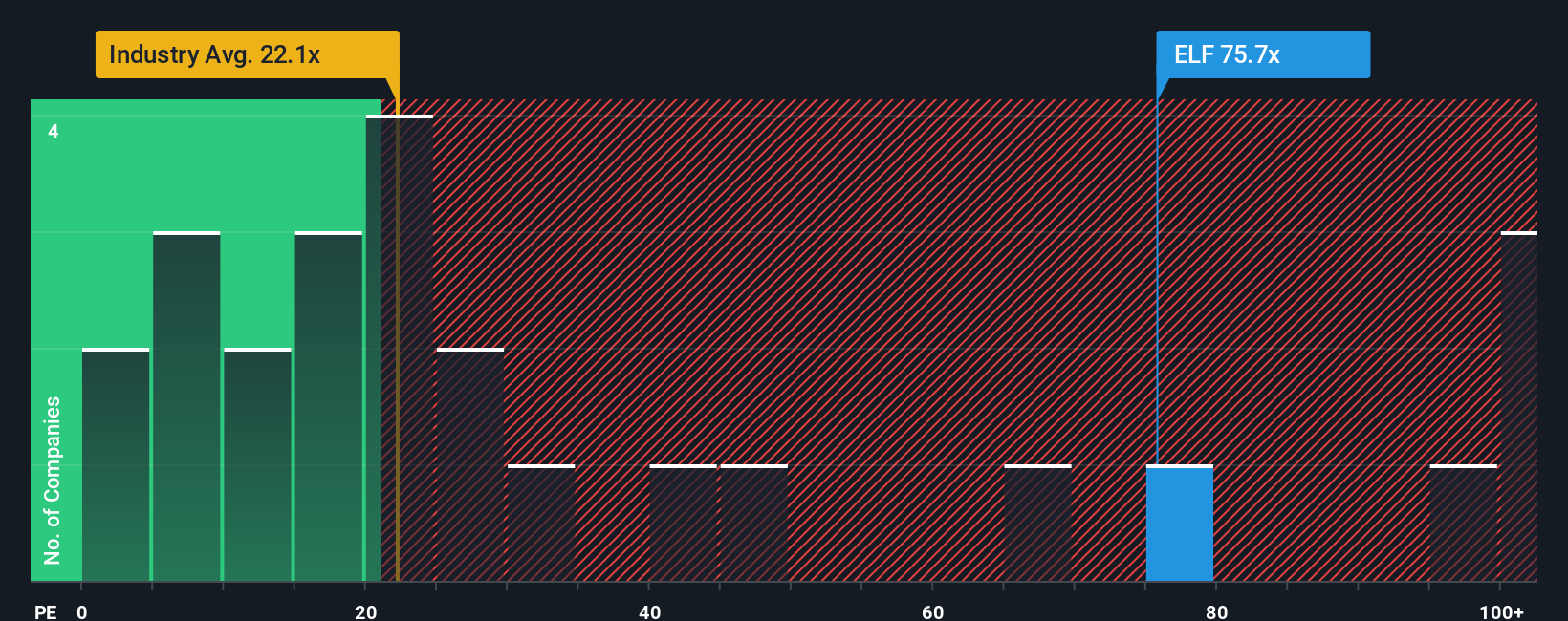

Another View: Are the Multiples Sending a Warning?

While fair value models highlight e.l.f. Beauty’s upside, its price-to-earnings ratio stands at 58x, nearly triple the North American industry average of 20.6x and far above the stock’s fair ratio of 33.9x. This significant premium could indicate valuation risk if results disappoint. Could expectations be running too hot?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own e.l.f. Beauty Narrative

If the consensus doesn’t fit your outlook or you want to dig deeper, it’s easy to analyze the data and develop your own take in minutes. Do it your way

A great starting point for your e.l.f. Beauty research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Act fast so you don’t miss your next opportunity. The Simply Wall Street Screener is your gateway to fresh possibilities. Go beyond the obvious and strengthen your portfolio with unique investment angles.

- Find high-potential opportunities among undervalued stocks based on future cash flow by checking out these 865 undervalued stocks based on cash flows.

- Uncover trending companies shaping the artificial intelligence landscape by jumping into these 24 AI penny stocks.

- Capitalize on the reliable income potential from companies offering attractive yields by exploring these 16 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ELF

e.l.f. Beauty

A beauty company, provides cosmetics and skin care products worldwide.

Reasonable growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives