- United States

- /

- Household Products

- /

- NYSE:CL

Is Colgate-Palmolive a Bargain After Sustainability Push and 13% Stock Decline?

Reviewed by Bailey Pemberton

- Ever wondered if Colgate-Palmolive is truly a bargain or if the brand power is already priced in? Let’s dig in and see if there’s hidden value waiting to be uncovered.

- The stock has seen a modest bounce recently, up 2.2% in the last week and 1.0% over the past month, but it’s still down 13.0% year-to-date and off 12.9% over the last year.

- While overall market conditions have weighed on consumer staples, Colgate-Palmolive has been in the headlines for new product rollouts and increased sustainability initiatives. These moves could reshape investor sentiment. They have sparked discussion about how ongoing innovation can influence long-term value beyond short-term price drops.

- On our simple valuation check, Colgate-Palmolive scores a 3 out of 6 for undervaluation. Of course, classic multiples and checklists only tell part of the story, so stick around as we break down the different approaches to valuing this stock. We will also explore an even smarter way to assess whether it’s worth your attention.

Find out why Colgate-Palmolive's -12.9% return over the last year is lagging behind its peers.

Approach 1: Colgate-Palmolive Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them back to today's dollars. This approach provides an intrinsic value snapshot based on expected performance.

For Colgate-Palmolive, the DCF model uses a 2 Stage Free Cash Flow to Equity approach. Last year, the company generated Free Cash Flow of $3.38 Billion, and analysts expect cash flows to grow into the future, reaching around $3.99 Billion by 2029. Estimates further out are extrapolated to give a clearer long-term outlook. These forecasts are then discounted to reflect the value of money over time, creating a present-day estimate of the company's worth.

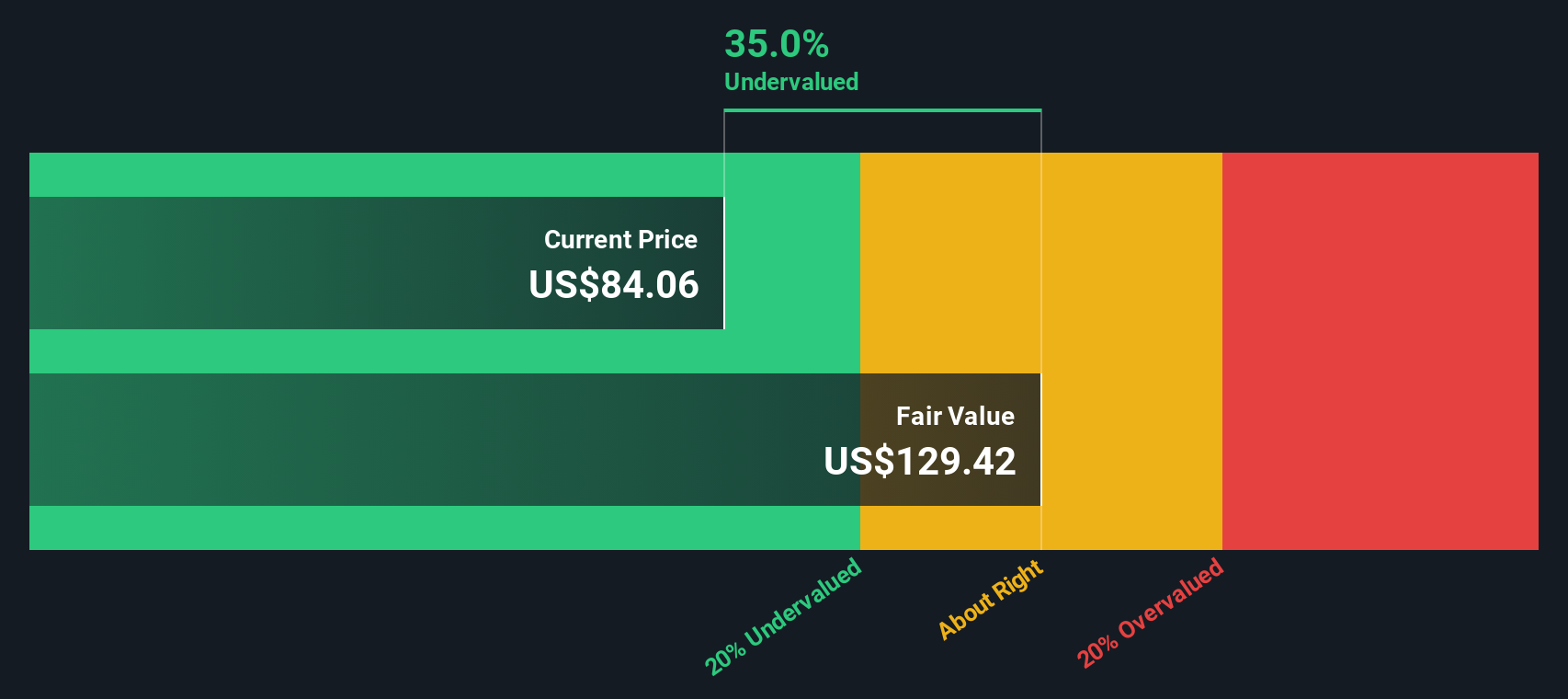

The DCF model places Colgate-Palmolive’s intrinsic value at $122.83 per share. This calculation suggests the stock is trading at a 35.9% discount to its fair value.

In summary, Colgate-Palmolive appears meaningfully undervalued according to its future cash flow prospects.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Colgate-Palmolive is undervalued by 35.9%. Track this in your watchlist or portfolio, or discover 870 more undervalued stocks based on cash flows.

Approach 2: Colgate-Palmolive Price vs Earnings

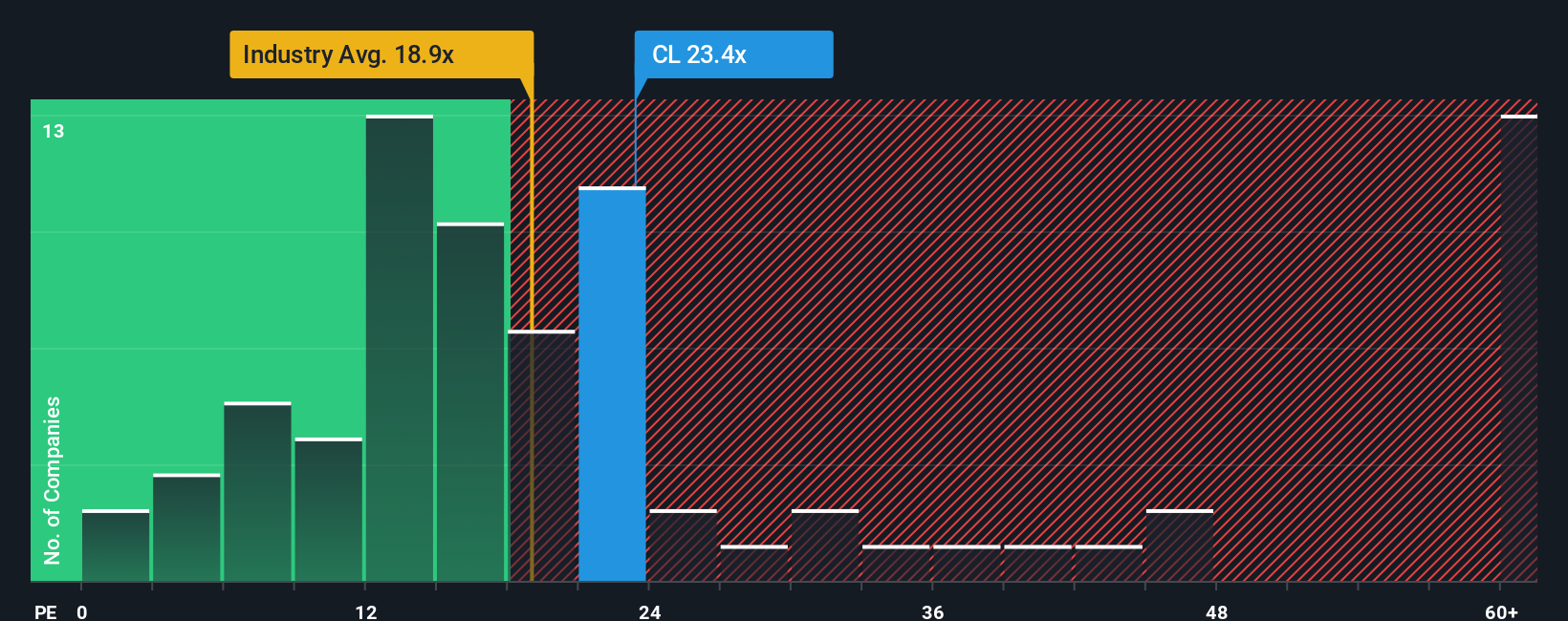

The Price-to-Earnings (PE) ratio is a common metric for valuing profitable companies like Colgate-Palmolive. It allows investors to compare how much they are paying today for each dollar of company earnings, making it particularly useful when those earnings are strong and reliable.

What is considered a “normal” or “fair” PE ratio often depends on the company’s growth trajectory and the risks it faces. Higher expected earnings growth or lower perceived risk can justify a higher PE, while slower growth or greater uncertainty tends to bring the ratio down.

Currently, Colgate-Palmolive trades at a 21.8x PE ratio. This is slightly above the industry average of 18.1x and the peer average of 20.4x. These benchmarks can be useful, though they may not capture company-specific factors.

This is where Simply Wall St's proprietary “Fair Ratio” comes in. This metric calculates a tailored, fair PE multiple for Colgate-Palmolive based on its growth expectations, profitability, risk profile, industry, and market cap. Unlike simple comparisons to peers or the broader industry, the Fair Ratio is designed to reflect what an informed investor should be willing to pay for Colgate-Palmolive’s unique characteristics.

For Colgate-Palmolive, the Fair Ratio stands at 22.4x, which is nearly identical to its current PE. This suggests the stock’s price reflects its expected growth, profitability, and risks quite accurately, with little evidence of a discount or premium at current levels.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1396 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Colgate-Palmolive Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply the story you believe about a company, based on your expectations for its future performance and the numbers you think are realistic for revenue, earnings, and margins.

Narratives help investors bridge the gap between the company’s story, a clearly defined financial forecast, and ultimately, a tailored fair value for the stock. Unlike traditional models or price multiples, Narratives empower you to document your viewpoint and assumptions directly, and see how those translate into a fair value, using an easy, interactive tool available for Colgate-Palmolive on Simply Wall St’s Community page.

With Narratives, deciding when to buy or sell becomes clearer, because you can immediately compare the fair value you’ve calculated with the actual share price. As soon as new company results or market news are released, Narratives are dynamically updated, so your valuation always reflects the latest information.

For example, some investors may see Colgate-Palmolive’s expansion in emerging markets and innovation in oral care as reasons for a higher fair value, targeting as much as $106 per share. Others may focus on competitive challenges and cost pressures, setting a more cautious target of $83 per share. Narratives allow both perspectives to be clearly defined and tested against the numbers.

Do you think there's more to the story for Colgate-Palmolive? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CL

Colgate-Palmolive

Manufactures and sells consumer products in the United States and internationally.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives