- United States

- /

- Household Products

- /

- NYSE:CL

A Look at Colgate-Palmolive’s Valuation Following Earnings Beat and Strategic Growth Updates

Reviewed by Simply Wall St

Colgate-Palmolive (NYSE:CL) just posted third quarter results that edged past adjusted profit forecasts, even with continued pressures from consumer uncertainty, persistent inflation, and competitive promotional strategies. Management underscored their commitment to innovation and long-term growth.

See our latest analysis for Colgate-Palmolive.

After a tough stretch, Colgate-Palmolive’s share price has shown some resilience recently. It is up 1.27% in the last day and has logged a 3.81% gain over the week, even as the year-to-date share price return sits at -12.24%. Ongoing buybacks, targeted innovation, and the new €600 million bond offering have kept long-term investors focused on the company’s 13.3% total return over three years. However, short-term momentum is still mixed as market headwinds persist.

If you’re keeping an eye on how companies navigate uncertain markets, now could be the perfect time to discover fast growing stocks with high insider ownership.

With shares showing slight gains and management reiterating a long-term strategy, the key question for investors is whether Colgate-Palmolive’s current valuation offers hidden value or if the market has already priced in the company’s growth prospects.

Most Popular Narrative: 10.5% Undervalued

The latest narrative estimates Colgate-Palmolive’s fair value at $88.84, compared to the last close of $79.47. Here’s a central belief powering that view.

Expansion and premiumization of core oral care lines like Colgate Total, coupled with the roll-out of complementary products across 75 markets, are set to capture increased value from emerging middle-class consumers and rising health and hygiene awareness globally, supporting top-line organic sales acceleration and improved pricing power.

Curious how global expansion, premium brands, and long-term sales assumptions shape Colgate’s value? One narrative leverages future profit growth for a premium-worthy price. Find out which core projections drive this bold valuation and what numbers are propelling it higher.

Result: Fair Value of $88.84 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent consumer caution in key markets and rising raw material costs could constrain Colgate-Palmolive’s growth and challenge the bullish case.

Find out about the key risks to this Colgate-Palmolive narrative.

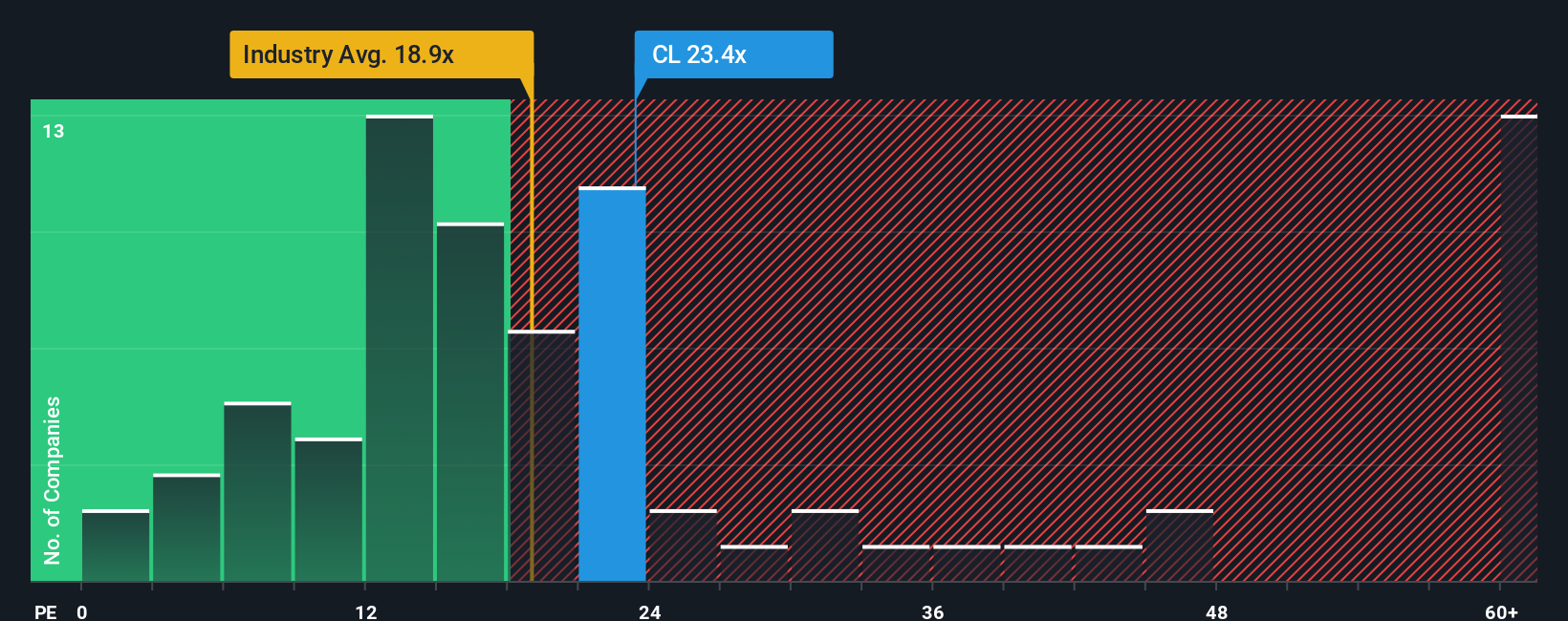

Another View: Multiples Suggest a Different Story

While the current fair value estimate paints Colgate-Palmolive as undervalued, a second perspective using valuations based on the price-to-earnings ratio tells a more cautious tale. Colgate-Palmolive's ratio stands at 22x, notably higher than its industry average of 18x and its peer group at 20.2x. Even compared to its fair ratio of 22.5x, there is less headroom and a tighter margin for upside, which means the market could be pricing in most of the upside already. Is the premium justified, or is there less value here than first meets the eye?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Colgate-Palmolive Narrative

If you have your own perspective or prefer to dig into the numbers yourself, crafting a custom narrative takes just a few minutes. Do it your way.

A great starting point for your Colgate-Palmolive research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Strong investing means seizing exceptional opportunities. Make the next move by uncovering well-positioned stocks in growing sectors before everyone else catches on.

- Earn steady income from reliable sources by targeting these 15 dividend stocks with yields > 3% for high-yield opportunities that support your financial goals.

- Capture the future of healthcare by tapping into artificial intelligence progress with these 32 healthcare AI stocks, a leader in medical innovation.

- Get ahead of the trend with potential breakout companies by checking out these 3575 penny stocks with strong financials, which may offer strong growth and untapped potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CL

Colgate-Palmolive

Manufactures and sells consumer products in the United States and internationally.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives