- United States

- /

- Household Products

- /

- NYSE:CHD

Church & Dwight (CHD): Valuation in Focus After Strong Q3 Results and Upbeat Guidance

Reviewed by Simply Wall St

Church & Dwight (CHD) just posted impressive third quarter results, showing both higher sales and profitability compared to last year. In addition, the company has boosted its full-year earnings outlook, signaling growing confidence.

See our latest analysis for Church & Dwight.

After a tough stretch for consumer staples stocks, Church & Dwight’s upbeat earnings and fresh buybacks have sparked investor interest. Even with last week’s jump, the year-to-date share price return sits at -16.35%, and the one-year total shareholder return is -17.44%. However, momentum could be shifting, especially as three-year total returns remain solidly positive at 20.87%.

If Church & Dwight’s renewed growth focus has you curious, it could be the perfect moment to expand your search and discover fast growing stocks with high insider ownership

With the company’s stock still down for the year, but recent results turning positive, is Church & Dwight an undervalued opportunity for long-term investors, or is the market already pricing in its growth prospects?

Most Popular Narrative: 10.4% Undervalued

Comparing the narrative’s fair value estimate of $96.95 with the last close at $86.86, the latest story suggests Church & Dwight still has meaningful upside, despite recent share price volatility and sector headwinds. Let’s explore the driving themes behind this outlook.

Innovation and new product launches remain a major internal catalyst. Roughly half of recent organic growth is attributed to innovations (e.g., BATISTE Light, HERO Mighty Patch Body, Touchland new fragrances), which tend to command higher prices and increase household penetration. This provides momentum for above-peer revenue growth and margin improvement.

Ever wondered what audacious financial forecasts power this valuation? The most closely watched prediction combines consistent revenue growth, rising profitability, and a high future earnings multiple. This paints a bullish scenario major investors cannot ignore. Dive in to uncover what’s fueling these optimistic assumptions.

Result: Fair Value of $96.95 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in Church & Dwight’s vitamin segment and rising input costs could challenge the upbeat outlook if these headwinds prove to be lasting.

Find out about the key risks to this Church & Dwight narrative.

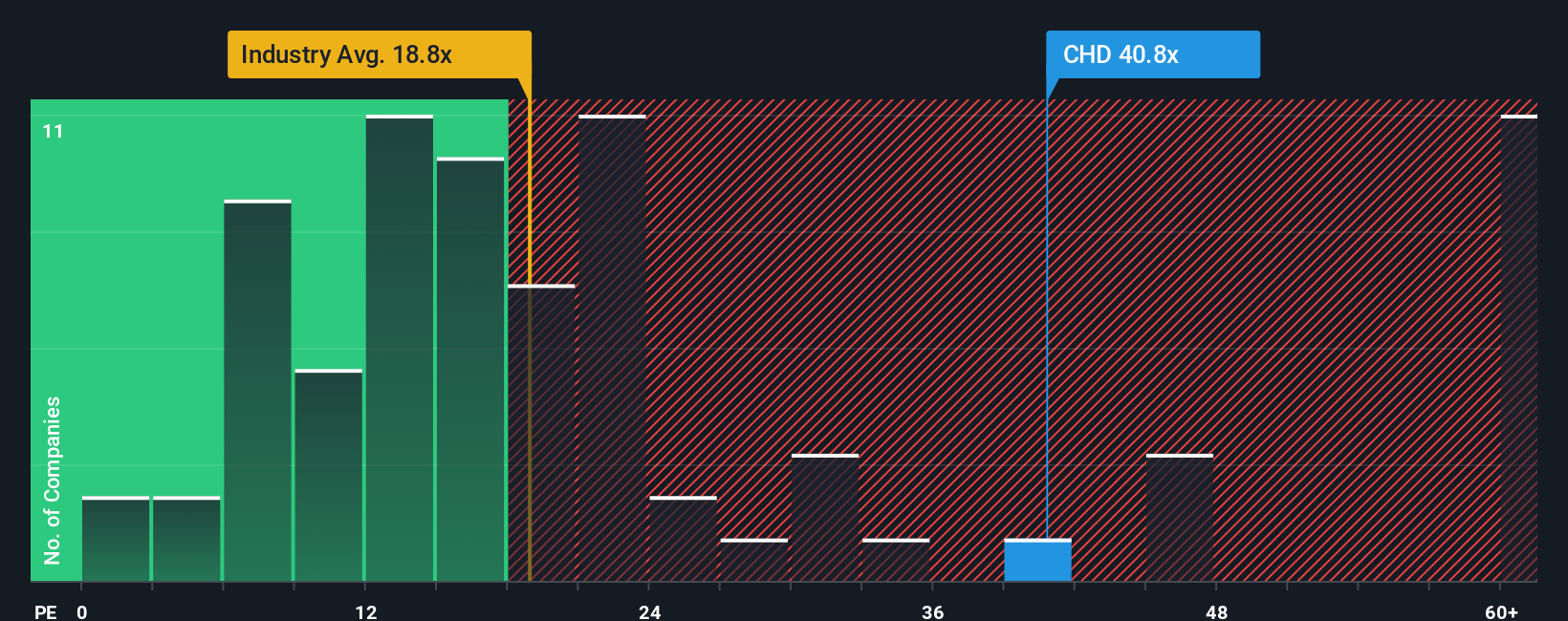

Another View: What Do Valuation Ratios Say?

Looking at current valuation ratios, shares of Church & Dwight trade at a price-to-earnings ratio of 26.7x. This is far above both the global household products industry average of 18.1x and the peer group’s 18.3x. It also surpasses its fair ratio of 20.5x. That gap suggests the stock could be pricing in a lot of future growth or holding valuation risk, so is this justified by the company’s fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Church & Dwight Narrative

If you see things differently, or want to dig into the numbers yourself, building your own take is quick and insightful. Do it your way

A great starting point for your Church & Dwight research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t limit your portfolio to just one opportunity. Expand your horizons and tap into trends shaping tomorrow’s stock winners on Simply Wall Street.

- Tap into genuine growth by checking out these 876 undervalued stocks based on cash flows, packed with hidden gems priced below their true potential.

- Ride the wave of artificial intelligence by searching these 25 AI penny stocks, offering exposure to companies powering tomorrow’s tech breakthroughs.

- Lock in reliable income streams by investing through these 16 dividend stocks with yields > 3%, highlighting shares with yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CHD

Church & Dwight

Develops, manufactures, and markets household, personal care, and specialty products.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives