- United States

- /

- Household Products

- /

- NasdaqGS:KMB

Is Kimberly-Clark a Hidden Gem After This Month's 11.7% Price Drop?

Reviewed by Bailey Pemberton

- Ever wondered if Kimberly-Clark is actually a bargain waiting to be discovered, or just another household name in your portfolio? Let’s dig into the real numbers behind the stock’s current price.

- The past month has been a roller coaster for Kimberly-Clark’s share price, with a drop of 11.7%. This brings its year-to-date return to -19.6%. While that may sound rough, short-term movements can reveal fresh opportunities or new risks.

- Recent headlines highlight shifts in consumer spending patterns and supply chain cost pressures. Both factors have impacted big players in the personal care space like Kimberly-Clark. In the past few weeks, industry news has zeroed in on how companies are adapting to these changes, signaling important context for stock price trends.

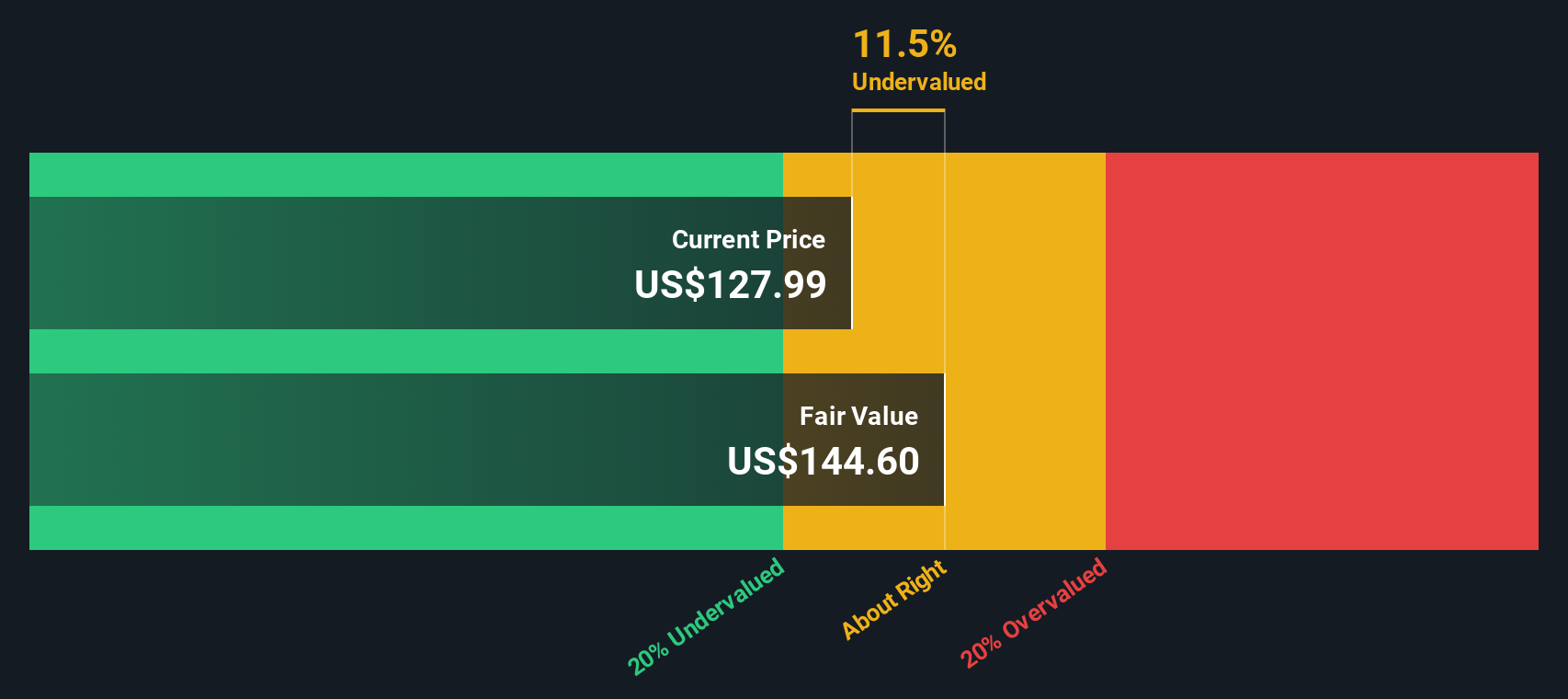

- On our valuation screen, Kimberly-Clark lands a perfect 6 out of 6 for being undervalued across multiple investment checks. We will walk through exactly how those numbers are calculated, but stick around to see a smarter approach to valuation at the end of the article.

Find out why Kimberly-Clark's -21.7% return over the last year is lagging behind its peers.

Approach 1: Kimberly-Clark Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s dollars. This approach is widely used to determine whether a stock is trading above or below its true worth based on its cash generation potential.

Kimberly-Clark’s current Free Cash Flow stands at $1.79 Billion. According to analyst estimates and further projections, free cash flow is set to grow steadily, with a projected value of $3.21 Billion in 2035. Notably, analysts provide direct forecasts up to 2027. After that point, growth is extrapolated using industry models. This methodology gives a full picture of the company’s earning power over the coming decade.

Using these cash flow estimates, the DCF model calculates Kimberly-Clark’s intrinsic value at $194.34 per share. This represents a significant 46.0% above its current share price, suggesting a strong margin of safety for investors interested in value opportunities.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Kimberly-Clark is undervalued by 46.0%. Track this in your watchlist or portfolio, or discover 928 more undervalued stocks based on cash flows.

Approach 2: Kimberly-Clark Price vs Earnings

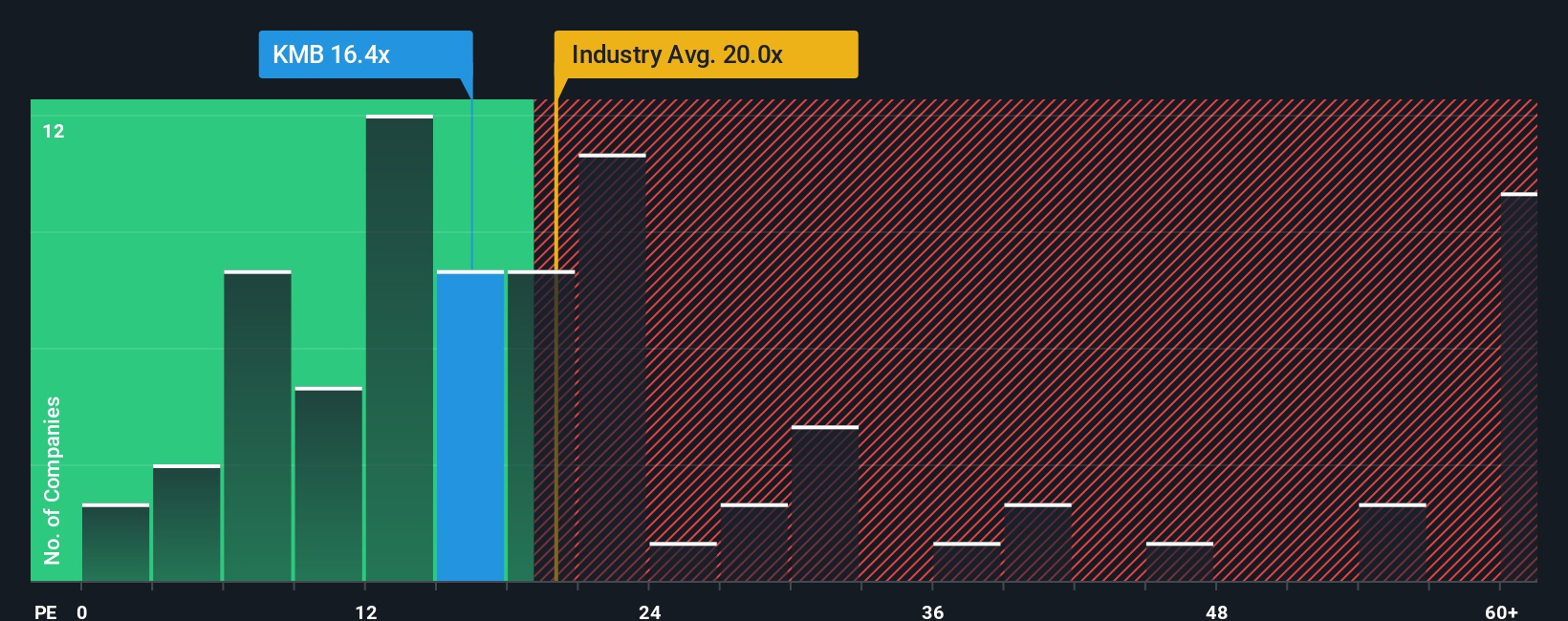

The price-to-earnings (PE) ratio is widely considered the go-to valuation tool for established, profitable companies like Kimberly-Clark. The PE ratio helps investors gauge how much they are paying for each dollar of company earnings, making it especially useful for comparing businesses within the same industry and those with steady profit streams.

When analyzing PE ratios, it is important to remember that growth prospects and risk profiles play a big part in defining what a “normal” or “fair” multiple should be. Companies expected to grow faster than peers, or with more predictable earnings, usually justify higher PE ratios, while those facing greater risks or slower growth often deserve a discount.

Kimberly-Clark currently trades at a PE ratio of 17.7x. This sits just below the Household Products industry average of 18.0x and is also lower than the peer group average of 20.1x. To get a more tailored comparison, Simply Wall St calculates a “Fair Ratio” for Kimberly-Clark at 22.3x. The Fair Ratio combines factors like earnings growth, profit margins, market cap, and risk profile, so it goes beyond simple industry or peer averages.

This makes the Fair Ratio a powerful reference point because it is custom-built for the specific characteristics of Kimberly-Clark, rather than relying on broad, one-size-fits-all comparisons. With Kimberly-Clark’s current PE at 17.7x and its Fair Ratio at 22.3x, the numbers suggest the stock may be trading at an attractive valuation relative to what it could deserve.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1436 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Kimberly-Clark Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, user-friendly way to express your own story or perspective behind a company’s numbers, combining your expectations for fair value, future earnings, revenue, and margins into one clear framework. Narratives connect what you believe is happening (or will happen) to Kimberly-Clark with how those beliefs could shape its possible fair value, making investment decisions more personal, transparent, and actionable.

Narratives are available to everyone on Simply Wall St's Community page, used by millions of investors, and they are designed for any experience level. By building a Narrative, you can compare your fair value to the current price and quickly see whether now might be the right time to buy, hold, or sell. Plus, Narratives update dynamically in response to new information, such as earnings reports or news headlines, so your investment thesis stays relevant.

For example, right now investors taking the most bullish view on Kimberly-Clark believe its fair value is $162, while the most cautious see it as low as $118, highlighting how Narratives can capture a wide range of perspectives as the situation evolves.

Do you think there's more to the story for Kimberly-Clark? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kimberly-Clark might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KMB

Kimberly-Clark

Manufactures and markets personal care products in the United States.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success