- United States

- /

- Household Products

- /

- NasdaqGS:CENT

Central Garden & Pet (CENT): Evaluating the Value Case After Recent Share Price Declines

Reviewed by Simply Wall St

Central Garden & Pet (CENT) has been catching some attention lately, as its recent performance offers a window into how consumer demand trends and cost management efforts are playing out for pet and garden suppliers. Investors are parsing its growth rates to gauge where value might emerge.

See our latest analysis for Central Garden & Pet.

Central Garden & Pet's share price has seen some bumps this year, with the stock currently sitting at $31.28 after a 17.99% year-to-date drawdown. While there is no shortage of operational progress beneath the surface, momentum has not translated into gains just yet. Its one-year total shareholder return stands at -14.77%, with the longer-term performance also remaining lackluster.

If you’re interested in finding companies that are weathering current market challenges with insider support and growth potential, now is a great time to check out fast growing stocks with high insider ownership

With shares trading well below analyst price targets and some positive trends in underlying earnings, the big question is whether Central Garden & Pet is trading at a bargain or if the market is already factoring in what comes next.

Most Popular Narrative: 26% Undervalued

The most widely followed narrative signals a notable gap between Central Garden & Pet’s fair value estimate and its last closing price. Whether this gap is opportunity or risk for investors depends on how sustainable recent earnings trends prove to be.

Persistent operational streamlining, via the Cost and Simplicity program, footprint rationalization, SKU rationalization, and consolidation of distribution centers into DTC-enabled hubs, continues to unlock operating leverage. This supports steady margin expansion and improves bottom-line earnings despite transitory headwinds.

What is the logic behind that sizable fair value estimate? The narrative hints at a transformation powered by renewed margins, smarter product portfolios, and ongoing cost-cutting. Find out which bold profit and efficiency assumptions drive analysts’ consensus and where the next chapter for this stock could lead.

Result: Fair Value of $42.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent supply chain pressures and unexpected weakness in core categories could challenge Central Garden & Pet’s ability to deliver on bullish growth expectations.

Find out about the key risks to this Central Garden & Pet narrative.

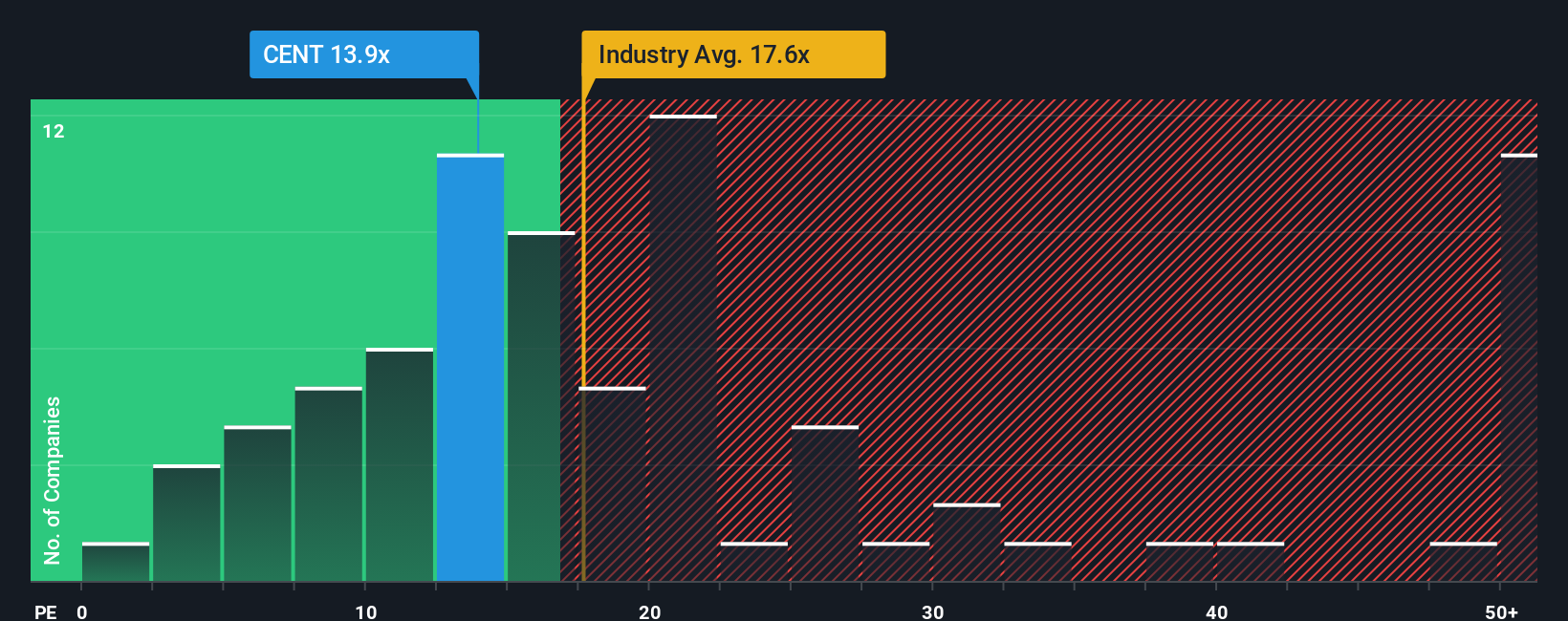

Another View: A Look Through Market Multiples

While analyst forecasts suggest Central Garden & Pet is undervalued, the market's go-to valuation ratio tells a similar story. Its price-to-earnings is 14.2x, which is below both its peer average of 18.7x and the industry average of 17.8x. The current multiple also sits under the fair ratio of 17.6x. This highlights what some might see as a valuation opportunity, but also raises questions about whether there are risks the market is pricing in. Could investors be missing something, or is this a chance before sentiment shifts?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Central Garden & Pet for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 861 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Central Garden & Pet Narrative

If you see things differently or prefer a hands-on approach, you can dive into the numbers and shape your own perspective in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Central Garden & Pet.

Looking for More Investment Ideas?

Smart investors are always one step ahead. Don’t let the next big opportunity pass you by. Leverage the power of the Simply Wall Street Screener to see what else is moving the markets right now.

- Capture steady income streams by checking out these 17 dividend stocks with yields > 3% offering attractive yields above 3% in today’s market.

- Ride the wave of artificial intelligence innovation with these 25 AI penny stocks driving transformational change across industries.

- Tap into growth potential by tracking these 861 undervalued stocks based on cash flows that show promising fundamentals and could be trading below their intrinsic value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CENT

Central Garden & Pet

Produces and distributes various products for the lawn and garden, and pet supplies markets in the United States.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives