- United States

- /

- Medical Equipment

- /

- NYSE:ZBH

The Bull Case For Zimmer Biomet Holdings (ZBH) Could Change Following FDA Breakthrough Status for Iodine Hip Implant

Reviewed by Sasha Jovanovic

- Zimmer Biomet announced that the U.S. Food and Drug Administration (FDA) has granted Breakthrough Device Designation for its first-to-world iodine-treated total hip replacement system, following earlier approval by Japan's PMDA as the world's first orthopedic implant with this technology.

- This marks a significant milestone for Zimmer Biomet, indicating regulatory recognition of its innovative approach to addressing periprosthetic joint infections in hip replacements.

- We'll examine how this landmark FDA designation for Zimmer Biomet’s iodine-treated implant could enhance its innovation narrative and future prospects.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Zimmer Biomet Holdings Investment Narrative Recap

To be a shareholder in Zimmer Biomet, you need to believe that continued innovation in orthopedics and a well-executed rollout of next-generation technologies will help the company overcome industry pricing pressures and intense competition. While the FDA's Breakthrough Device Designation for its iodine-treated hip implant is a meaningful validation of R&D capabilities and could support product differentiation, it may not immediately move the needle on short-term revenue growth, the most important near-term catalyst remains execution on new product launches, while integration risks from recent acquisitions are still front and center.

Among recent announcements, Zimmer Biomet's showcase of robotics innovations at the American Association of Hip and Knee Surgeons annual meeting stands out, particularly its expansion of digital and AI-powered robotic platforms. This focus is closely linked to the catalyst of increasing premium product adoption, which could drive margin expansion even as pricing and reimbursement pressures persist across the sector.

However, in contrast to the optimism around innovation, investors should be aware that the company’s recent acquisition integrations continue to carry risk, especially if synergy realizations are slower than expected and ...

Read the full narrative on Zimmer Biomet Holdings (it's free!)

Zimmer Biomet Holdings is projected to reach $9.2 billion in revenue and $1.3 billion in earnings by 2028. This forecast assumes annual revenue growth of 5.5% and an earnings increase of $476.5 million from current earnings of $823.5 million.

Uncover how Zimmer Biomet Holdings' forecasts yield a $110.92 fair value, a 10% upside to its current price.

Exploring Other Perspectives

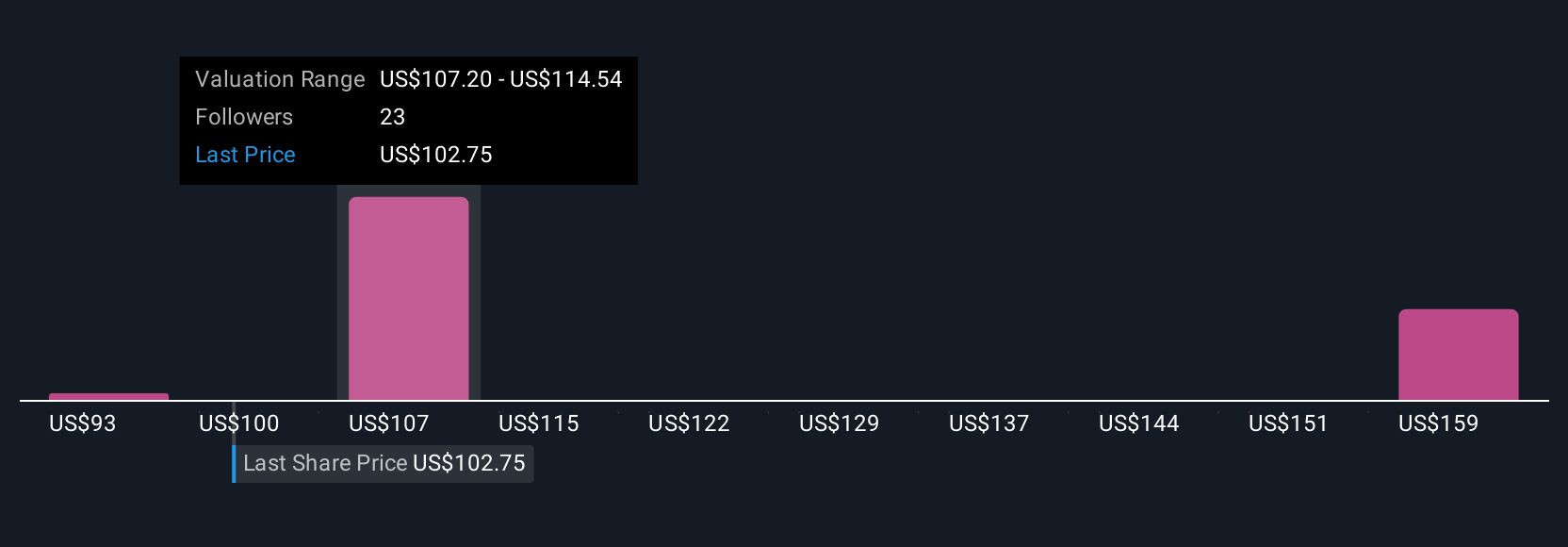

Retail investors in the Simply Wall St Community have set fair value estimates for Zimmer Biomet ranging from US$95 to US$167, based on three distinct analyses. While you weigh these broad perspectives, remember that intensified competition in robotics and core orthopedics could have wide-ranging effects on future performance, explore how different viewpoints factor in this risk.

Explore 3 other fair value estimates on Zimmer Biomet Holdings - why the stock might be worth as much as 66% more than the current price!

Build Your Own Zimmer Biomet Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Zimmer Biomet Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Zimmer Biomet Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Zimmer Biomet Holdings' overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zimmer Biomet Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ZBH

Zimmer Biomet Holdings

Operates as a medical technology company worldwide.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives