- United States

- /

- Medical Equipment

- /

- NYSE:ZBH

Should Investors Rethink Zimmer Biomet After a 9.3% Drop in 2025?

Reviewed by Bailey Pemberton

- Curious if Zimmer Biomet Holdings is a hidden bargain or just fairly priced? Let’s dig into what’s really driving the value behind the ticker.

- The company’s stock has slipped recently, down 2.4% in the past week and 9.3% year-to-date, which might have shifted how investors are thinking about its future growth or risk.

- Some of these price changes come off broader market talk around the healthcare sector’s evolving landscape, including regulatory headlines and ongoing product innovation. These factors may sway sentiment for stocks like Zimmer Biomet.

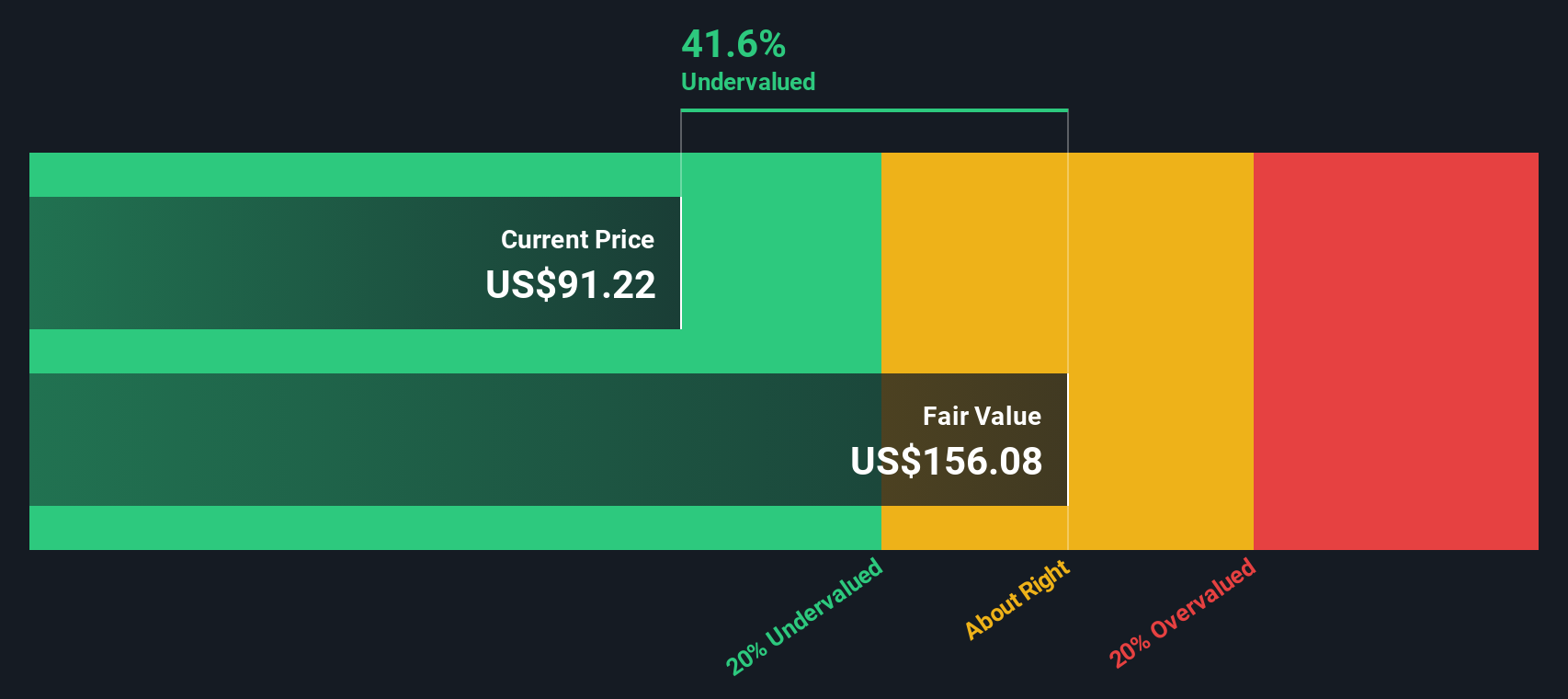

- When we run Zimmer Biomet through our valuation checks, the company scores 5 out of 6 for being undervalued, which is considered impressive by most standards. Ahead, we’ll unpack what these scores mean, and why the real insight could come from digging even deeper into valuation techniques.

Find out why Zimmer Biomet Holdings's -13.6% return over the last year is lagging behind its peers.

Approach 1: Zimmer Biomet Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future free cash flows and discounting them back to today’s dollars. This approach offers a more fundamental look at a business by focusing on actual cash generation, rather than just earnings metrics.

For Zimmer Biomet Holdings, recent data shows Free Cash Flow (FCF) over the last twelve months at $1.04 billion. Looking ahead, analysts expect this to grow, with projections from Simply Wall St suggesting FCF could reach about $2.40 billion by 2035. It is important to note that only the next five years are based on analyst estimates, while the years after 2028 are modeled using extrapolation, which adds additional uncertainty but still provides insight into potential growth.

With these future cash flows in mind, the DCF model estimates Zimmer Biomet Holdings’ intrinsic value at $166.64 per share. Compared to the current market price, this model suggests the stock is trading at a 43.1% discount. This indicates meaningful undervaluation according to this approach.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Zimmer Biomet Holdings is undervalued by 43.1%. Track this in your watchlist or portfolio, or discover 930 more undervalued stocks based on cash flows.

Approach 2: Zimmer Biomet Holdings Price vs Earnings

The price-to-earnings (PE) ratio is widely used to value profitable companies because it gives investors a quick sense of how much they are paying for each dollar of current earnings. For established businesses like Zimmer Biomet Holdings, the PE ratio is particularly relevant, as it reflects how the market values the company’s profitability and growth prospects.

Growth expectations and risks play a big role in determining what is considered a “normal” PE ratio. Higher expected earnings growth or lower risk generally justifies a higher multiple, while slower growth or greater uncertainty calls for a lower one.

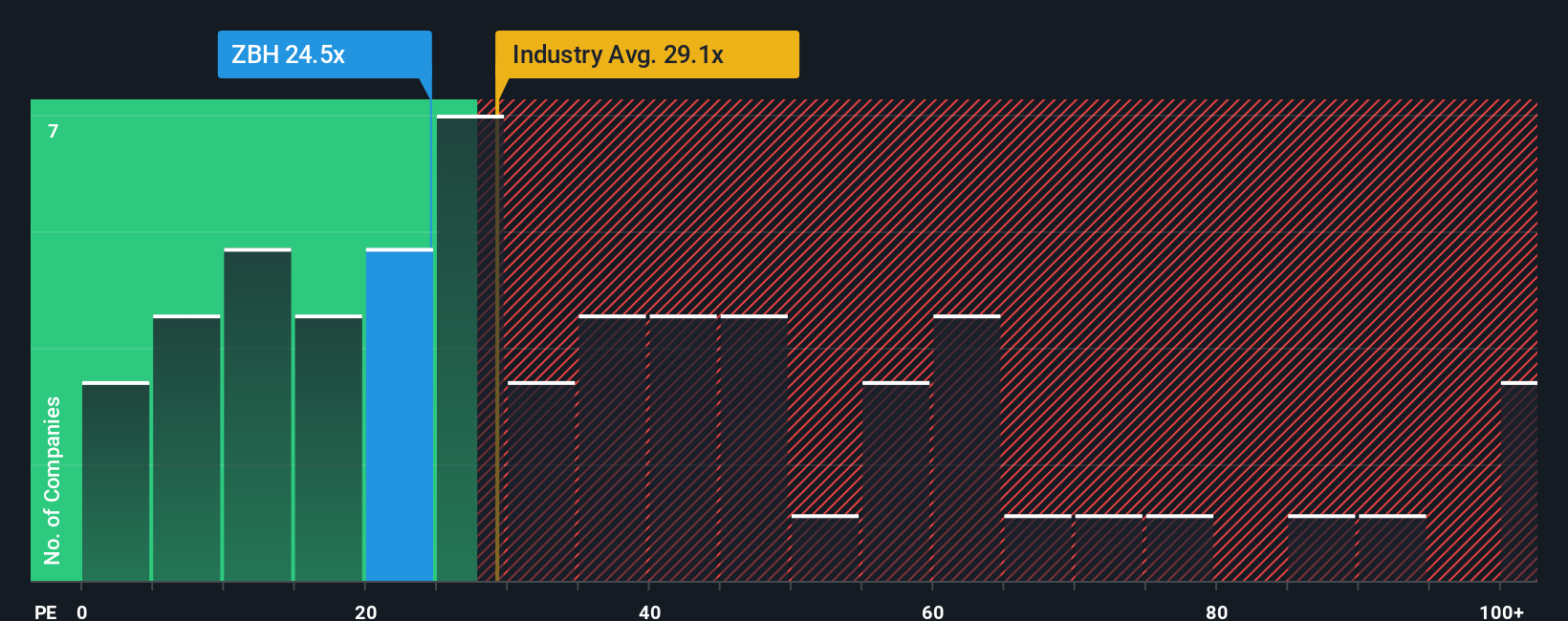

Currently, Zimmer Biomet’s PE ratio sits at 23.3x. This is below both the medical equipment industry average of 28.6x and the major peer group’s average of 47.5x. This indicates the stock is priced more conservatively than many competitors.

Simply Wall St’s Fair Ratio tool calculates a fair PE of 28.5x for Zimmer Biomet. Unlike a simple comparison to industry or peers, the Fair Ratio factors in not just sector trends but also the company’s unique mix of profit margins, growth outlook, market cap, and specific risks. This makes it a more nuanced benchmark for valuation.

Zimmer Biomet’s current PE is about 5x below its Fair Ratio, suggesting that investors have a margin of safety at today’s price and the stock looks undervalued by this measure.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1444 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Zimmer Biomet Holdings Narrative

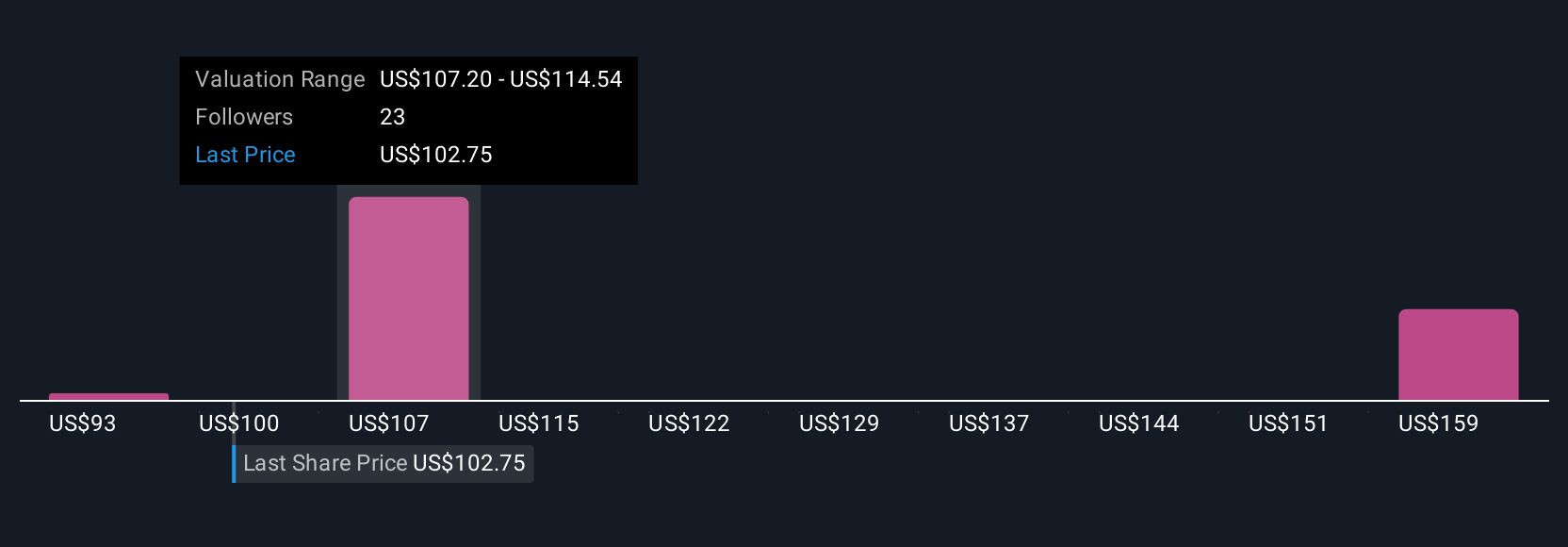

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives, a tool that puts the story behind a company front and center in your investment analysis. A Narrative is your own perspective about a company, where you connect your outlook (for key factors like future revenue, margins, and risk) with a financial forecast, and ultimately to your estimate of fair value.

Narratives go beyond static numbers by linking your beliefs about Zimmer Biomet Holdings’ products, opportunities, and risks directly to the data. Available on Simply Wall St’s Community page, Narratives make it easy for anyone to create, share, and discuss their unique investment story. They are used by millions of investors worldwide.

With Narratives, you can quickly see whether your view of fair value is above or below today’s share price, giving clear guidance on when a stock looks like a Buy or Sell. Your Narrative keeps updating automatically whenever new information or earnings are announced.

For example, one investor might project strong momentum from new product launches and set a high fair value for Zimmer Biomet Holdings, while another, more cautious investor might focus on industry headwinds and define a lower fair value. Narratives help make these perspectives clear, dynamic, and actionable.

Do you think there's more to the story for Zimmer Biomet Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zimmer Biomet Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ZBH

Zimmer Biomet Holdings

Operates as a medical technology company worldwide.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026