- United States

- /

- Medical Equipment

- /

- NYSE:ZBH

ROSA Knee Robotics Clearance Could Be a Game Changer for Zimmer Biomet Holdings (ZBH)

Reviewed by Sasha Jovanovic

- Earlier this month, Zimmer Biomet Holdings announced that the U.S. FDA had granted 510(k) clearance for ROSA® Knee with OptimiZe™, an enhanced robotic-assisted knee replacement system offering greater surgical customization and planning features for orthopedic procedures.

- While this product milestone highlights continued innovation in surgical robotics, recent financial results and subsequent shareholder investigations are currently shaping the overarching narrative for Zimmer Biomet.

- We'll review how disappointing Q3 earnings and renewed legal scrutiny may affect Zimmer Biomet's outlook despite advancements in its robotics product portfolio.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Zimmer Biomet Holdings Investment Narrative Recap

To be a Zimmer Biomet shareholder, you need conviction in the company's ability to drive sustainable long-term growth from innovative orthopedic solutions and successful integration of recent acquisitions. While the FDA clearance of ROSA® Knee with OptimiZe™ reaffirms the company's commitment to advanced surgical robotics, the most immediate stock catalyst remains product adoption and revenue recovery, and ongoing shareholder legal investigations present the largest near-term risk. The impact of this month’s news is unlikely to materially offset heightened scrutiny following underwhelming Q3 earnings and revised revenue guidance.

The ROSA® Knee with OptimiZe™ announcement is highly relevant, representing a technical leap in Zimmer Biomet's surgical robotics suite and strengthening its premium offering in knee replacements. As demand for personalized joint solutions rises and the company invests in digital and data-driven platforms, this product could help differentiate Zimmer Biomet’s portfolio, though near-term results depend more on execution and market acceptance than individual clearances.

In contrast, the sharp pullback following Q3 earnings and the legal probes into possible securities law breaches raise issues investors should be mindful of, especially regarding...

Read the full narrative on Zimmer Biomet Holdings (it's free!)

Zimmer Biomet Holdings is projected to reach $9.2 billion in revenue and $1.3 billion in earnings by 2028. This outlook assumes a 5.5% annual revenue growth rate and a $476.5 million increase in earnings from the current $823.5 million.

Uncover how Zimmer Biomet Holdings' forecasts yield a $102.92 fair value, a 12% upside to its current price.

Exploring Other Perspectives

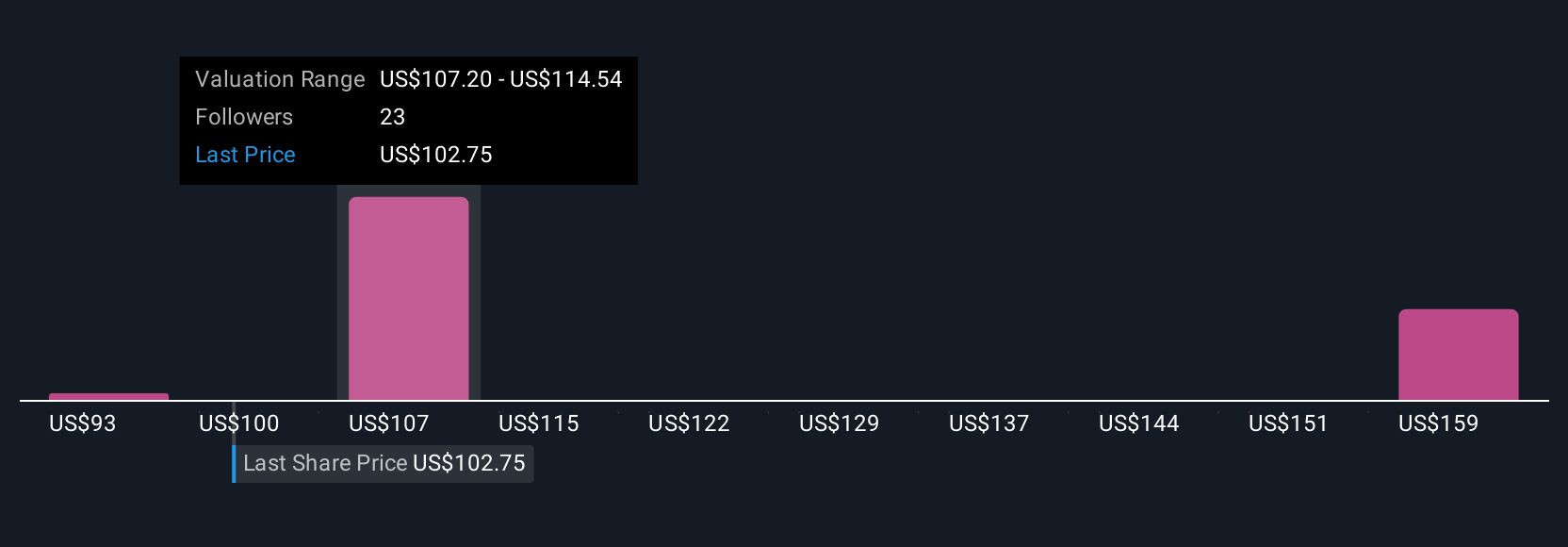

Four distinct fair value estimates from the Simply Wall St Community range from US$95 to US$165, with the highest views sharply exceeding recent share prices. As opinions span such a wide gap, remember that closer attention to regulatory or legal risks could become critical to your research.

Explore 4 other fair value estimates on Zimmer Biomet Holdings - why the stock might be worth as much as 79% more than the current price!

Build Your Own Zimmer Biomet Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Zimmer Biomet Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Zimmer Biomet Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Zimmer Biomet Holdings' overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zimmer Biomet Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ZBH

Zimmer Biomet Holdings

Operates as a medical technology company worldwide.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives